Assessing Duolingo (DUOL) Valuation After A Sharp Multi‑Month Share Price Slide

Without a specific news catalyst driving attention to Duolingo (DUOL) today, recent share performance and fundamentals such as revenue of US$964.271m and net income of US$386.018m are front and center for investors assessing the stock.

See our latest analysis for Duolingo.

At a share price of US$176.48, Duolingo has seen a sharp 30 day share price return of an 11.65% decline and a 90 day share price return of a 44.85% decline, while the 3 year total shareholder return of 140.70% points to stronger longer term momentum that has cooled recently.

If Duolingo’s recent swing has you reassessing growth names, this could be a good moment to scan high growth tech and AI stocks that might fit your watchlist next.

With Duolingo trading at US$176.48 and an indicated intrinsic discount of 63%, the key question is whether the recent share price slide leaves upside on the table or if the market is already factoring in years of future growth.

Most Popular Narrative: 34.8% Undervalued

With Duolingo’s last close at US$176.48 versus a narrative fair value of about US$270.74, the most followed view sees a sizeable valuation gap built on long range product and user growth assumptions.

Early positive results from localized partnerships, marketing in under-penetrated regions, and price optimization experiments, along with the ongoing global shift toward digital, lifelong learning and recurring subscription models, position Duolingo for long-term secular revenue and net margin growth as digital education adoption accelerates worldwide.

Curious what underpins that higher fair value? The narrative leans heavily on faster top line expansion, richer margins, and a premium P/E years from now. The full story unpacks how those pieces are expected to fit together.

Result: Fair Value of $270.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, consensus hinges on continued user growth and monetization. Any slowdown in DAUs or tougher regulatory conditions in key markets like China could quickly challenge that view.

Find out about the key risks to this Duolingo narrative.

Another Angle on Valuation

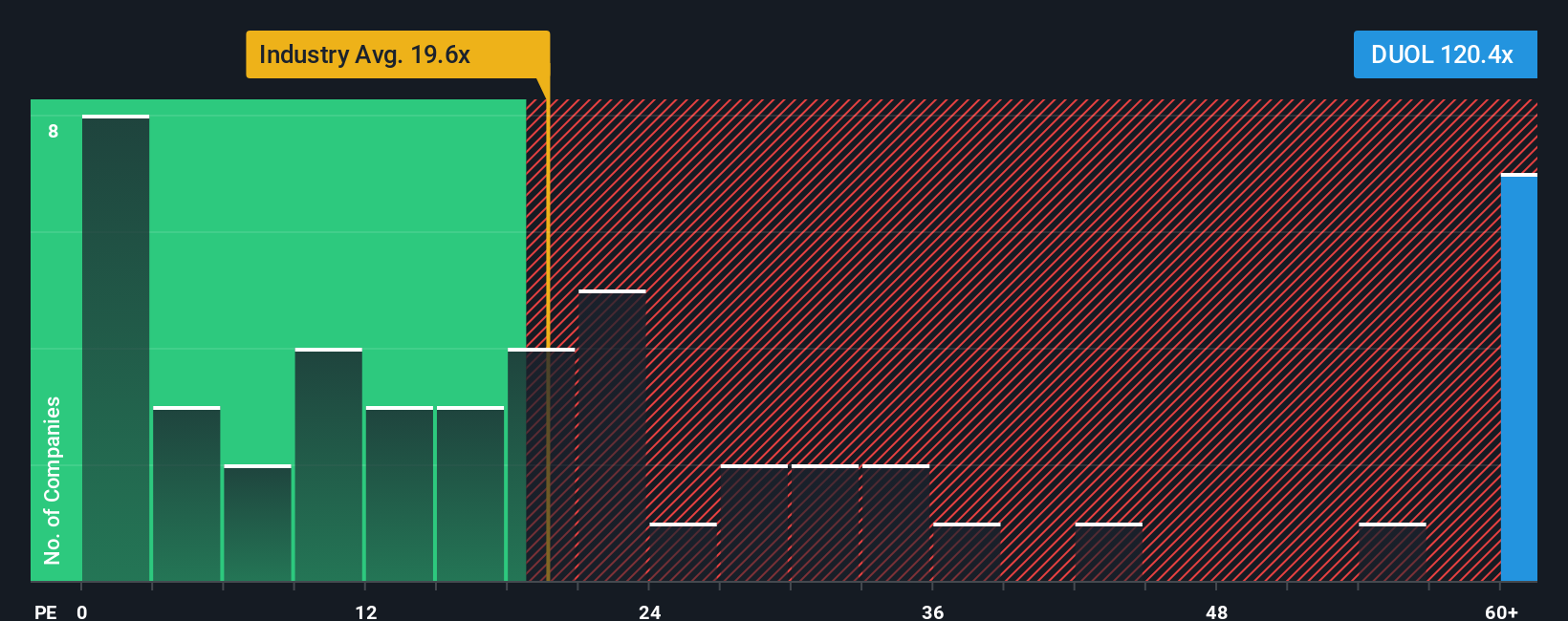

Those fair value estimates that suggest Duolingo is trading 63.2% below worth sit alongside a very different signal from its P/E ratio. At 21.1x, the stock screens as expensive versus a fair ratio of 9.8x and the US Consumer Services average of 16.5x, even though it is cheaper than peers at 29.5x. That kind of split can matter if sentiment or earnings expectations change again, so which crowd do you think the market eventually listens to?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Duolingo Narrative

If the numbers or stories here do not quite match your view, you can pull up the same data, stress test the assumptions and Do it your way in under three minutes.

A great starting point for your Duolingo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Duolingo has you rethinking your watchlist, this can be a useful time to widen the net and line up a few fresh ideas before the next move.

- Target higher income potential by scanning these 14 dividend stocks with yields > 3% that may appeal if you want yields doing more of the heavy lifting in your returns.

- Explore earlier-stage opportunities by checking out these 3564 penny stocks with strong financials that pair smaller market caps with stronger financials than you might expect at that size.

- Focus on price versus fundamentals by reviewing these 870 undervalued stocks based on cash flows that could offer more value for every dollar you commit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報