A Look At Mirion Technologies (MIR) Valuation After Its Earnings Beat And Nuclear Power Segment Strength

Mirion Technologies (MIR) has drawn fresh attention after reporting quarterly earnings per share ahead of expectations, along with strong performance in its nuclear power end market, yet the stock has retreated following the announcement.

See our latest analysis for Mirion Technologies.

The latest earnings news arrives after a mixed stretch in the share price, with a 3.03% 90 day share price return and a 36.25% 1 year total shareholder return suggesting long term momentum, while shorter term sentiment has cooled around the current US$23.83 level.

If Mirion’s earnings beat has you thinking about where else growth stories might emerge in adjacent areas like medical imaging and radiation safety, it could be worth scanning healthcare stocks as a next step.

With Mirion posting an earnings beat, double digit annual revenue growth of 13.44% and net income growth that is a very large multiple of the prior year, yet trading around US$23.83, is this a genuine opportunity or is the market already baking in years of future growth?

Most Popular Narrative: 22.5% Undervalued

With Mirion last closing at US$23.83 against a most-followed fair value of US$30.75, the narrative leans toward meaningful upside based on future earnings power.

Recent investment in capital structure optimization has reduced interest expense and increased financial flexibility, enabling additional M&A and technology investments while freeing up cash flow that may be deployed to accretive growth initiatives or returned to shareholders, improving net margin and cash generation over time.

Curious what has to happen for that higher value to make sense? The narrative leans on faster revenue expansion, fatter margins and a richer future earnings multiple. Want to see how those three pieces fit together and what they imply for Mirion’s profit pool over the next few years?

Result: Fair Value of $30.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could be challenged if nuclear sector demand softens or if acquisitions like Certrec are harder to integrate and weigh on margins.

Find out about the key risks to this Mirion Technologies narrative.

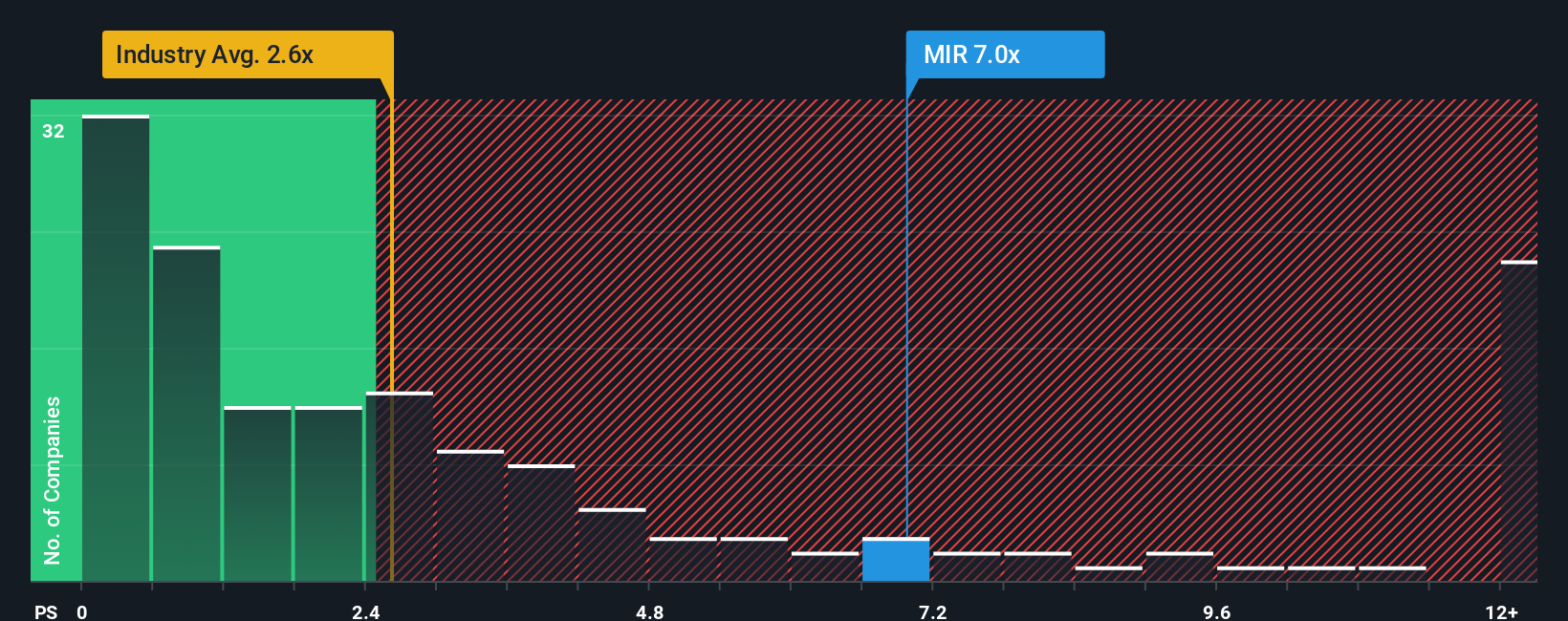

Another View: Multiples Send A Different Signal

The popular narrative points to 22.5% upside, yet Mirion trades on a P/S of 6x versus an estimated fair ratio of 3.7x and a US Electronic industry average of 2.5x. That richer pricing can mean higher valuation risk. Which story do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mirion Technologies Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a complete, data driven view in just a few minutes with Do it your way.

A great starting point for your Mirion Technologies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Mirion has sharpened your thinking, do not stop here. You are only seeing a fraction of what the market offers right now.

- Target potential bargains early by scanning these 878 undervalued stocks based on cash flows that might be trading below what their cash flows suggest.

- Consider technology shifts by reviewing these 25 AI penny stocks that are positioned around artificial intelligence themes.

- Focus on income generation by reviewing these 14 dividend stocks with yields > 3% that offer yields above 3% as part of a returns oriented approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報