A Look At MDU Resources Group (MDU) Valuation After Recent Share Price Momentum

Recent trading in MDU Resources Group (MDU) has drawn attention after the stock’s 1 day move of 1.79%, alongside a one-month return of 3.17% and a three-month total return of 9.12%.

See our latest analysis for MDU Resources Group.

Zooming out, the recent 3 month share price return of 9.12% sits alongside a 1 year total shareholder return of 14.34%. This hints that momentum has been building rather than fading around the current US$19.87 level.

If MDU Resources Group has caught your eye, it can be useful to compare it with other regulated utilities and energy distributors by screening for solid balance sheet and fundamentals stocks screener (None results).

With the shares at US$19.87, close to analyst targets and an intrinsic value estimate that suggests a premium rather than a discount, investors may need to consider whether there is still a buying opportunity or if future growth is already reflected in the price.

Most Popular Narrative: 4.5% Undervalued

The most followed narrative sees MDU Resources Group trading below an assessed fair value of US$20.80 compared with the last close of US$19.87, and anchors that view in long term utility and pipeline projects.

Strong ongoing and future investment in U.S. infrastructure, including large pipeline expansion projects and potential new transmission or generation to serve data centers, positions MDU to benefit from robust construction demand and growing energy needs, providing significant future revenue and earnings uplift.

Curious what sits behind that uplift claim? Revenue growth, margin expansion and a richer future earnings multiple all play a part, along with specific cash flow assumptions. The fair value hinges on how those pieces fit together. Want to see how far the narrative stretches those forecasts?

Result: Fair Value of $20.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on execution, with faster renewable adoption or rising operating and maintenance costs potentially undercutting natural gas demand and the earnings trajectory that analysts are assuming.

Find out about the key risks to this MDU Resources Group narrative.

Another Angle On Value

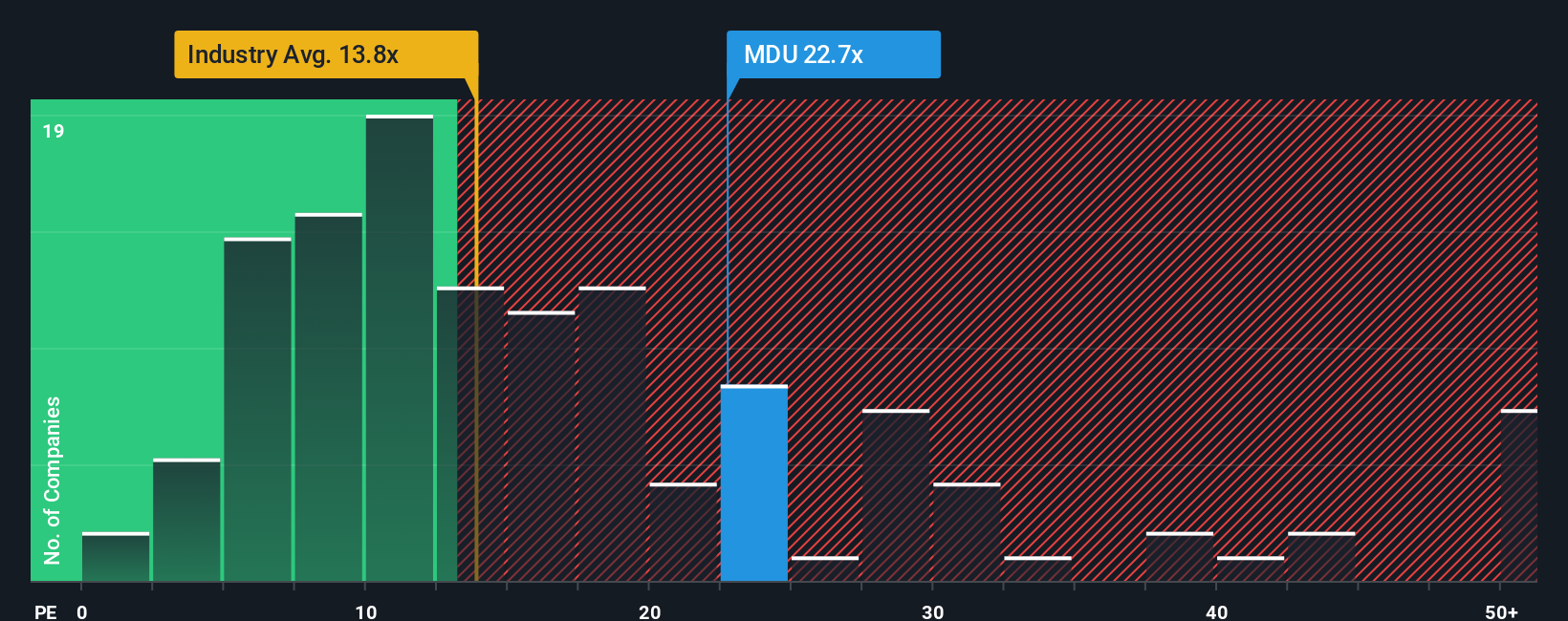

That 4.5% undervalued fair value of US$20.80 leans on long term earnings forecasts and a richer future multiple. Our P/E based view paints a cooler picture, with MDU at 21.9x earnings versus a 19.1x fair ratio, which suggests the market may already be paying up. Which story do you think fits the risk you want to take?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MDU Resources Group Narrative

If you are not fully on board with this view or prefer to lean on your own research, you can build a fresh thesis in just a few minutes by starting with Do it your way.

A great starting point for your MDU Resources Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with one company, you risk missing opportunities that better fit your goals, so keep scanning the market and let the numbers guide you.

- Spot underappreciated companies by filtering for these 876 undervalued stocks based on cash flows that may trade at prices below what their cash flows suggest.

- Tap into potential growth themes in medical technology by focusing on these 29 healthcare AI stocks that link data, software, and patient outcomes.

- Lean into digital asset trends by checking out these 79 cryptocurrency and blockchain stocks tied to blockchain infrastructure, payments, and related services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報