A Look At Moelis (MC) Valuation After Mixed Quarterly Earnings Surprise

Moelis (MC) is back in focus after its latest quarterly earnings, where revenue grew 33.9% year on year but came in 3.2% below expectations, while EPS topped forecasts and EBITDA missed.

See our latest analysis for Moelis.

The mixed earnings reaction sits alongside a 6.6% 90 day share price return and a 3.7% 30 day share price return. At the same time, the 3 year total shareholder return of 90.95% contrasts with a slightly negative 1 year total shareholder return, suggesting momentum has cooled recently after a strong multi year run.

If Moelis has you rethinking financials, it could be a good moment to scan for other opportunities among fast growing stocks with high insider ownership.

With revenue and net income growth, a long term total return record, and a small discount to the average analyst price target, you have to ask: is Moelis still undervalued, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 6.9% Undervalued

Moelis' most followed narrative puts fair value slightly above the last close of US$71.22, suggesting the current price already reflects a lot of good news.

The firm's growing recurring and retained advisory assignments, particularly through expansion of capital structure advisory and creditor-side franchises, provide more predictable and less volatile fee income streams. This can smooth out earnings cyclicality and improve the quality of earnings, which may potentially lead to a valuation re-rating.

Curious what justifies that higher fair value? The narrative focuses on expectations for faster earnings growth and firmer margins, as well as a future earnings multiple that is anticipated to be lower than today. Want to see how those moving parts fit together?

Result: Fair Value of $76.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh the risk that higher hiring and compensation costs, or weaker deal activity, could pressure margins and challenge this undervalued narrative.

Find out about the key risks to this Moelis narrative.

Another View: Earnings Multiple Sends A Different Signal

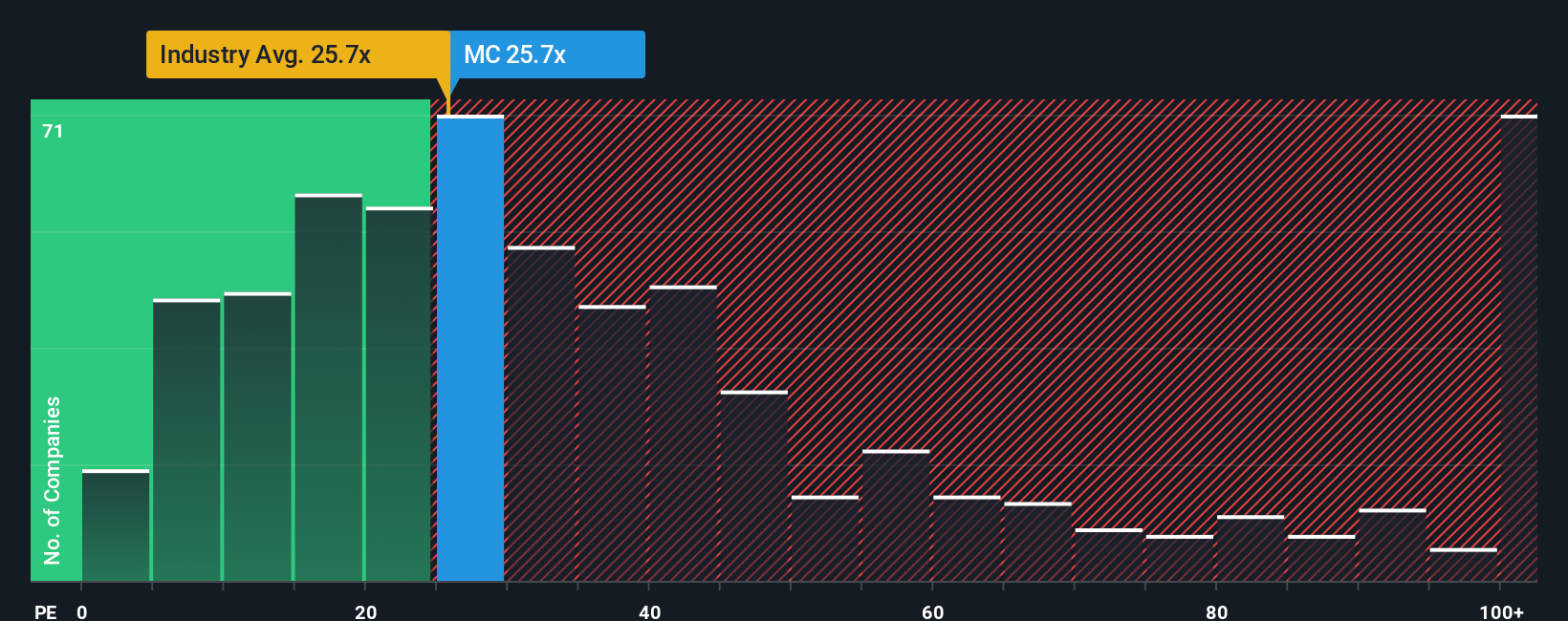

Our DCF style fair value narrative leans toward Moelis looking modestly undervalued, but the earnings multiple paints a tougher picture. The current P/E of 22.5x is above the fair ratio of 18.3x and well above peer averages of 8.6x, even if it sits below the broader US Capital Markets average of 25.6x.

In plain terms, you are paying more for each dollar of Moelis earnings than for many peers, and even more than what the fair ratio suggests the market could move toward. That can mean less room for error if the growth story or margins soften, so the real question is whether you are comfortable paying up for this profile.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Moelis Narrative

If this view does not quite match your own, you can review the same numbers yourself and build a custom Moelis story in minutes, Do it your way.

A great starting point for your Moelis research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Moelis has sharpened your thinking, do not stop here. Use the same tools to quickly spot other opportunities that might better fit your style and goals.

- Target income focused ideas with these 14 dividend stocks with yields > 3% that highlight companies offering yields above 3% for investors who care about regular cash returns.

- Explore potential growth across these 25 AI penny stocks to see which smaller names are tied to artificial intelligence themes and could deserve a closer look.

- Look for potential mispriced opportunities in these 878 undervalued stocks based on cash flows where prices sit below cash flow based assessments and might appeal if you are value oriented.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報