Asian Growth Companies With High Insider Ownership In January 2026

As we enter 2026, the Asian markets are navigating a complex landscape marked by mixed performances across major indices, with China showing signs of manufacturing recovery and South Korea experiencing robust export growth. In this environment, companies that exhibit strong growth potential coupled with high insider ownership can be particularly appealing to investors, as they often signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Modetour Network (KOSDAQ:A080160) | 12.8% | 41.8% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's take a closer look at a couple of our picks from the screened companies.

J&T Global Express (SEHK:1519)

Simply Wall St Growth Rating: ★★★★☆☆

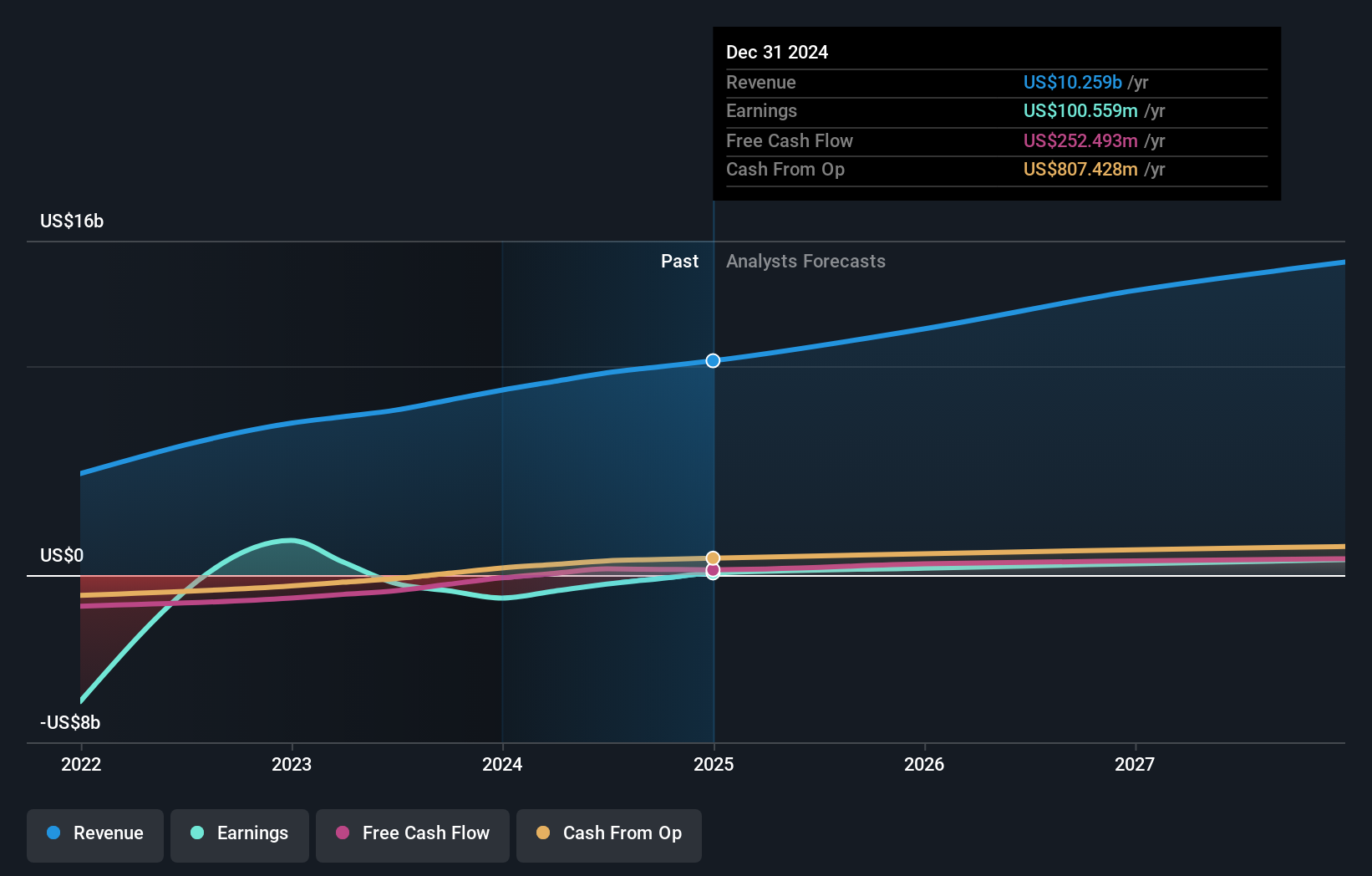

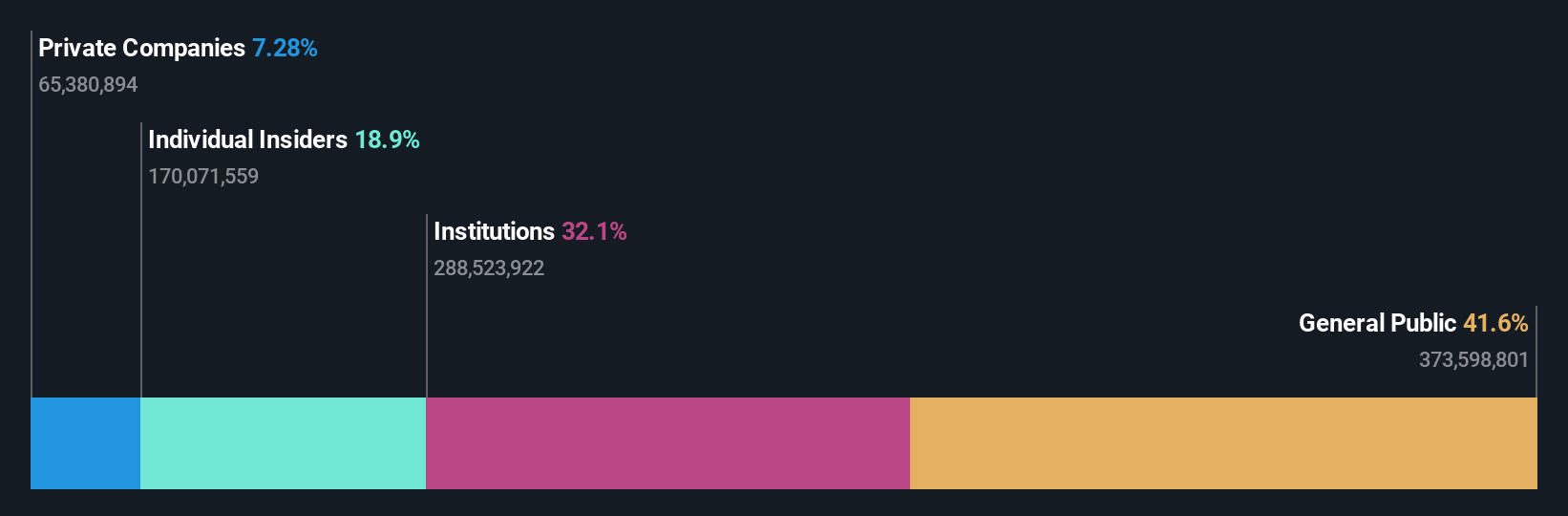

Overview: J&T Global Express Limited is an investment holding company providing integrated express delivery services across several countries including China, Indonesia, and Brazil, with a market cap of HK$97.88 billion.

Operations: The company's revenue segments include Transportation - Air Freight, which generated $10.90 billion.

Insider Ownership: 19.1%

Revenue Growth Forecast: 13.9% p.a.

J&T Global Express exhibits strong growth potential with earnings forecasted to grow significantly at 36.3% annually, outpacing the Hong Kong market's average. Despite a slower revenue growth rate of 13.9% per year, it surpasses the market average and reflects robust operational performance, evidenced by a recent 23.1% YoY increase in parcel volume for Q3 2025. The company trades at a substantial discount to its estimated fair value, enhancing its appeal as an investment opportunity in Asia's growth sector.

- Navigate through the intricacies of J&T Global Express with our comprehensive analyst estimates report here.

- The analysis detailed in our J&T Global Express valuation report hints at an inflated share price compared to its estimated value.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

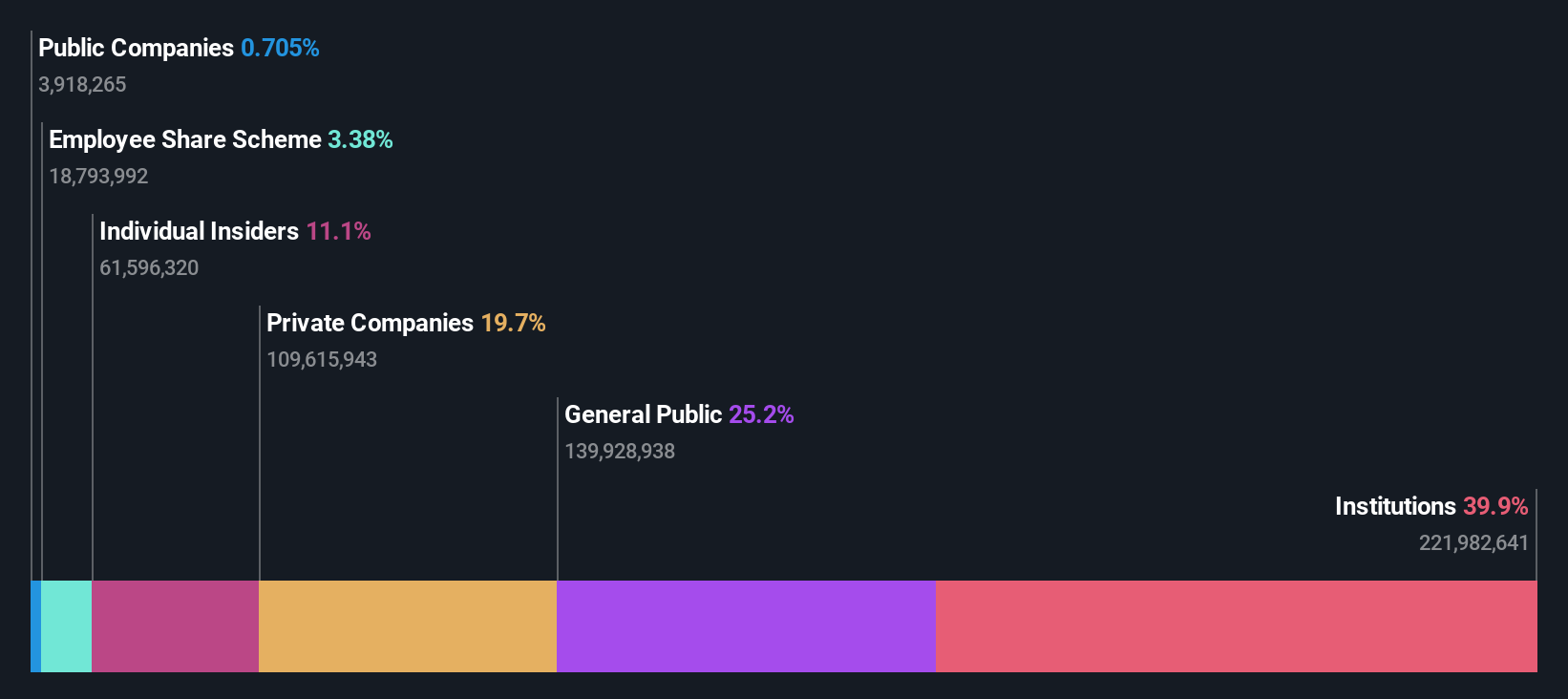

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacture, and commercialization of antibody drugs globally with a market cap of approximately HK$107.87 billion.

Operations: The company generates revenue of CN¥2.51 billion from its activities in the research, development, production, and sale of biopharmaceutical products.

Insider Ownership: 18.1%

Revenue Growth Forecast: 30.1% p.a.

Akeso demonstrates significant growth potential, with revenue expected to grow at 30.1% annually, surpassing the Hong Kong market's average. The company is on track to become profitable within three years and maintains a high forecasted return on equity of 25.3%. Recent advancements in its bispecific antibody pipeline, including FDA trial approvals for cadonilimab and promising results for ivonescimab in lung cancer studies, highlight Akeso's innovative edge in immuno-oncology.

- Delve into the full analysis future growth report here for a deeper understanding of Akeso.

- Our valuation report unveils the possibility Akeso's shares may be trading at a premium.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★★

Overview: RemeGen Co., Ltd. is a biopharmaceutical company engaged in the discovery, development, production, and commercialization of biological drugs for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States with a market cap of HK$48.16 billion.

Operations: The company's revenue from biopharmaceutical research, services, production, and sales amounts to CN¥2.23 billion.

Insider Ownership: 12.4%

Revenue Growth Forecast: 25.2% p.a.

RemeGen's growth trajectory is underscored by its forecasted revenue increase of 25.2% annually, outpacing the Hong Kong market average. The company aims for profitability within three years, with a projected high return on equity of 42%. Recent developments include its addition to the Shanghai Stock Exchange Health Care Sector Index and a CNY 40 million share repurchase program. Clinical advancements in telitacicept and disitamab vedotin further enhance RemeGen's innovative position in autoimmune and oncology treatments.

- Click here to discover the nuances of RemeGen with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that RemeGen is priced higher than what may be justified by its financials.

Key Takeaways

- Reveal the 634 hidden gems among our Fast Growing Asian Companies With High Insider Ownership screener with a single click here.

- Interested In Other Possibilities? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報