EchoStar (SATS) Valuation Check After License Sales To AT&T And SpaceX

EchoStar (SATS) is back in focus after resolving a Federal Communications Commission dispute. The company sold valuable licenses to AT&T and SpaceX, and in the process became a significant shareholder in SpaceX.

See our latest analysis for EchoStar.

The FCC resolution and multi billion dollar license sales sit alongside sharp market moves, with EchoStar’s 36.8% 1 month share price return and very large 1 year total shareholder return indicating that momentum has been building rather than fading.

If this kind of regulatory turnaround has your attention, it could be a good time to widen your watchlist and review fast growing stocks with high insider ownership.

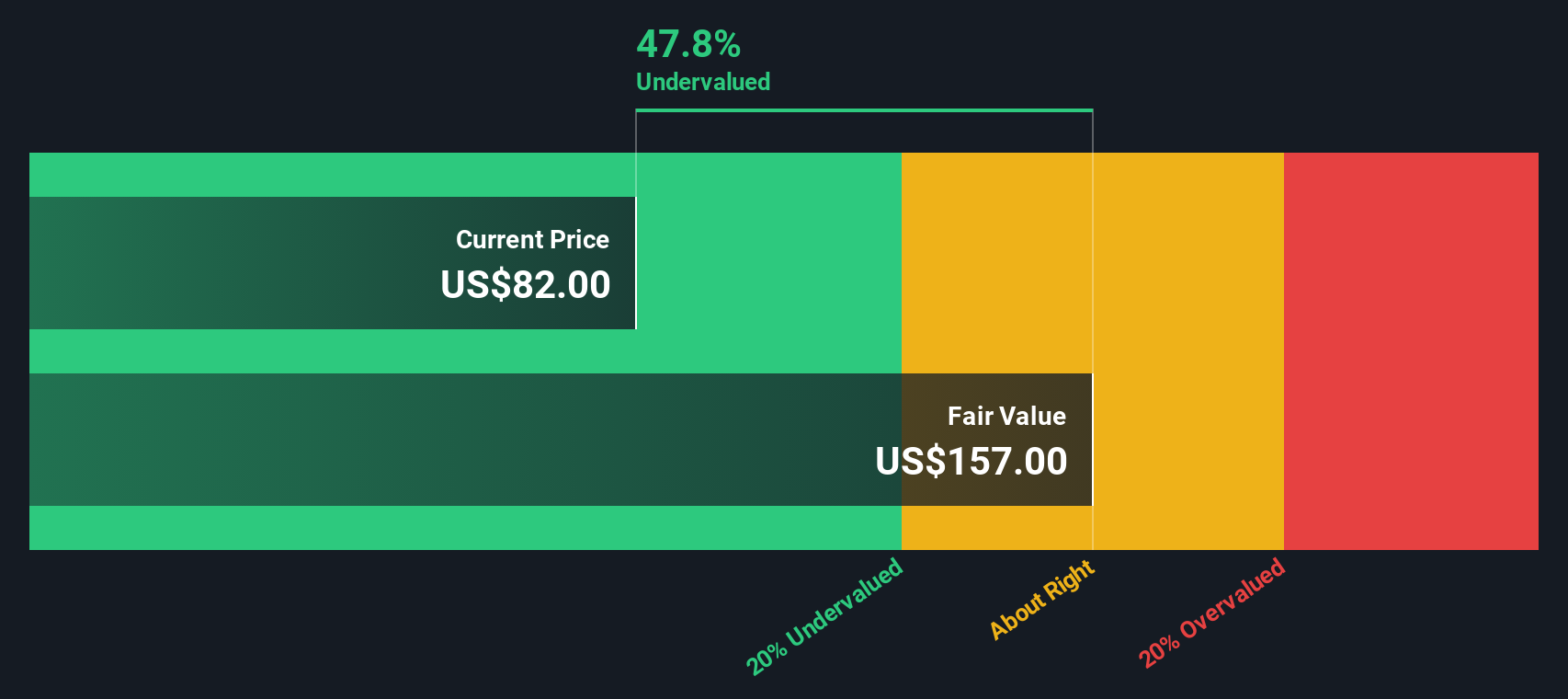

With the shares up sharply and the latest close near the analyst price target, the key question now is whether EchoStar still trades at a discount to its intrinsic value or if the market is already pricing in future growth.

Most Popular Narrative: 24.3% Overvalued

EchoStar’s most followed narrative points to a fair value of about $90.29 per share, which sits below the recent $112.18 close. This creates a valuation gap that depends on how future cash flows are framed.

Analysts have raised their price target on EchoStar by approximately 13 percent to around $90 per share, reflecting a lower perceived discount rate and higher future valuation multiples that more than offset slightly softer long term revenue growth and margin assumptions.

Curious how slightly weaker growth assumptions still support a higher value? The narrative focuses on richer future earnings multiples and a lower 8.28% discount rate. Want to see how those pieces fit together without any back of the envelope guesswork?

Result: Fair Value of $90.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story can change quickly if heavy debt maturities or further erosion in legacy Pay TV and broadband revenue put more pressure on cash flow and execution.

Find out about the key risks to this EchoStar narrative.

Another Angle on EchoStar’s Value

Our SWS DCF model paints a different picture to the popular $90.29 narrative, with EchoStar trading about 19.6% below an estimated fair value of $139.48. That gap suggests the market could be discounting future cash flows quite heavily. Which story do you think is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out EchoStar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own EchoStar Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom EchoStar thesis in just a few minutes with Do it your way.

A great starting point for your EchoStar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If EchoStar has sharpened your focus, do not stop here. Broaden your opportunity set and pressure test your thinking with a few targeted stock lists.

- Spot potential mispricings by scanning these 876 undervalued stocks based on cash flows that may not fully reflect their cash flow potential yet.

- Explore technology themes by checking out these 25 AI penny stocks positioned at the intersection of computing power and real world applications.

- Consider income-focused ideas by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3% alongside listed business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報