Assessing Viavi Solutions (VIAV) Valuation After Q3 Beat And Upgraded Q4 Outlook

Q3 earnings beat and Q4 outlook put Viavi Solutions (VIAV) in focus

Viavi Solutions (VIAV) is back on investor radars after reporting Q3 CY2025 revenue of US$299.1 million and adjusted EPS of US$0.15, both ahead of analyst expectations and paired with guidance that also exceeded consensus.

See our latest analysis for Viavi Solutions.

The Q3 beat and strong Q4 outlook arrive after a sharp shift in sentiment, with a 43.5% 90 day share price return and a 78.8% 1 year total shareholder return suggesting momentum has strengthened recently.

If Viavi’s move has you looking across the sector, this could be a good moment to scan other high growth tech and AI stocks that might fit your watchlist next.

With the share price up sharply and the stock now sitting only about 5% below the average analyst target of US$19, the key question is whether Viavi is still mispriced or if the market is already factoring in future growth.

Most Popular Narrative: 1.5% Undervalued

With Viavi’s narrative fair value at about US$18.43 versus the last close of US$18.15, the valuation gap is narrow and hinges on a few key growth levers.

The analysts have a consensus price target of $14.0 for Viavi Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $12.0.

Curious how a modest fair value premium rests on much faster earnings growth than revenue, rising margins and a future P/E well below today’s level? The narrative runs the numbers on all three and more, then backs into today’s valuation using a specific required return.

Result: Fair Value of $18.43 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be knocked off course if integration of the Spirent and Inertial Labs deals proves difficult, or if telecom and wireless spending stays subdued longer.

Find out about the key risks to this Viavi Solutions narrative.

Another View: Multiples Paint A Different Picture

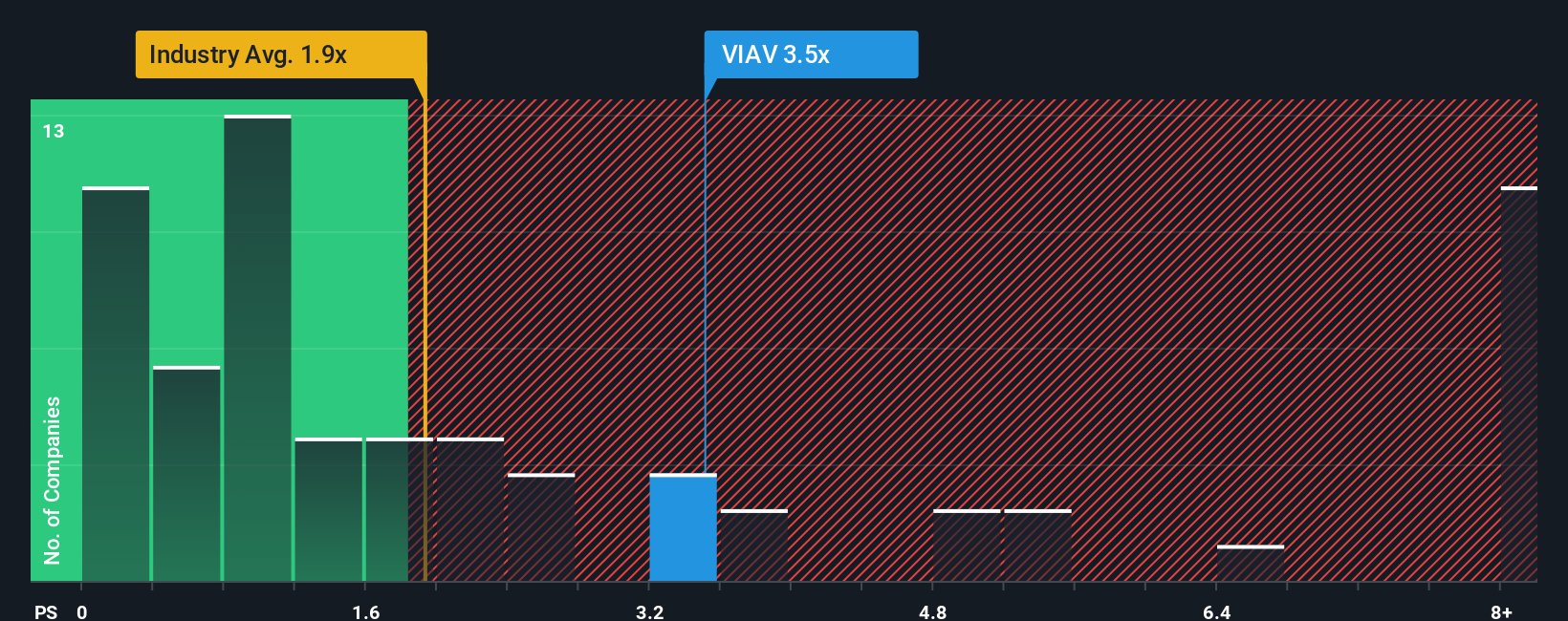

That “about right” fair value near US$18.43 sits alongside some mixed signal pricing. On one hand, Viavi screens expensive on a P/S of 3.5x versus 2.1x for the US Communications industry and 2.2x for peers, which hints at less room for error if the story does not play out as expected.

At the same time, the fair ratio for Viavi’s P/S is 5.1x, above the current 3.5x. If the market ever shifted closer to that 5.1x level, today’s valuation could look more like an entry point rather than a ceiling. Which side of this tug of war do you think wins out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Viavi Solutions Narrative

If this view does not fully line up with your own or you simply prefer to test the numbers yourself, you can build a custom thesis in just a few minutes, starting with Do it your way.

A great starting point for your Viavi Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Viavi has sharpened your focus, do not stop here. Casting a wider net with focused screeners can reveal opportunities that might not stay under the radar for long.

- Target potential value by checking out these 876 undervalued stocks based on cash flows that line up with your expectations for cash flow strength and pricing discipline.

- Spot early movers in artificial intelligence by reviewing these 25 AI penny stocks that could reshape how software, hardware and services evolve.

- Tap into the growth of digital assets by scanning these 79 cryptocurrency and blockchain stocks tied to payment systems, blockchain infrastructure and related services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報