A Look At e.l.f. Beauty (ELF) Valuation After Quarterly Miss And Guidance Shortfall

e.l.f. Beauty (ELF) is back in focus after its latest quarterly report. Revenue grew 14.2% year over year, but came in 6.4% below analyst expectations and full-year guidance also lagged forecasts.

See our latest analysis for e.l.f. Beauty.

The stock reaction around the results has been sharp, with a 90 day share price return showing a 44.66% decline and a 1 year total shareholder return showing a 38.11% decline, contrasting with a 5 year total shareholder return of 236.69% that points to earlier strong momentum now fading.

If earnings-driven swings in e.l.f. Beauty have you thinking about where else growth stories might emerge next, it could be a good time to look at fast growing stocks with high insider ownership.

With revenue still growing and the share price sharply lower, e.l.f. Beauty now trades at a discount to the average analyst price target. This raises a key question: is this a reset buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 32.6% Undervalued

Based on the most followed narrative, e.l.f. Beauty's fair value of about US$115 per share sits well above the last close of US$77.81, setting up a clear valuation gap tied to growth and margin expectations.

The company is highly effective at leveraging influencer marketing, social media virality, and community-driven innovation (e.g., TikTok Shop exclusives, rapid launch cadence). This enables lower customer acquisition costs and highly efficient brand-building, supporting both top-line growth and sustainable net margin expansion.

Curious how revenue, earnings, and future P/E assumptions combine to justify that higher fair value? The narrative leans on strong growth, rising margins, and a premium earnings multiple that many investors usually associate with larger global consumer brands. Want to see exactly how those moving parts add up in the model?

Result: Fair Value of $115.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are clear pressure points here, including tariff exposure from China sourcing and higher SG&A that could squeeze margins if growth or price increases do not keep up.

Find out about the key risks to this e.l.f. Beauty narrative.

Another View: Market Multiple Sends a Different Signal

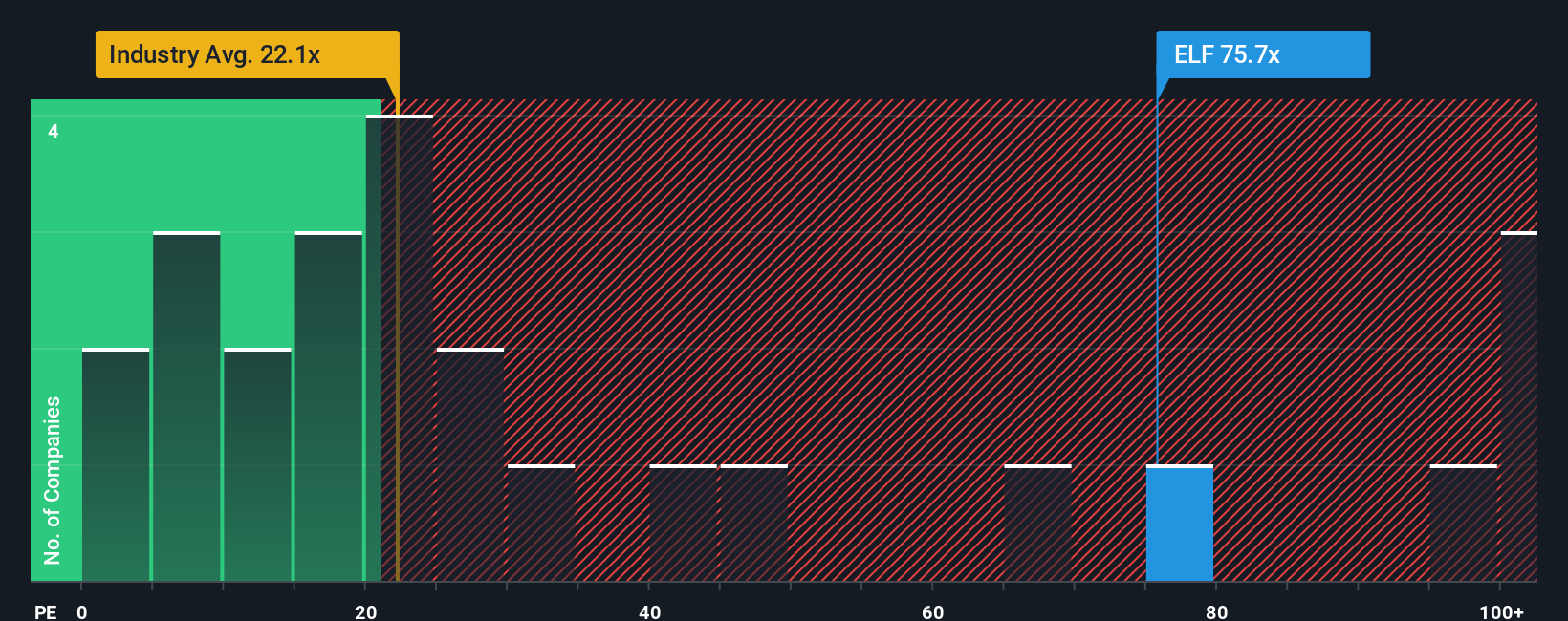

That 32.6% undervalued fair value from the narrative sits awkwardly next to how the market is actually pricing e.l.f. Beauty today. The current P/E is 56.7x, compared with 21.4x for the North American Personal Products industry, 13.9x for peers, and a fair ratio of 39.7x.

In plain terms, the share price already reflects a much richer earnings multiple than both the sector and peers, and it also sits well above the fair ratio the market could move toward over time. If that gap closes, does it narrow the upside case or simply set a higher bar for execution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own e.l.f. Beauty Narrative

If you see the numbers differently, or just prefer to test your own assumptions, you can build a custom e.l.f. Beauty narrative in minutes, starting with Do it your way.

A great starting point for your e.l.f. Beauty research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If e.l.f. Beauty has sharpened your thinking, do not stop here. A broader watchlist can help you spot opportunities you might otherwise overlook.

- Target potential mispricings by scanning these 870 undervalued stocks based on cash flows that may offer more attractive entry points based on cash flow fundamentals.

- Spot emerging trends in automation and machine learning with these 25 AI penny stocks that could reshape entire business models.

- Strengthen your income focus by reviewing these 14 dividend stocks with yields > 3% that combine yield with stock market exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報