3 Middle Eastern Dividend Stocks Yielding Up To 5.9%

As Gulf markets experience a downturn due to weak oil prices and geopolitical tensions, investors are increasingly turning their attention towards dividend stocks as a potential source of steady income. In this environment, selecting stocks with strong fundamentals and consistent dividend yields can be an effective strategy for navigating market volatility while aiming for reliable returns.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.21% | ★★★★★★ |

| Saudi Awwal Bank (SASE:1060) | 6.25% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.45% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.26% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.04% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.30% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.46% | ★★★★★☆ |

| Banque Saudi Fransi (SASE:1050) | 6.59% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.12% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.06% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

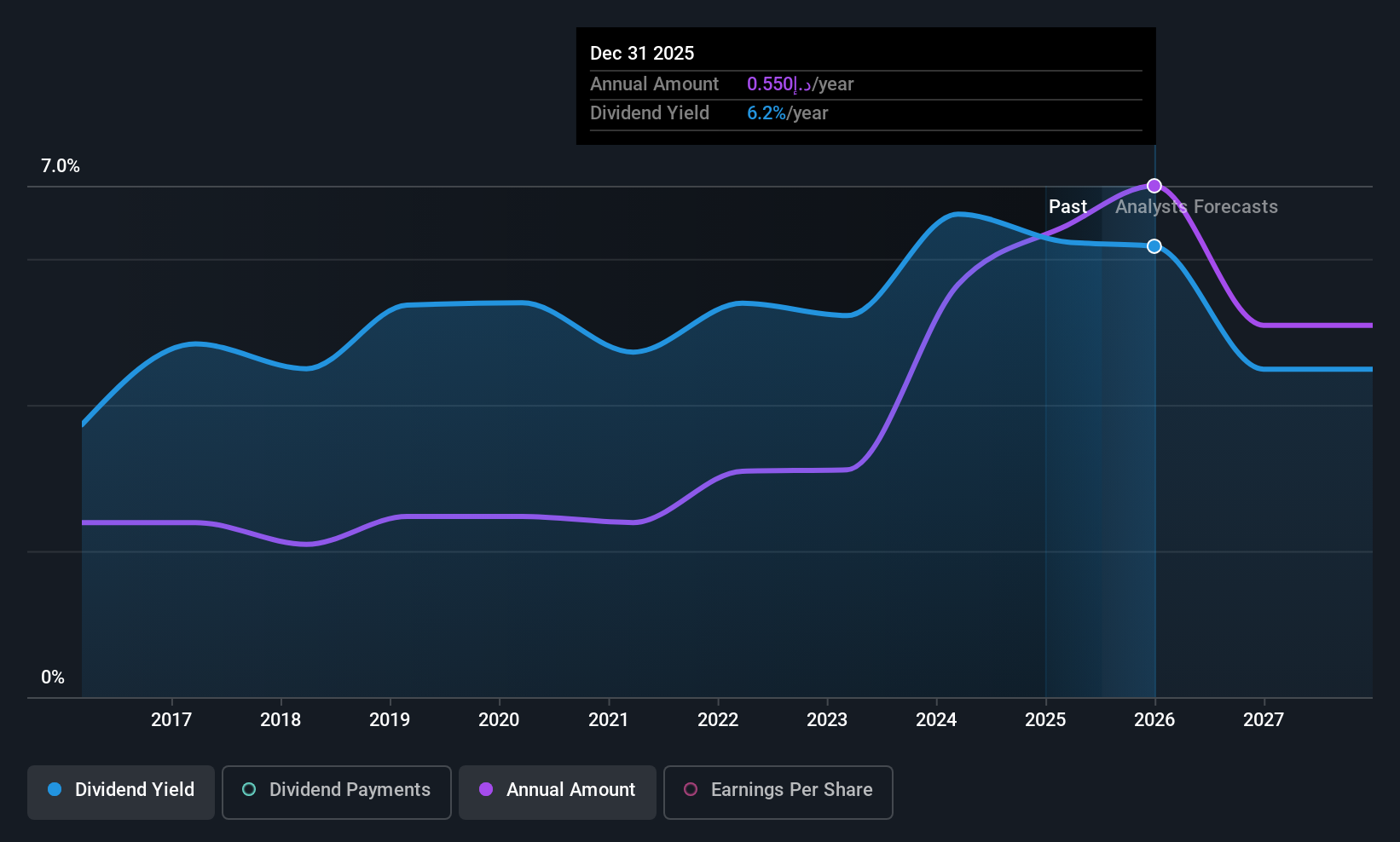

Commercial Bank of Dubai PSC (DFM:CBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Commercial Bank of Dubai PSC offers commercial and retail banking services in the United Arab Emirates, with a market capitalization of AED27.73 billion.

Operations: Commercial Bank of Dubai PSC generates its revenue primarily from Personal Banking (AED2.13 billion), Institutional Banking (AED1.48 billion), and Corporate Banking (AED1.33 billion) services in the United Arab Emirates.

Dividend Yield: 5.5%

Commercial Bank of Dubai PSC offers a reliable dividend yield of 5.46%, supported by a low payout ratio of 46.7%, ensuring dividends are well covered by earnings. Despite having a high level of bad loans at 4%, the bank maintains stable and growing dividend payments over the past decade, though its yield is below top-tier levels in the AE market. Recent earnings growth, with net income reaching AED 2.58 billion for nine months ending September 2025, underscores financial stability.

- Click to explore a detailed breakdown of our findings in Commercial Bank of Dubai PSC's dividend report.

- The valuation report we've compiled suggests that Commercial Bank of Dubai PSC's current price could be inflated.

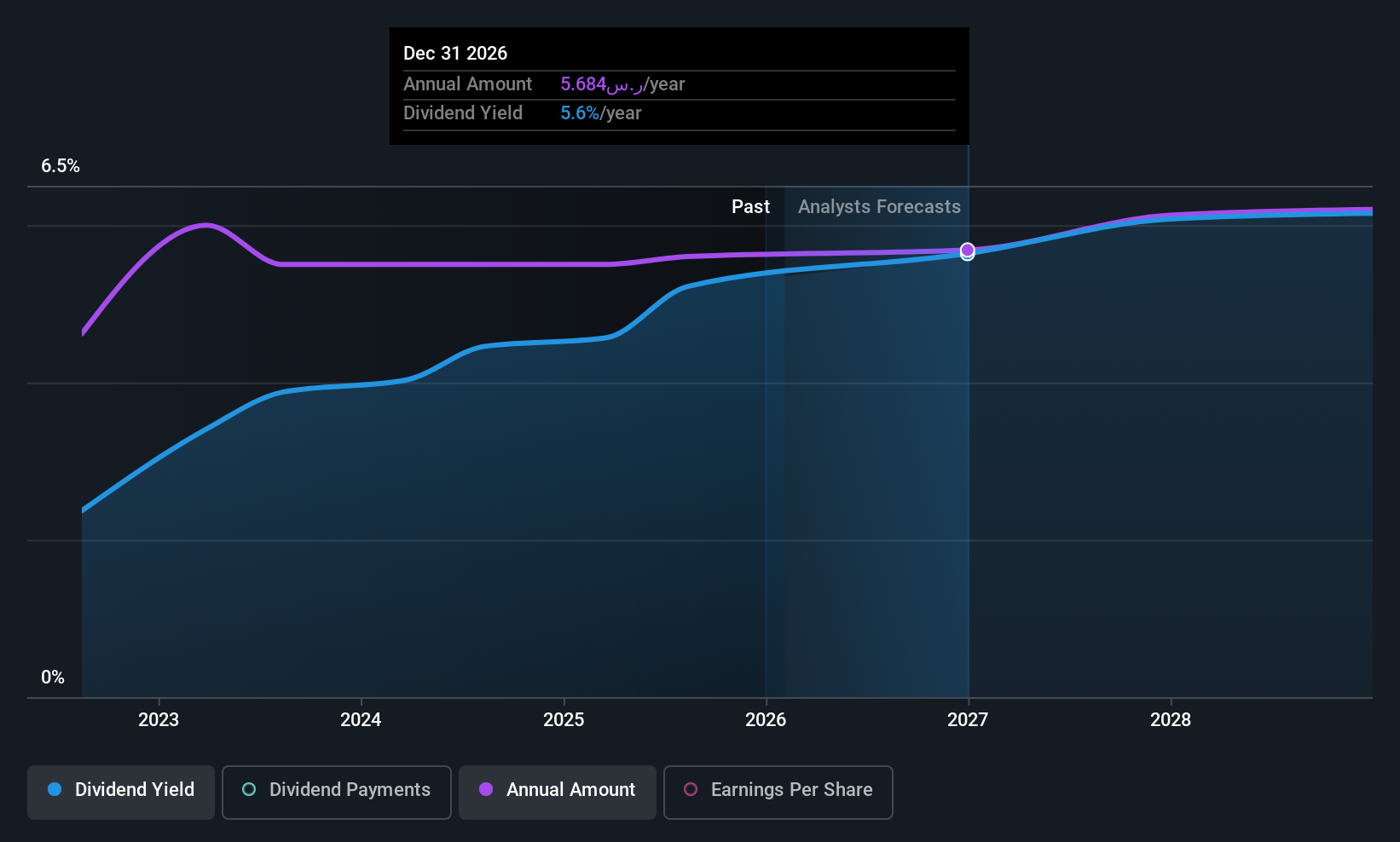

Nahdi Medical (SASE:4164)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nahdi Medical Company is a pharmaceutical retailer operating in the Kingdom of Saudi Arabia and the United Arab Emirates, with a market cap of SAR11.99 billion.

Operations: Nahdi Medical Company's revenue from its retailing segment amounts to SAR9.99 billion.

Dividend Yield: 6%

Nahdi Medical's dividend yield of 5.96% ranks in the top 25% in Saudi Arabia, but its dividends have been volatile over the past three years, with a high payout ratio of 89.6%. Despite recent earnings decline—net income fell to SAR 161.25 million for Q3 2025—the company's dividends remain covered by earnings and cash flows. Trading at a good value compared to peers, Nahdi offers potential growth opportunities despite its unstable dividend history.

- Click here to discover the nuances of Nahdi Medical with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Nahdi Medical's share price might be too pessimistic.

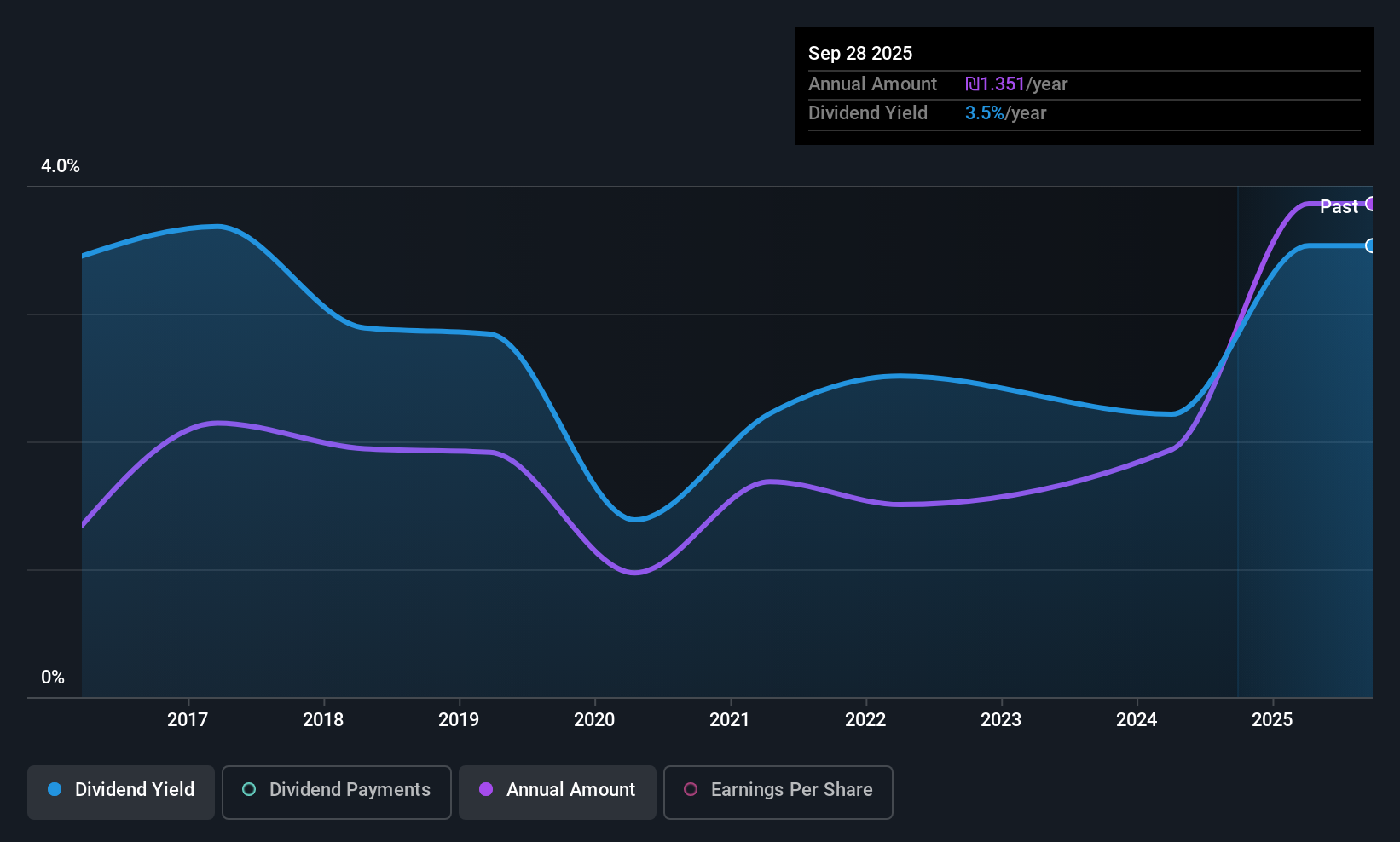

Shufersal (TASE:SAE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shufersal Ltd. operates a chain of supermarkets under the Shufersal brand name in Israel, with a market cap of ₪11.29 billion.

Operations: Shufersal Ltd.'s revenue is primarily derived from its retail chains, contributing ₪14.58 billion, and its real estate sector, adding ₪275 million.

Dividend Yield: 3.2%

Shufersal's dividend payments are well covered by cash flows, with a low cash payout ratio of 21%, though its dividend yield of 3.19% is below the top tier in the IL market. Despite a volatile dividend history over the past decade, earnings have grown at 16.8% annually over five years, supporting sustainability with an earnings payout ratio of 81.3%. Recent Q3 results show decreased sales and net income, indicating potential challenges ahead.

- Take a closer look at Shufersal's potential here in our dividend report.

- Our expertly prepared valuation report Shufersal implies its share price may be lower than expected.

Taking Advantage

- Discover the full array of 59 Top Middle Eastern Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報