TSX Penny Stocks Spotlight: Nano One Materials And 2 Other Promising Picks

As we enter 2026, the Canadian market is navigating a landscape of economic optimism and cautious anticipation, with investors encouraged to reassess their strategies in light of recent employment trends and inflation data. Penny stocks, while an older term, continue to represent intriguing opportunities for growth at accessible price points. By focusing on companies with strong fundamentals and sound balance sheets, investors can discover potential gems within this often-overlooked segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.24 | CA$56.63M | ✅ 3 ⚠️ 4 View Analysis > |

| Cannara Biotech (TSXV:LOVE) | CA$1.78 | CA$169.07M | ✅ 3 ⚠️ 0 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.32 | CA$253.17M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.30 | CA$131.03M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.51M | ✅ 2 ⚠️ 3 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.27 | CA$844.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.19 | CA$23.59M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.45 | CA$175M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$186.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 383 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Nano One Materials (TSX:NANO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nano One Materials Corp. produces and sells cathode active materials for lithium-ion batteries used in electric vehicles, energy storage systems, and consumer electronics, with a market cap of CA$132.68 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: CA$132.68M

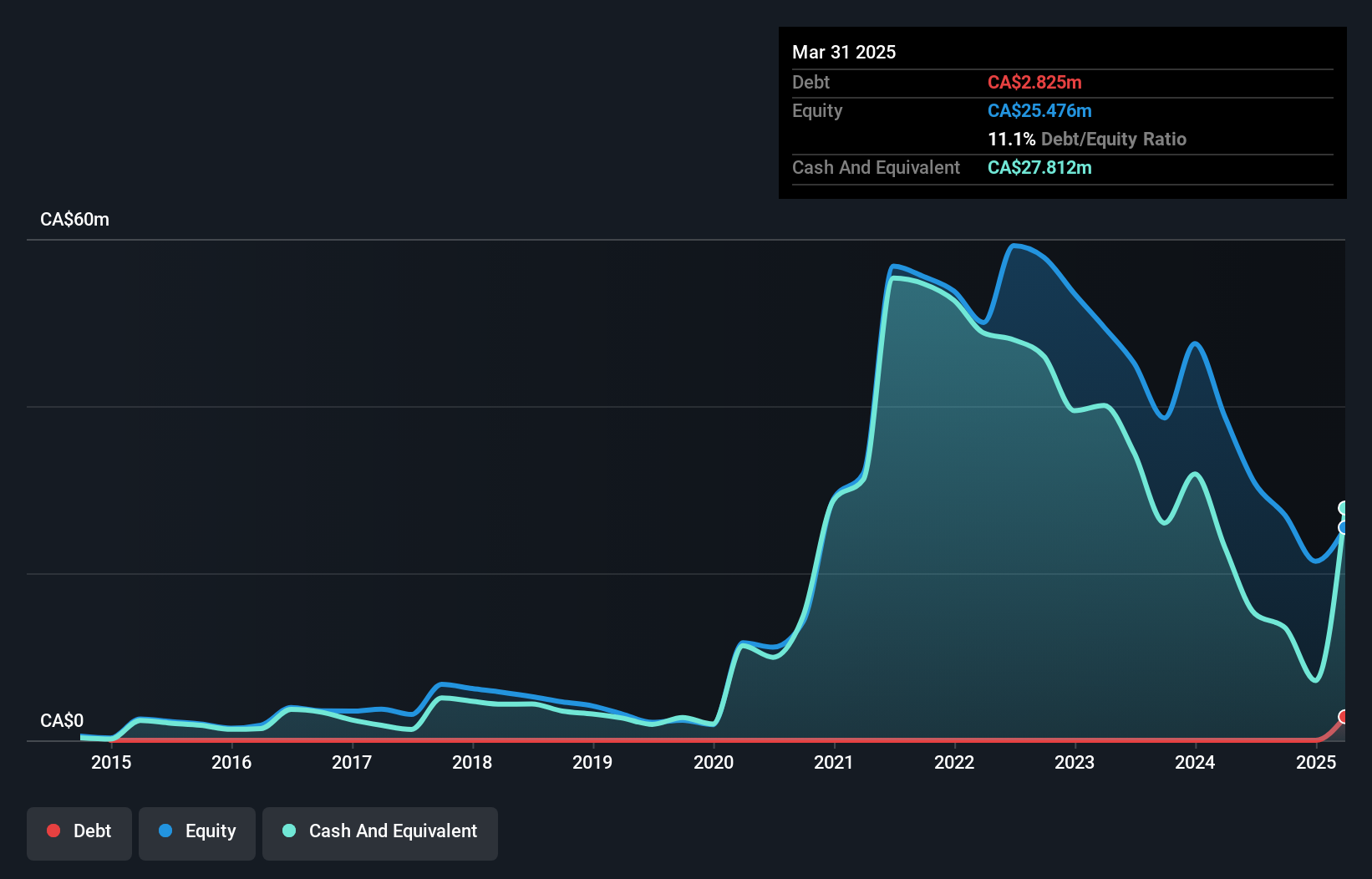

Nano One Materials Corp., with a market cap of CA$132.68 million, remains pre-revenue, focusing on developing cathode active materials for lithium-ion batteries. Recent strategic collaborations and funding, including a CAD 5 million non-repayable contribution from Natural Resources Canada, aim to scale production and accelerate commercialization efforts. Despite its unprofitable status and negative return on equity of -84.94%, the company maintains more cash than debt and has sufficient short-term assets to cover liabilities. Its management team is experienced, but it faces challenges with a limited cash runway if free cash flow continues to decline at historical rates.

- Navigate through the intricacies of Nano One Materials with our comprehensive balance sheet health report here.

- Examine Nano One Materials' past performance report to understand how it has performed in prior years.

High Tide (TSXV:HITI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Tide Inc. operates in the cannabis retail sector in Canada with a market cap of CA$334.51 million.

Operations: The company's revenue is derived from two segments: E-commerce, contributing CA$23.13 million, and Bricks and Mortar, generating CA$545.12 million.

Market Cap: CA$334.51M

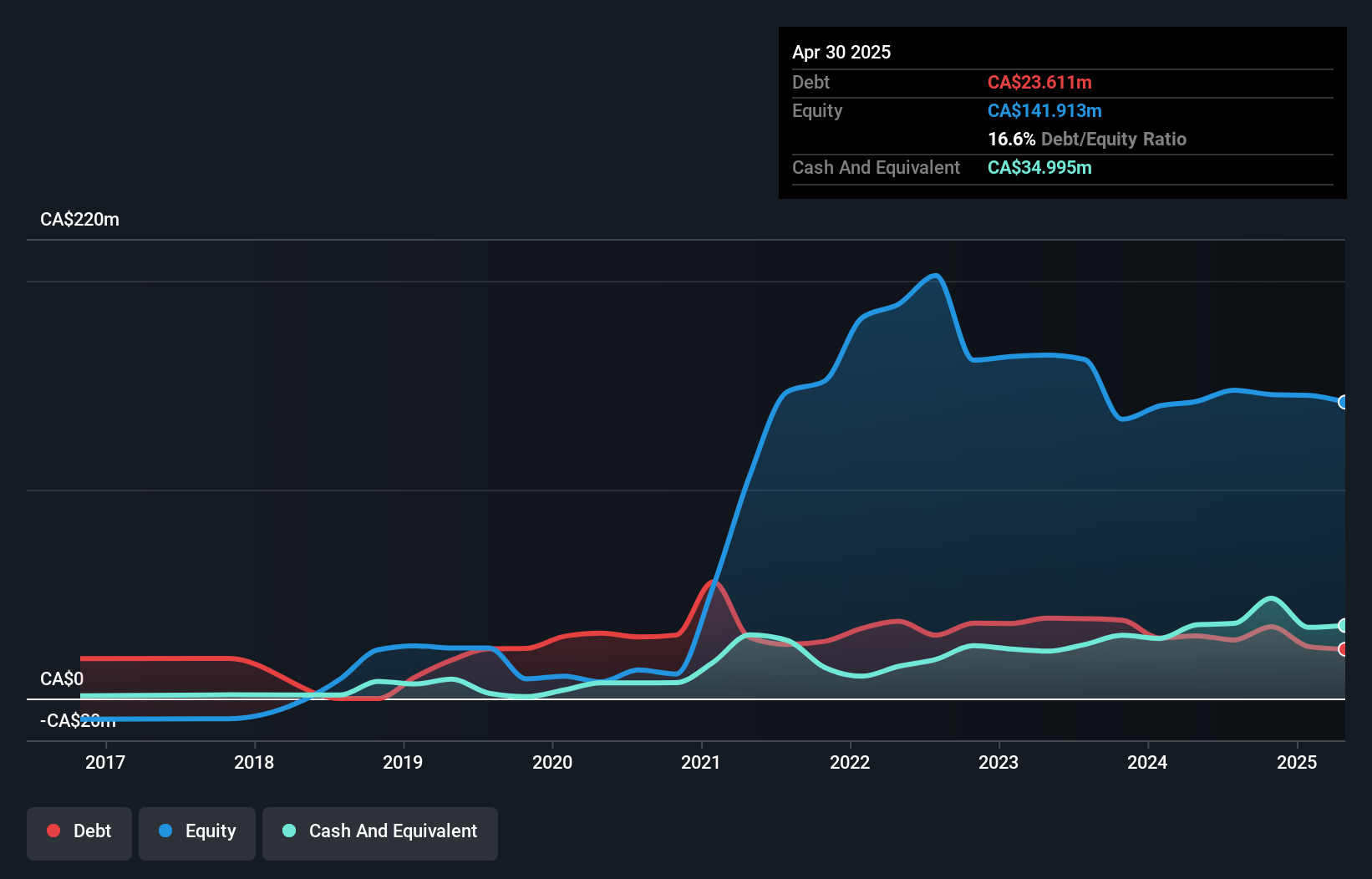

High Tide Inc., with a market cap of CA$334.51 million, is actively expanding its Canna Cabana retail footprint, recently opening several new locations in Ontario and Alberta, bringing the total to 218 stores across Canada. The company is unprofitable but has reduced losses over five years and maintains a strong financial position with short-term assets exceeding liabilities and more cash than debt. High Tide's strategic positioning in the cannabis sector is bolstered by potential U.S. expansion plans following favorable regulatory developments regarding cannabis rescheduling, which could enhance its market presence and revenue streams through both retail operations and CBD product offerings.

- Take a closer look at High Tide's potential here in our financial health report.

- Explore High Tide's analyst forecasts in our growth report.

Auxly Cannabis Group (TSX:XLY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Auxly Cannabis Group Inc. is a consumer packaged goods company in the Canadian cannabis market with a market cap of CA$195.52 million.

Operations: The company's revenue is derived from its Venture Capital segment, amounting to CA$145.99 million.

Market Cap: CA$195.52M

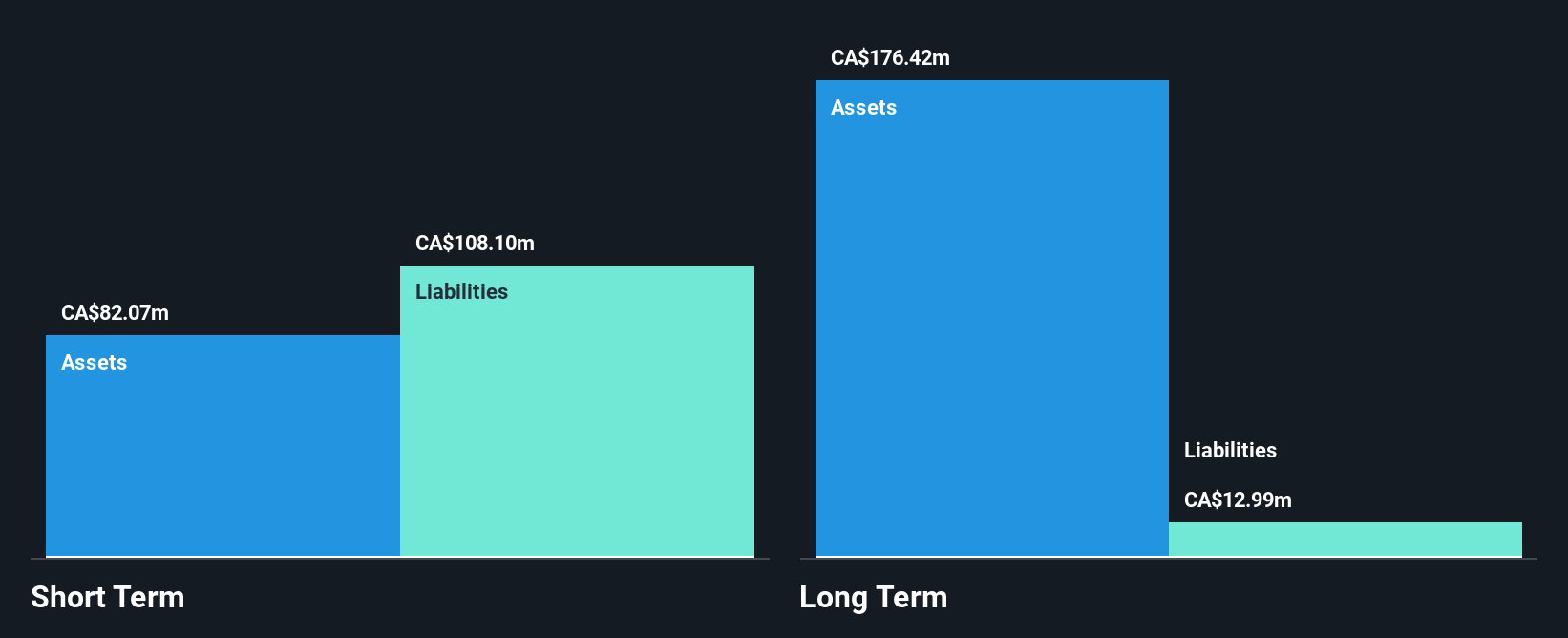

Auxly Cannabis Group, with a market cap of CA$195.52 million, has shown significant financial improvement by becoming profitable recently. The company's revenue for the third quarter was CA$39.9 million, up from CA$33.28 million the previous year, and net income increased to CA$20.49 million from CA$3.24 million in the same period last year. Auxly's return on equity is high at 26.3%, and its debt is well-covered by operating cash flow (34.4%). The company’s short-term assets exceed both its short- and long-term liabilities, indicating a solid financial footing amidst volatility reduction in recent times.

- Click here to discover the nuances of Auxly Cannabis Group with our detailed analytical financial health report.

- Examine Auxly Cannabis Group's earnings growth report to understand how analysts expect it to perform.

Next Steps

- Reveal the 383 hidden gems among our TSX Penny Stocks screener with a single click here.

- Ready To Venture Into Other Investment Styles? These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報