Revenues Tell The Story For Kernex Microsystems (India) Limited (NSE:KERNEX) As Its Stock Soars 32%

Kernex Microsystems (India) Limited (NSE:KERNEX) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

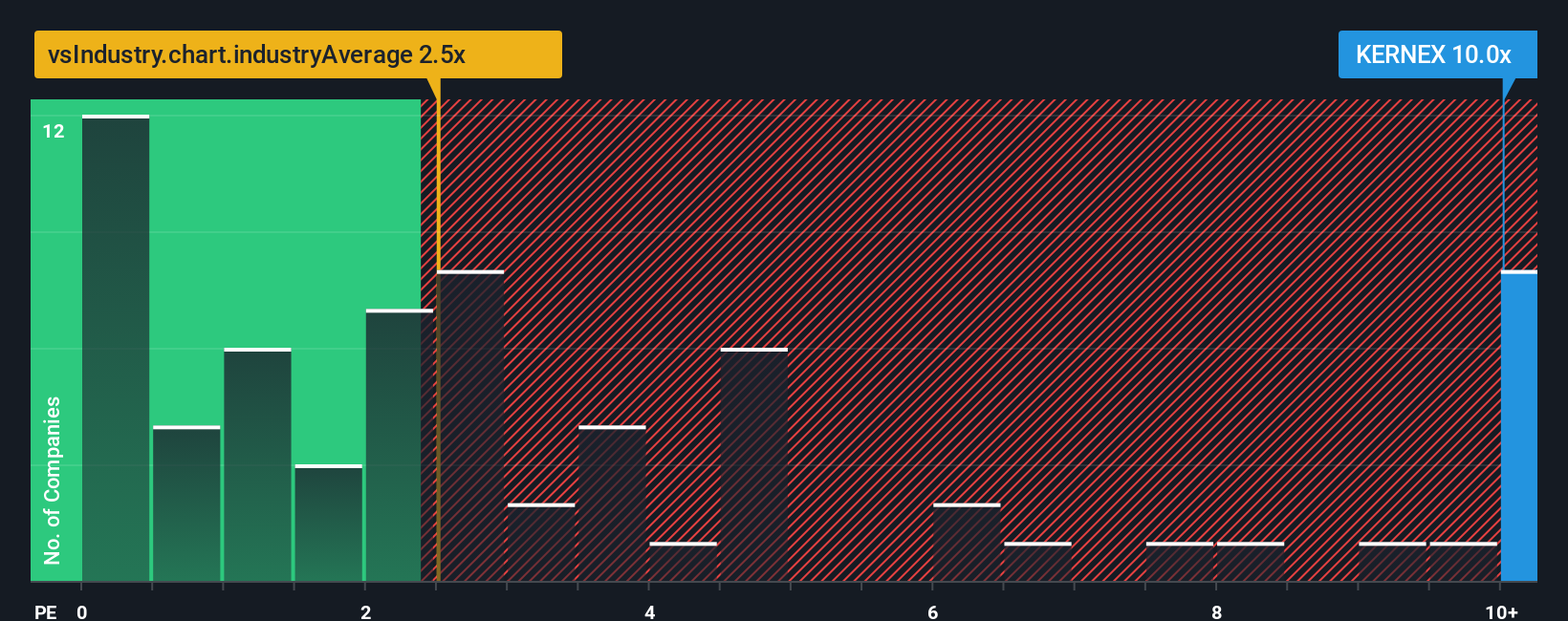

Following the firm bounce in price, when almost half of the companies in India's Electronic industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider Kernex Microsystems (India) as a stock not worth researching with its 10x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Kernex Microsystems (India)

What Does Kernex Microsystems (India)'s P/S Mean For Shareholders?

Kernex Microsystems (India) certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kernex Microsystems (India) will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

Kernex Microsystems (India)'s P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 156% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 30%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Kernex Microsystems (India)'s P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Kernex Microsystems (India)'s P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Kernex Microsystems (India) maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Kernex Microsystems (India) you should be aware of, and 1 of them is a bit concerning.

If you're unsure about the strength of Kernex Microsystems (India)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報