How Autoliv's (ALV) Foldable Steering Wheel for Level 4 Robocars Has Changed Its Investment Story

- Autoliv and mobility startup Tensor recently unveiled what they describe as the world's first foldable steering wheel for the Tensor Robocar, combining manual control with Level 4 autonomous driving and adaptive airbags that adjust to the wheel’s position.

- This innovation highlights how Autoliv is extending its passive safety expertise into emerging autonomous vehicle interiors, where flexible cabin layouts and mode-dependent protection systems may become more important for automakers.

- Next, we’ll examine how Autoliv’s foldable steering wheel and adaptive airbag technology could influence its investment narrative in autonomous safety.

Find companies with promising cash flow potential yet trading below their fair value.

Autoliv Investment Narrative Recap

For Autoliv, the core belief is that stricter safety regulations and higher safety content per vehicle can underpin its role as a global passive safety supplier, even if vehicle production growth slows. The Tensor foldable steering wheel announcement showcases Autoliv’s push into autonomous-ready interiors, but its near term business remains more exposed to pricing pressure from major OEM customers and uncertainty around global light vehicle production than to this specific program, so the immediate financial impact looks limited.

Against this backdrop, Autoliv’s recent Q3 2025 results, with sales of US$2,706 million and higher earnings than the prior year, are more relevant for assessing the next few quarters than the Tensor launch timing. They give investors a clearer view of how Autoliv is handling tariffs, cost recovery and OEM pricing tension while it gradually builds positions in newer applications like the Tensor Robocar and other advanced EV and autonomous platforms.

But investors should also be aware that ongoing pricing pressure from powerful OEMs could...

Read the full narrative on Autoliv (it's free!)

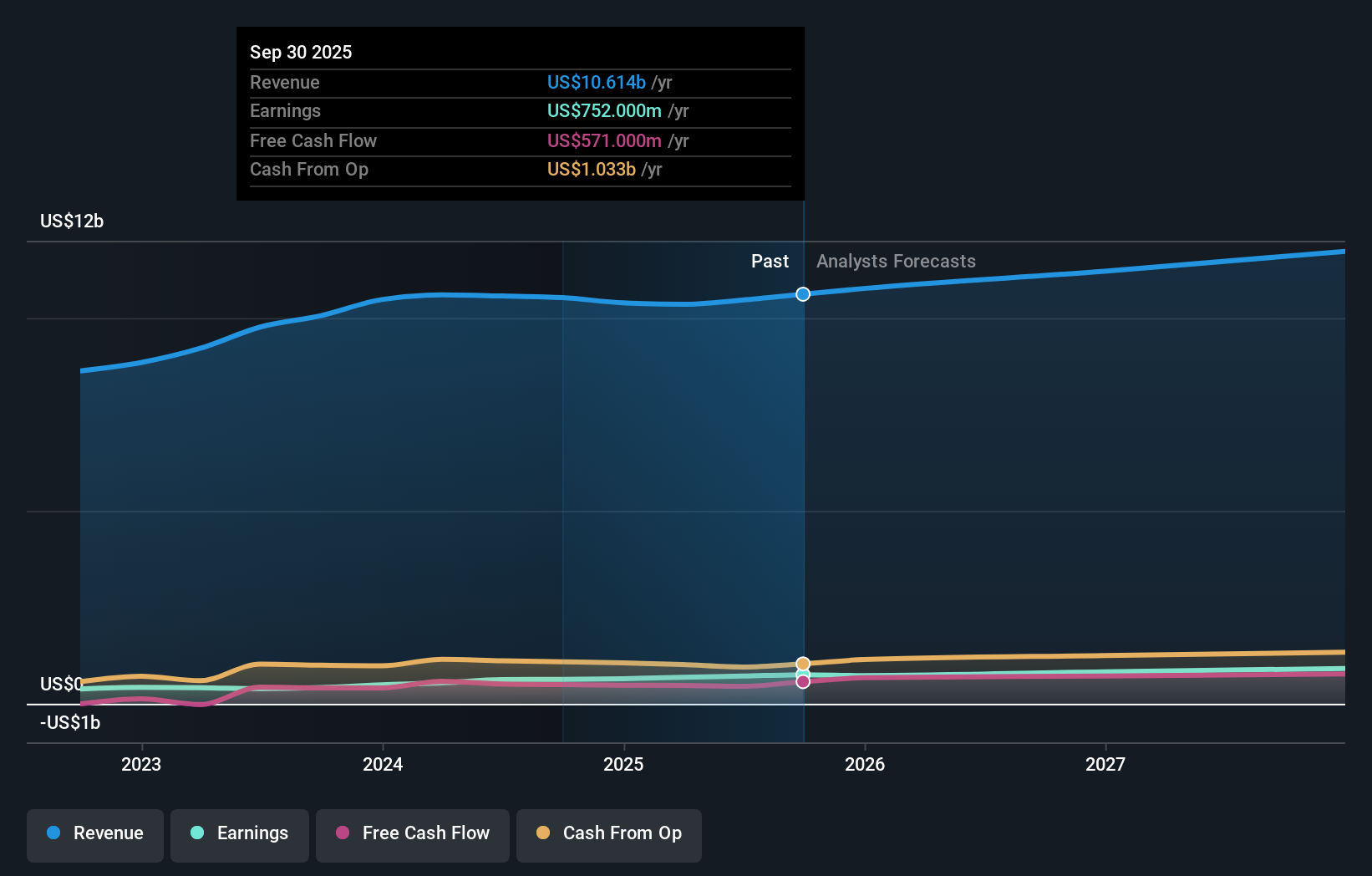

Autoliv's narrative projects $11.8 billion revenue and $896.4 million earnings by 2028. This requires 4.2% yearly revenue growth and about a $181 million earnings increase from $715.0 million today.

Uncover how Autoliv's forecasts yield a $138.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span roughly US$126.97 to US$156.68, showing how far individual views can stretch. You can set those alongside the risk that slower global light vehicle production growth may weigh on Autoliv’s revenue and consider how different assumptions about future volumes influence the company’s potential performance.

Explore 3 other fair value estimates on Autoliv - why the stock might be worth just $126.97!

Build Your Own Autoliv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autoliv research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Autoliv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autoliv's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報