LK Samyang Co., Ltd (KOSDAQ:225190) Stock Rockets 27% As Investors Are Less Pessimistic Than Expected

Those holding LK Samyang Co., Ltd (KOSDAQ:225190) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

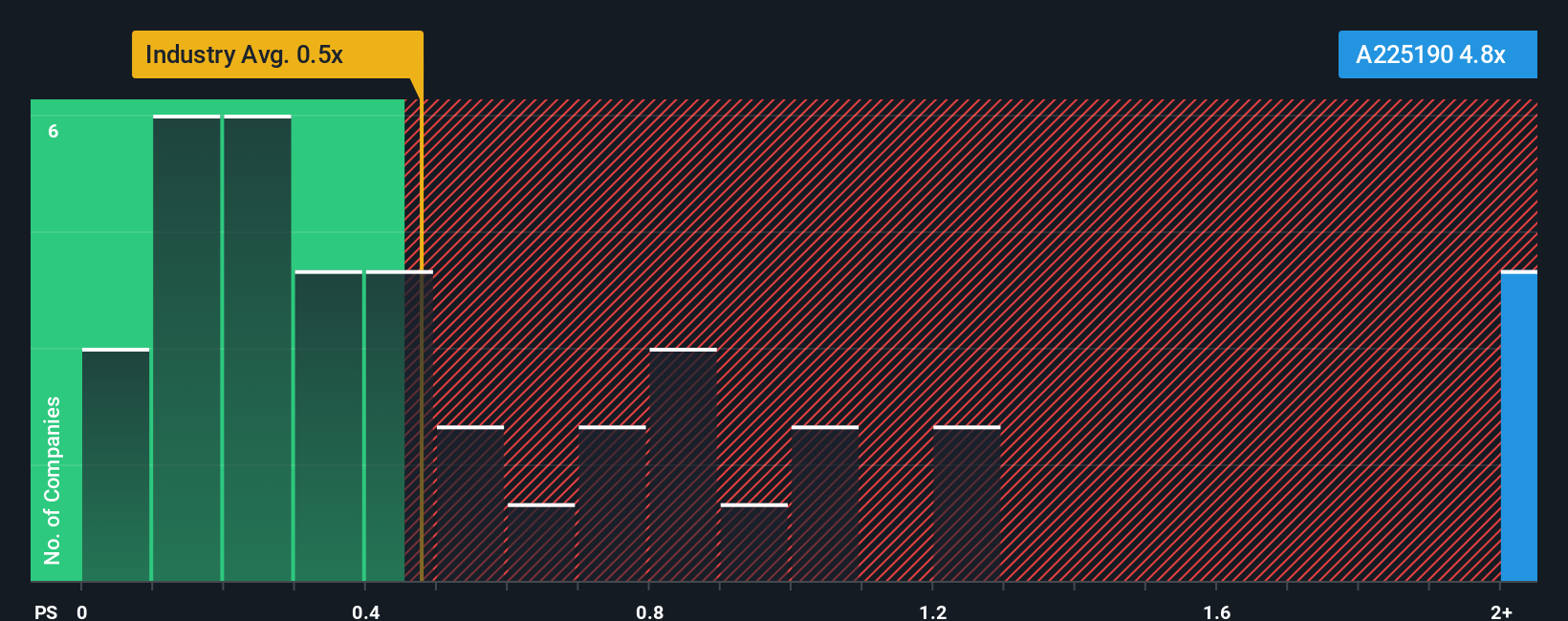

After such a large jump in price, when almost half of the companies in Korea's Consumer Durables industry have price-to-sales ratios (or "P/S") below 0.5x, you may consider LK Samyang as a stock not worth researching with its 4.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for LK Samyang

How LK Samyang Has Been Performing

For example, consider that LK Samyang's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on LK Samyang will help you shine a light on its historical performance.How Is LK Samyang's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like LK Samyang's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 43% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 63% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 5.4% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that LK Samyang is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has lead to LK Samyang's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of LK Samyang revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

There are also other vital risk factors to consider and we've discovered 6 warning signs for LK Samyang (5 can't be ignored!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報