Should Ryanair’s Robust December Traffic and Load Factors Shape a Rethink for (ISE:RYA) Investors?

- Ryanair Holdings plc has reported its December 2025 traffic results, with 14.5 million guests for the month and 206.5 million year to date, while maintaining load factors of 92% and 94% respectively, broadly in line with the prior year.

- The combination of rising guest numbers and consistently high load factors points to sustained demand for Ryanair’s network and capacity deployment.

- We will now examine how this continued growth in guest numbers shapes Ryanair’s investment narrative and future operating priorities.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Ryanair Holdings' Investment Narrative?

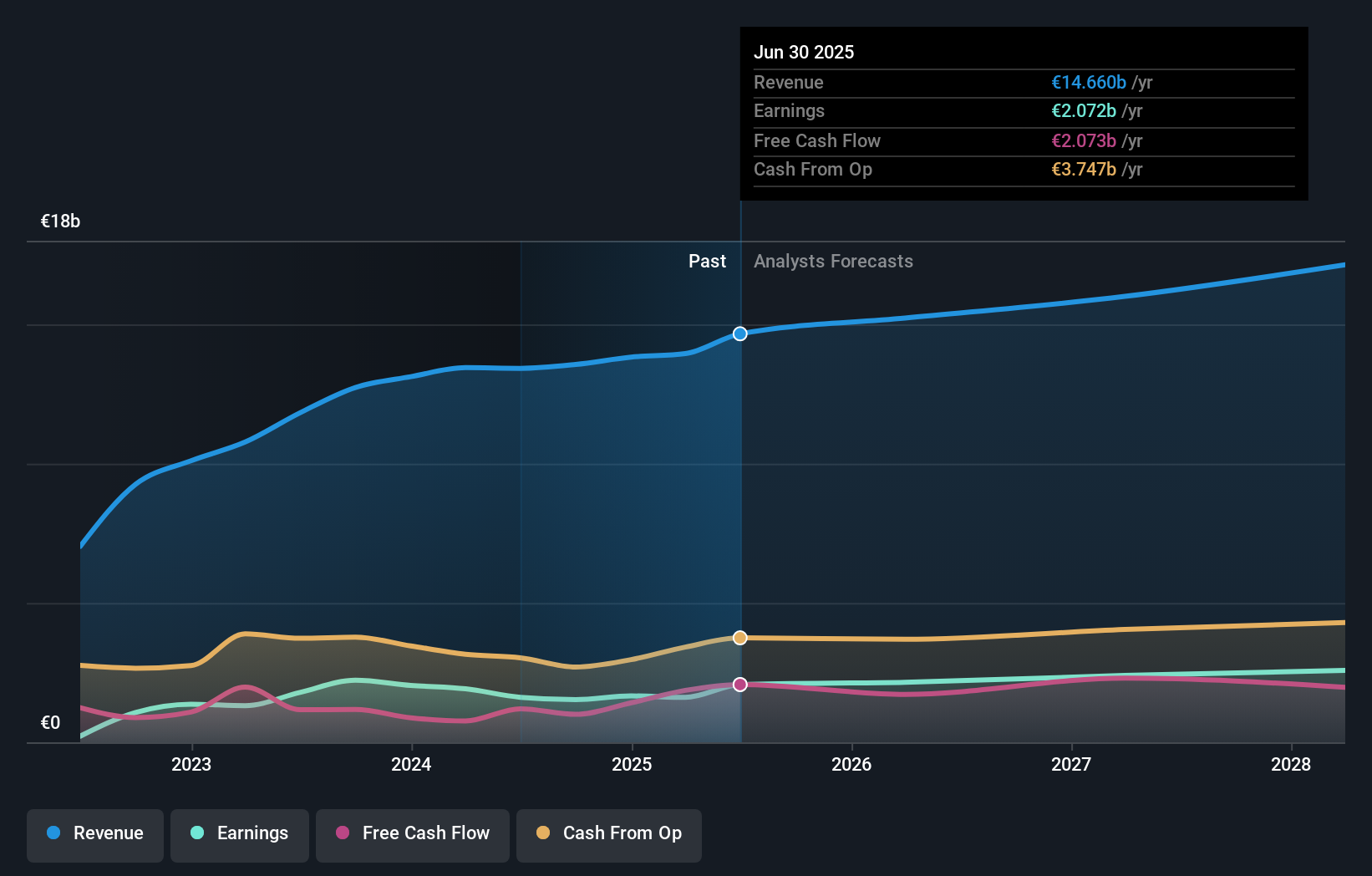

To own Ryanair, you really have to believe in its ability to keep filling a growing fleet at attractive economics while running a tight cost base. The December 2025 traffic print, with guests already above the company’s FY26 guidance of 206 million, underlines that demand has so far met or exceeded its capacity plans, but it does not materially shift the near term investment story on its own. The key catalysts still sit around capacity additions, pricing discipline, and how effectively management uses strong free cash flow for dividends and the sizeable €750 million buyback. On the risk side, the mix of an “expensive vs global peers” valuation and an unstable dividend track record has not gone away, even with solid recent traffic.

However, investors should not ignore how rising traffic interacts with costs and capital returns. Ryanair Holdings' shares are on the way up, but they could be overextended by 15%. Uncover the fair value now.Exploring Other Perspectives

Nine Simply Wall St Community fair values for Ryanair span about €25 to almost €40 per share, showing how far apart private views can be. Against that spread, recent traffic outperformance and the still‑elevated global airline valuation gap keep the focus squarely on whether current profitability and buybacks remain sustainable. Readers should weigh these contrasting perspectives before deciding how much optimism is already in the price.

Explore 9 other fair value estimates on Ryanair Holdings - why the stock might be worth 15% less than the current price!

Build Your Own Ryanair Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ryanair Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ryanair Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ryanair Holdings' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報