Exploring 3 Undiscovered Gems in Asia with Strong Fundamentals

As global markets navigate a complex landscape marked by mixed performances in major indices and evolving economic conditions, Asia presents intriguing opportunities for investors seeking to uncover potential growth stories. In this dynamic environment, identifying stocks with robust fundamentals becomes crucial, as strong financial health and strategic positioning can help companies weather market fluctuations and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ubiquoss Holdings | 0.27% | 1.42% | -5.51% | ★★★★★★ |

| Woori Technology Investment | NA | 8.42% | -4.10% | ★★★★★★ |

| Namuga | 14.15% | -4.88% | 23.32% | ★★★★★★ |

| ITE Tech | NA | 4.26% | 6.18% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Wan Hwa Enterprise | NA | 9.74% | 13.35% | ★★★★★★ |

| Zhejiang Chinastars New Materials Group | 42.04% | 1.78% | 6.47% | ★★★★★☆ |

| Ligitek ElectronicsLtd | 42.94% | -6.26% | -26.95% | ★★★★★☆ |

| Hangzhou Zhengqiang | 19.76% | 7.83% | 16.32% | ★★★★★☆ |

| Nippon Care Supply | 12.39% | 10.40% | 1.75% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

OceanaGold (Philippines) (PSE:OGP)

Simply Wall St Value Rating: ★★★★★☆

Overview: OceanaGold (Philippines) Inc. focuses on the exploration, development, production, and utilization of gold, copper, silver, and other mineral resources in the Philippines with a market capitalization of ₱81.28 billion.

Operations: The company generates revenue primarily from the metals and mining segment, specifically gold and other precious metals, amounting to $397.11 million.

OceanaGold (Philippines) is carving a niche in the metals and mining sector, boasting impressive earnings growth of 115% over the past year. The company reported a notable increase in third-quarter sales to US$141.7 million from US$102.1 million last year, with net income jumping to US$27 million from US$3.6 million. It remains debt-free, eliminating concerns over interest coverage and highlighting its financial health with consistent free cash flow generation—US$119.96 million as of September 2025—despite capital expenditures reaching approximately US$47 million. Looking ahead, earnings are projected to grow around 27% annually, suggesting potential for further expansion.

- Click here to discover the nuances of OceanaGold (Philippines) with our detailed analytical health report.

Learn about OceanaGold (Philippines)'s historical performance.

Bank of Guizhou (SEHK:6199)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank of Guizhou Co., Ltd. offers a range of banking products and services in the People's Republic of China, with a market capitalization of approximately HK$15.46 billion.

Operations: The bank's primary revenue streams are derived from corporate banking (CN¥3.04 billion), retail banking (CN¥1.84 billion), and financial markets (CN¥2.80 billion).

Bank of Guizhou, with total assets of CN¥603.7 billion and equity at CN¥53 billion, offers an intriguing investment case. It trades at 65% below its estimated fair value, suggesting potential upside. The bank's bad loan allowance is robust at 332%, while non-performing loans stand appropriately low at 1.7%. Customer deposits make up 75% of its liabilities, highlighting a stable funding base. Over the past year, earnings grew by 6.3%, outpacing the industry average of 4.7%. Recent board changes and proposed governance amendments could further strengthen its strategic direction moving forward.

- Dive into the specifics of Bank of Guizhou here with our thorough health report.

Review our historical performance report to gain insights into Bank of Guizhou's's past performance.

INKON Life Technology (SZSE:300143)

Simply Wall St Value Rating: ★★★★★☆

Overview: INKON Life Technology Co., Ltd. is engaged in creating an ecological platform for the prevention, diagnosis, treatment, and rehabilitation of tumors, offering medical services both in China and internationally with a market cap of CN¥8.46 billion.

Operations: INKON Life Technology generates revenue primarily from its medical services focused on tumor prevention, diagnosis, treatment, and rehabilitation. The company has a market cap of CN¥8.46 billion.

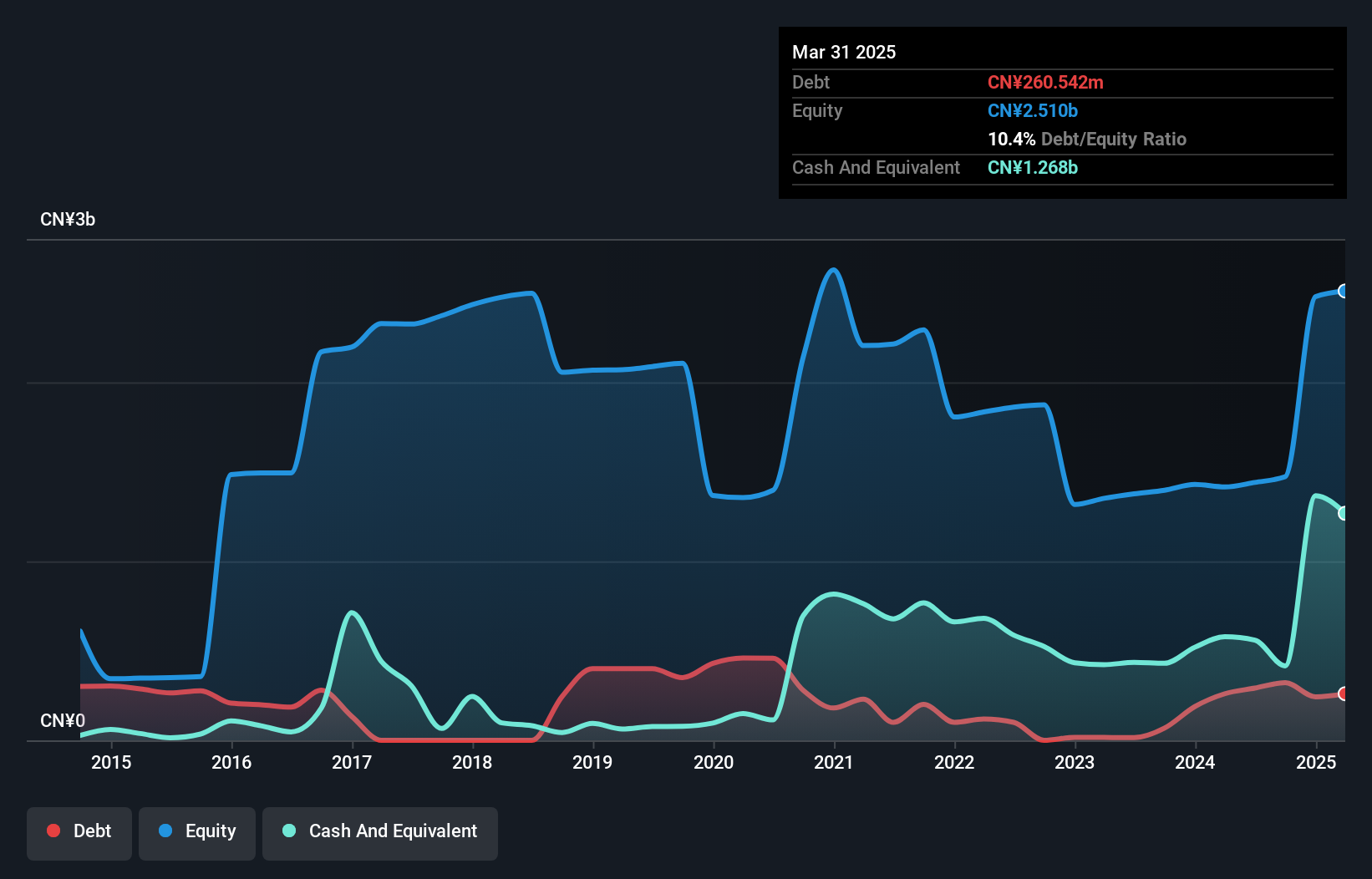

INKON Life Technology, a smaller player in the healthcare sector, has shown impressive financial resilience. Over the past year, earnings surged by 34.6%, outpacing the industry average of -11.8%. The company reported nine-month sales of CNY 1.36 billion, up from CNY 1.23 billion year-on-year, with net income reaching CNY 86.84 million compared to CNY 82.54 million previously. Despite increasing its debt-to-equity ratio from 13% to 20.7% over five years, INKON holds more cash than total debt and maintains strong interest coverage capabilities; however, a CN¥31M one-off gain notably influenced recent results.

- Get an in-depth perspective on INKON Life Technology's performance by reading our health report here.

Assess INKON Life Technology's past performance with our detailed historical performance reports.

Next Steps

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2493 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報