Assessing SharpLink Gaming (SBET) Valuation As iGaming And Ethereum Staking Model Draws Fresh Attention

Without a fresh headline to point to, SharpLink Gaming (SBET) is drawing attention for its mix of affiliate marketing for sportsbooks and online casinos alongside an Ethereum staking business model.

See our latest analysis for SharpLink Gaming.

The recent 1 day share price return of 8.39% to US$9.69 stands against a 30 day share price return of 9.61% decline and a 90 day share price return of 45.47% decline, while the 1 year total shareholder return of 22.54% contrasts sharply with a 3 year total shareholder return of 79.02% decline, hinting that short term momentum has picked up after a tough multi year stretch.

If this mix of iGaming and crypto exposure has your attention, it could be a good moment to widen your search and check out fast growing stocks with high insider ownership.

With shares well below the US$35.25 analyst price target, yet recent returns still uneven, the key question is simple: is SharpLink Gaming undervalued right now, or is the market already pricing in its future growth potential?

Price to Book of 0.6x: Is it justified?

On a P/B of 0.6x, SharpLink Gaming’s last close at US$9.69 sits well below both peers and the wider US Hospitality industry on this metric.

P/B compares the market value of the company to its net assets on the balance sheet. This can be especially relevant for businesses that are not yet profitable.

In SharpLink’s case, the Statements Data describe the stock as good value based on its 0.6x P/B versus a 2.8x peer average, and also versus the 2.7x US Hospitality industry average. That is a steep discount and suggests the market is pricing SharpLink’s book value more cautiously than comparable companies.

Compared with both its direct peers at 2.8x and the broader industry at 2.7x, SharpLink’s 0.6x multiple represents a deep gap that would need to close for the valuation to move closer to sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-book of 0.6x (UNDERVALUED)

However, you still need to weigh risks such as the net loss of US$1.00m, reliance on Ethereum staking, and a competitive iGaming affiliate market.

Find out about the key risks to this SharpLink Gaming narrative.

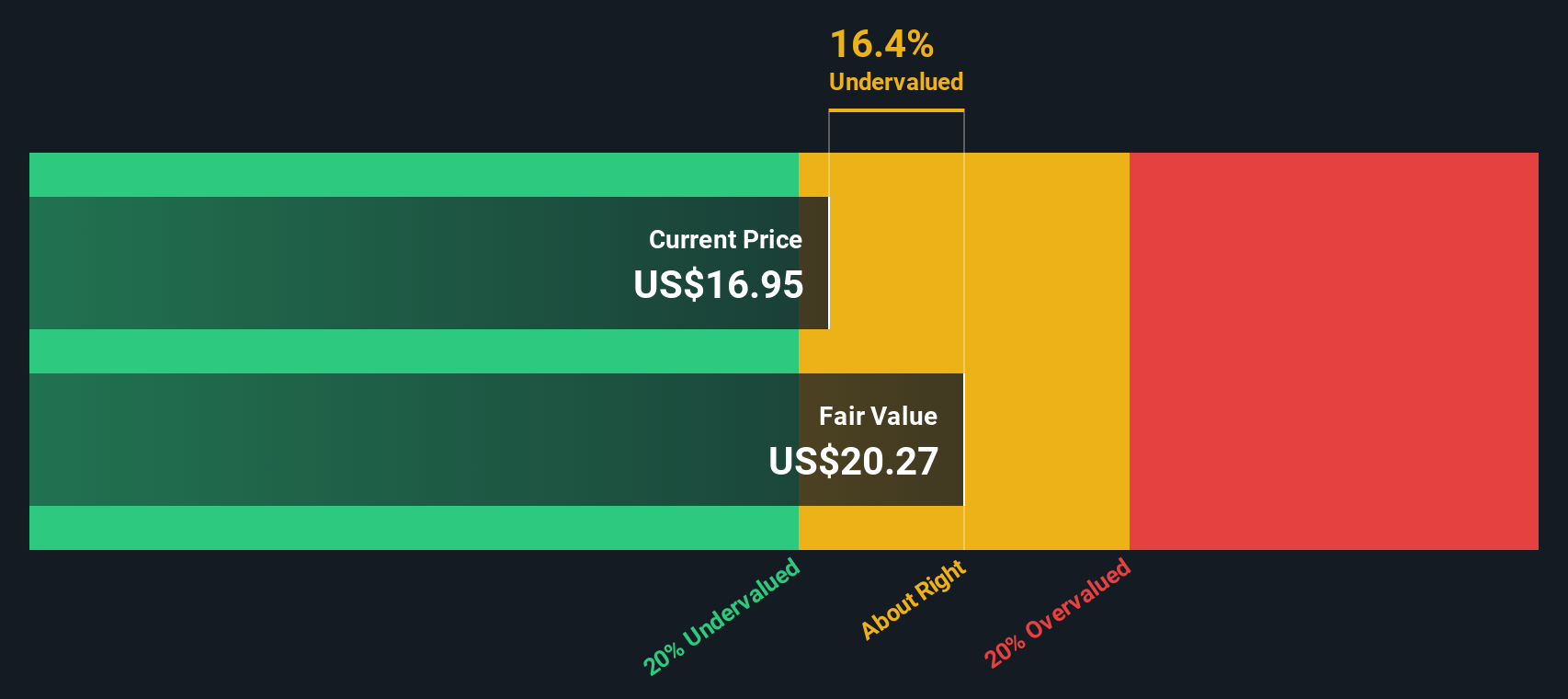

Another view through the SWS DCF model

Price to book paints SharpLink Gaming as cheap, and the DCF model tells a similar story. With the shares at US$9.69 and an estimated fair value of US$13.64, the stock is described as trading about 29% below that level. Do you think that gap is justified or temporary?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SharpLink Gaming for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SharpLink Gaming Narrative

If you see the numbers differently or prefer to build your own view from the ground up, you can shape a full story in minutes with Do it your way.

A great starting point for your SharpLink Gaming research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more stock ideas worth your time?

If SharpLink has sparked your curiosity, do not stop here, use screened ideas to quickly spot other opportunities that might fit what you are looking for.

- Target consistent income by reviewing these 14 dividend stocks with yields > 3% that may offer steadier cash returns than more speculative names.

- Back potential growth stories early by scanning these 3562 penny stocks with strong financials with financials that could support their next phase.

- Ride structural tech trends by checking out these 25 AI penny stocks shaping how businesses adopt artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報