3 Asian Stocks Estimated To Be 35.9% To 49.2% Below Intrinsic Value

As 2026 begins, Asian markets are navigating a complex landscape marked by mixed performances across major indices and cautious optimism about economic recovery. In this climate, identifying undervalued stocks can be a strategic move for investors looking to capitalize on potential growth opportunities, particularly those estimated to be significantly below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.72 | CN¥9.38 | 49.7% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.40 | CN¥162.39 | 48.6% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1579.24 | 49.7% |

| Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990) | HK$432.00 | HK$851.22 | 49.2% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥2332.00 | ¥4591.95 | 49.2% |

| Mobvista (SEHK:1860) | HK$15.43 | HK$30.64 | 49.6% |

| Meitu (SEHK:1357) | HK$7.59 | HK$14.75 | 48.5% |

| Kuraray (TSE:3405) | ¥1599.50 | ¥3167.05 | 49.5% |

| Great Giant Fibre Garment (TWSE:4441) | NT$234.50 | NT$457.28 | 48.7% |

| CURVES HOLDINGS (TSE:7085) | ¥794.00 | ¥1582.86 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

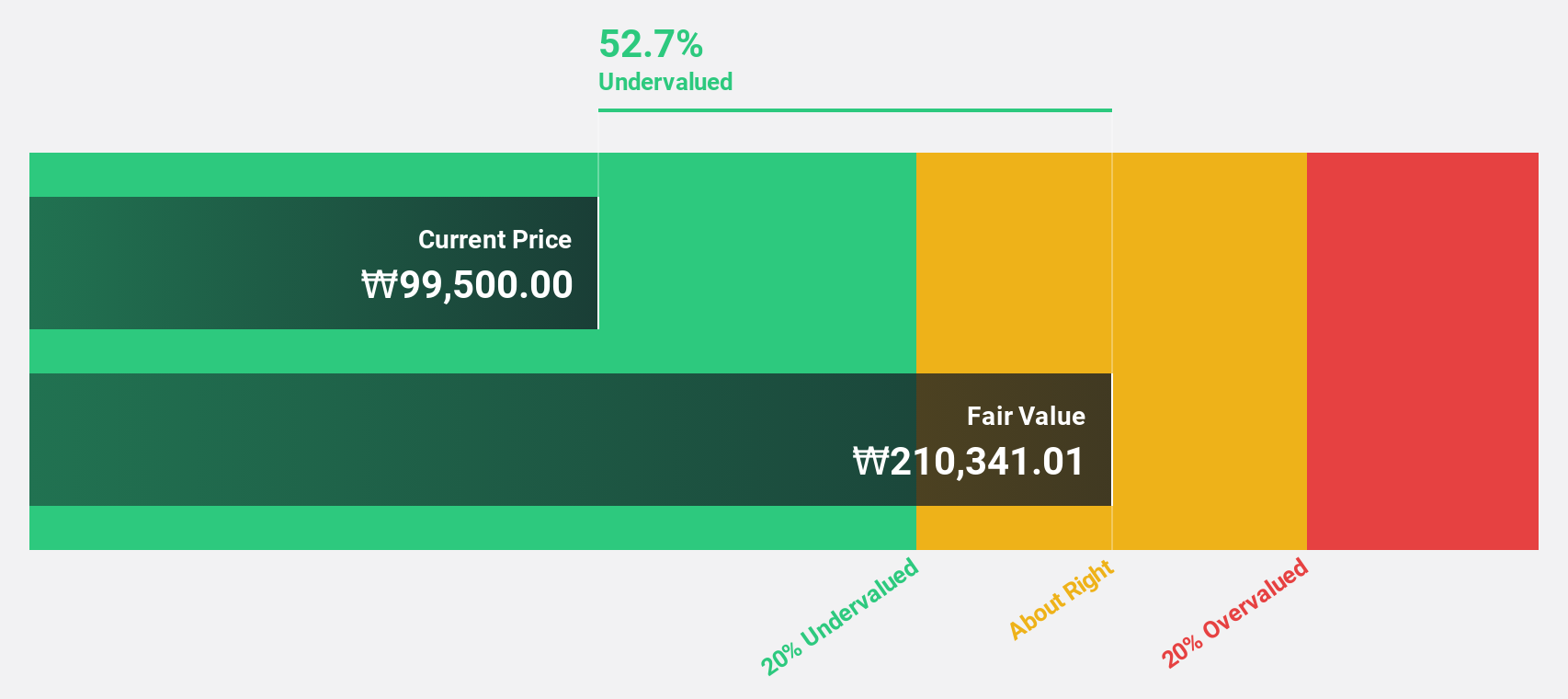

Samsung Electronics (KOSE:A005930)

Overview: Samsung Electronics Co., Ltd. operates globally in consumer electronics, information technology and mobile communications, and device solutions, with a market cap of ₩903.85 trillion.

Operations: The company's revenue segments consist of Device Experience (DX) at ₩184.19 billion, Device Solutions (DS) at ₩116.22 billion, SDC at ₩28.47 million, and Harman at ₩15.13 million.

Estimated Discount To Fair Value: 43.6%

Samsung Electronics is trading at ₩138,100, significantly below its estimated fair value of ₩244,763.67. Despite a forecasted revenue growth of 12.3% annually—outpacing the Korean market's 11.4%—its Return on Equity is expected to remain low at 10.4%. Earnings are projected to grow significantly by over 40% annually in the next three years, surpassing the broader market's growth rate of 31.8%. Recent product innovations and strategic partnerships enhance its integrated ecosystem and AI capabilities.

- According our earnings growth report, there's an indication that Samsung Electronics might be ready to expand.

- Click to explore a detailed breakdown of our findings in Samsung Electronics' balance sheet health report.

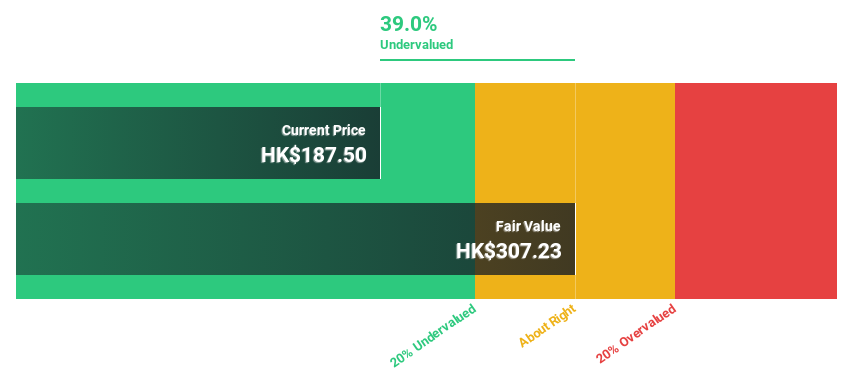

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company involved in the research, development, manufacturing, and commercialization of novel drugs focusing on oncology and immunology both in China and internationally, with a market cap of approximately HK$100.74 billion.

Operations: The company generates revenue of approximately CN¥1.50 billion from its pharmaceuticals segment, which includes novel drugs in oncology and immunology.

Estimated Discount To Fair Value: 49.2%

Sichuan Kelun-Biotech Biopharmaceutical is trading at HK$432, well below its estimated fair value of HK$851.22. The company's revenue is projected to grow significantly at 32.1% annually, surpassing the Hong Kong market's growth rate of 8.3%. It is expected to become profitable within three years with a high Return on Equity forecasted at 27.5%. Recent breakthroughs in antibody-drug conjugates and strategic collaborations could bolster its financial outlook and expedite product approvals in China.

- Our earnings growth report unveils the potential for significant increases in Sichuan Kelun-Biotech Biopharmaceutical's future results.

- Navigate through the intricacies of Sichuan Kelun-Biotech Biopharmaceutical with our comprehensive financial health report here.

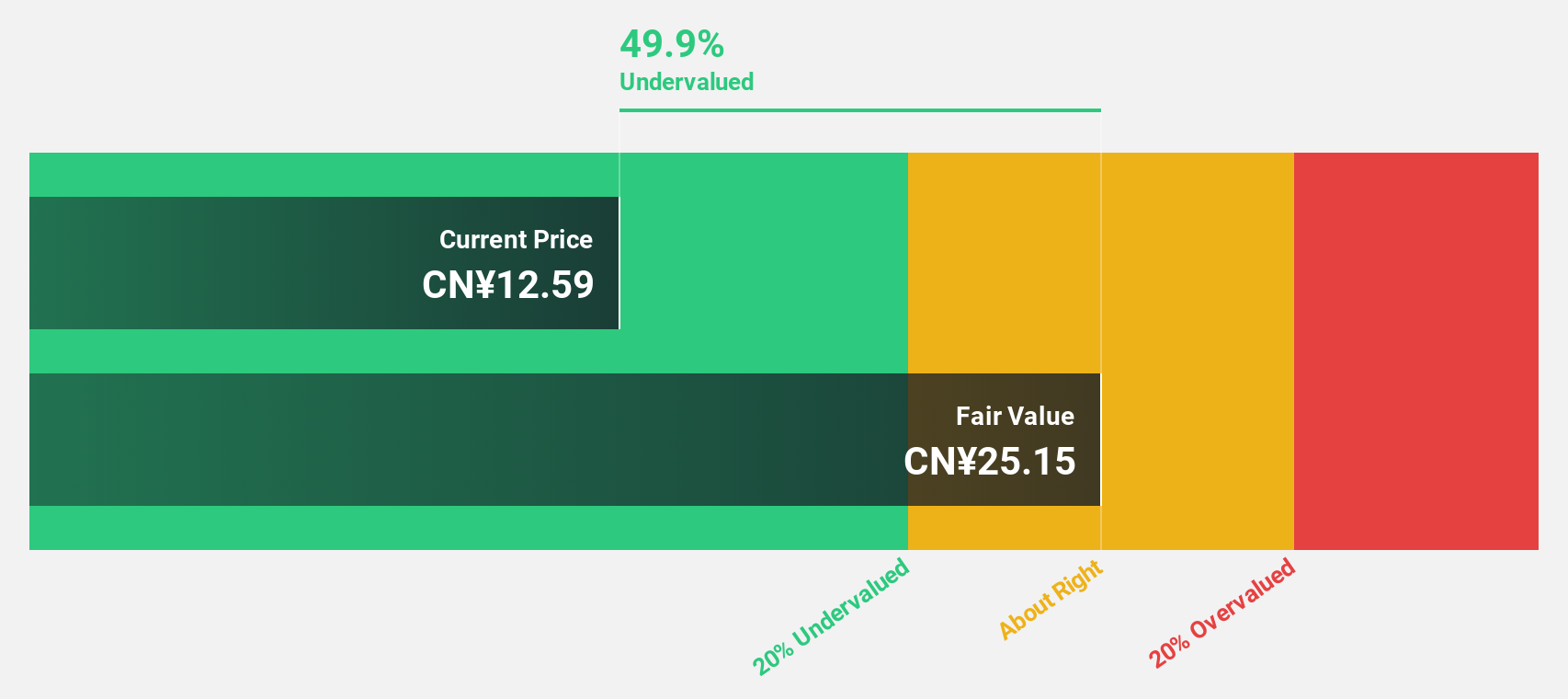

Wuhan Guide Infrared (SZSE:002414)

Overview: Wuhan Guide Infrared Co., Ltd. designs, manufactures, markets, and sells infrared thermal imaging detectors and modules as well as electro-optical systems both in China and internationally, with a market cap of CN¥68.93 billion.

Operations: Wuhan Guide Infrared Co., Ltd. generates revenue through the production and distribution of infrared thermal imaging detectors, modules, and electro-optical systems across domestic and international markets.

Estimated Discount To Fair Value: 35.9%

Wuhan Guide Infrared is trading at CN¥16.14, significantly below its estimated fair value of CN¥25.18, suggesting it may be undervalued based on cash flows. The company has shown strong financial performance, with revenue reaching CNY 3.07 billion for the first nine months of 2025 and net income increasing to CNY 581.94 million from CNY 50.21 million a year ago. Forecasts indicate robust annual earnings growth of over 61%, outpacing the Chinese market's average growth rate.

- Insights from our recent growth report point to a promising forecast for Wuhan Guide Infrared's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Wuhan Guide Infrared.

Make It Happen

- Navigate through the entire inventory of 260 Undervalued Asian Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報