A Look At RioCan REIT (TSX:REI.UN) Valuation After Recent Steady Returns

RioCan REIT’s recent performance snapshot

RioCan Real Estate Investment Trust (TSX:REI.UN) has drawn fresh attention after recent unit price moves, with short term returns differing from its longer term record and prompting investors to reassess income and value characteristics.

See our latest analysis for RioCan Real Estate Investment Trust.

RioCan’s recent 1 month share price return of 3.02% comes after a modest 1 day move of 0.32%. Its 1 year total shareholder return of 7.70% contrasts with the slightly negative 90 day share price return of 1.05%, suggesting momentum has been steady rather than surging.

If you are comparing income focused REITs with other income ideas, this could be a good moment to broaden your watchlist and check out pharma stocks with solid dividends.

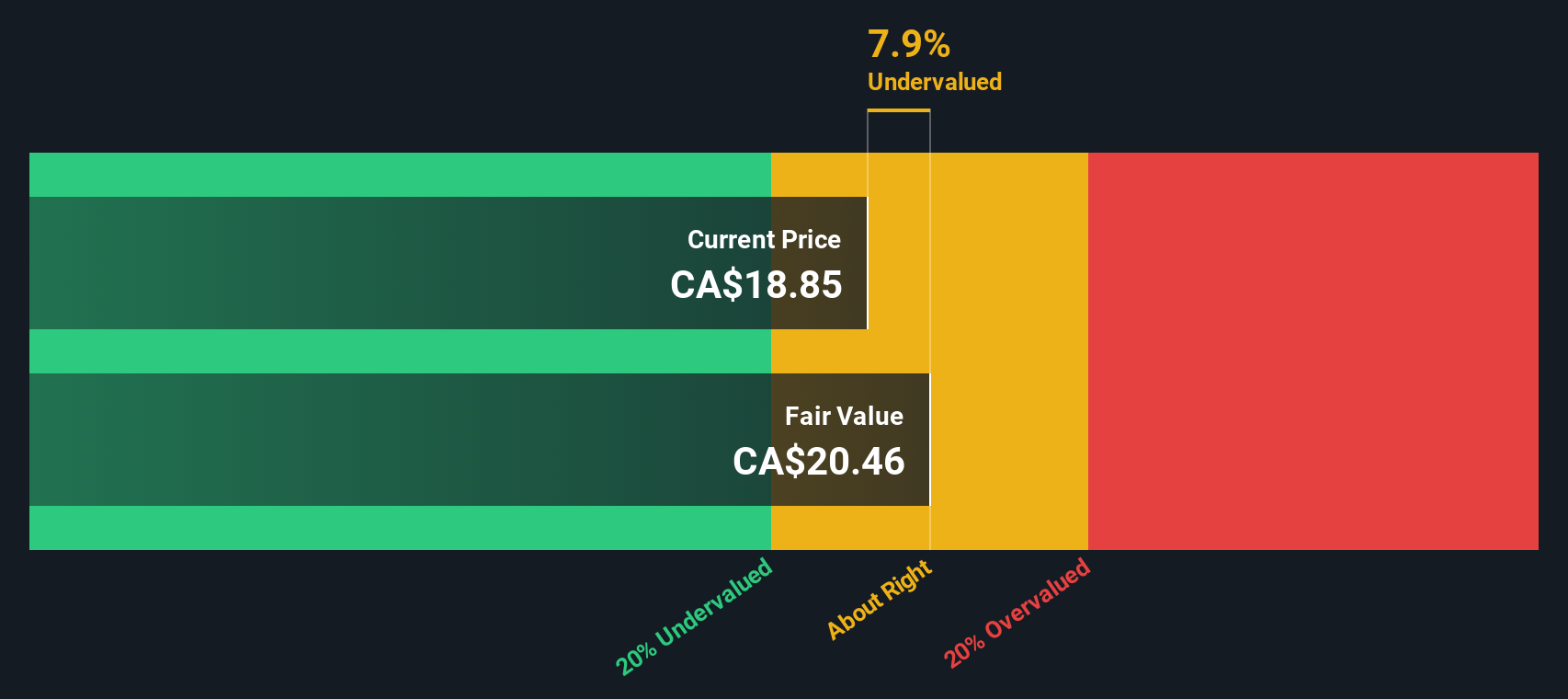

With RioCan trading at CA$18.76 and showing an estimated intrinsic discount of about 11%, the key question is whether units are quietly undervalued or if the current price already reflects future growth.

Price-to-Earnings of 82.9x: Is it justified?

RioCan units closed at CA$18.76, and on a P/E of 82.9x they look expensive compared with both peers and the broader Retail REITs industry.

The P/E multiple compares the current unit price to earnings per unit and is a common way to see how much investors are paying for each dollar of profit. For a REIT like RioCan, a very high P/E can signal that the market is pricing in a recovery in earnings or treating recent profits as temporarily depressed.

Here the current P/E of 82.9x stands well above the estimated fair P/E of 36.5x. This is a level our fair ratio model suggests the market could move toward if earnings and sentiment normalise. It also sits sharply higher than the peer average P/E of 16.5x and the North American Retail REITs average of 23.9x. This indicates investors are currently paying a significant premium to sector and peer benchmarks.

Explore the SWS fair ratio for RioCan Real Estate Investment Trust

Result: Price-to-Earnings of 82.9x (OVERVALUED)

However, you need to weigh risks, such as a very high P/E multiple and RioCan’s reliance on Canadian retail and mixed use property demand holding up.

Find out about the key risks to this RioCan Real Estate Investment Trust narrative.

Another view on RioCan’s value

That high 82.9x P/E suggests RioCan looks expensive, but our DCF model points the other way, with units trading at about a 10.7% discount to an estimated fair value of CA$21. For you, the real question is which story feels more realistic: earnings today, or cash flows over time?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RioCan Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RioCan Real Estate Investment Trust Narrative

If you see the numbers differently or want to stress test your own view, you can build a custom RioCan story in just a few minutes by starting with Do it your way.

A great starting point for your RioCan Real Estate Investment Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If RioCan is on your radar, do not stop there. Widen your opportunity set with a few targeted stock ideas that match how you like to invest.

- Spot potential mispricings by scanning these 878 undervalued stocks based on cash flows that currently look cheap relative to their cash flows and might warrant a closer look.

- Tap into growth themes by checking out these 25 AI penny stocks that are tied to artificial intelligence trends and could reshape how certain industries operate.

- Add income angles to your watchlist by reviewing these 14 dividend stocks with yields > 3% that combine 3%+ yields with equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報