A Look At Camtek (NasdaqGM:CAMT) Valuation As AI Hype Lifts Chip Equipment Shares And Earnings Approach

Camtek (NasdaqGM:CAMT) rose about 8% in afternoon trading, moving with a broader chip equipment rally as investors positioned around artificial intelligence related spending and looked ahead to the company’s upcoming earnings update.

See our latest analysis for Camtek.

Today’s move adds to a 7-day share price return of 7.04% and a 90-day share price return of 3.33%. The 1-year total shareholder return of 30.51% and very large 3-year total shareholder return suggest momentum has been building over time.

If Camtek’s AI driven story has caught your eye, it could be a prompt to look across the sector and see which other names stand out in high growth tech and AI stocks.

With Camtek’s shares already up strongly over 1 and 3 years and the stock trading close to analyst targets, the key question is whether AI driven demand still leaves upside on the table, or if the market is already pricing in future growth.

Most Popular Narrative Narrative: 8.9% Undervalued

With Camtek last closing at $115.50 against a narrative fair value of $126.75, the current setup leans toward upside if those assumptions hold.

Successful integration and ramp of the MicroProf metrology offering, as evidenced by 30+ installations at a Tier 1 customer, demonstrates Camtek's ability to expand its product portfolio and access new metrology-heavy workflows, enabling higher-margin revenue streams and operating income growth.

Curious what underpins that higher fair value? The narrative leans on brisk revenue growth, firm margins and a rich future P/E multiple usually reserved for sector leaders.

Result: Fair Value of $126.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view still hinges on Camtek avoiding a sharp pullback in Asian demand or losing ground to larger rivals in advanced packaging and metrology.

Find out about the key risks to this Camtek narrative.

Another View: Rich P/E Tells a Different Story

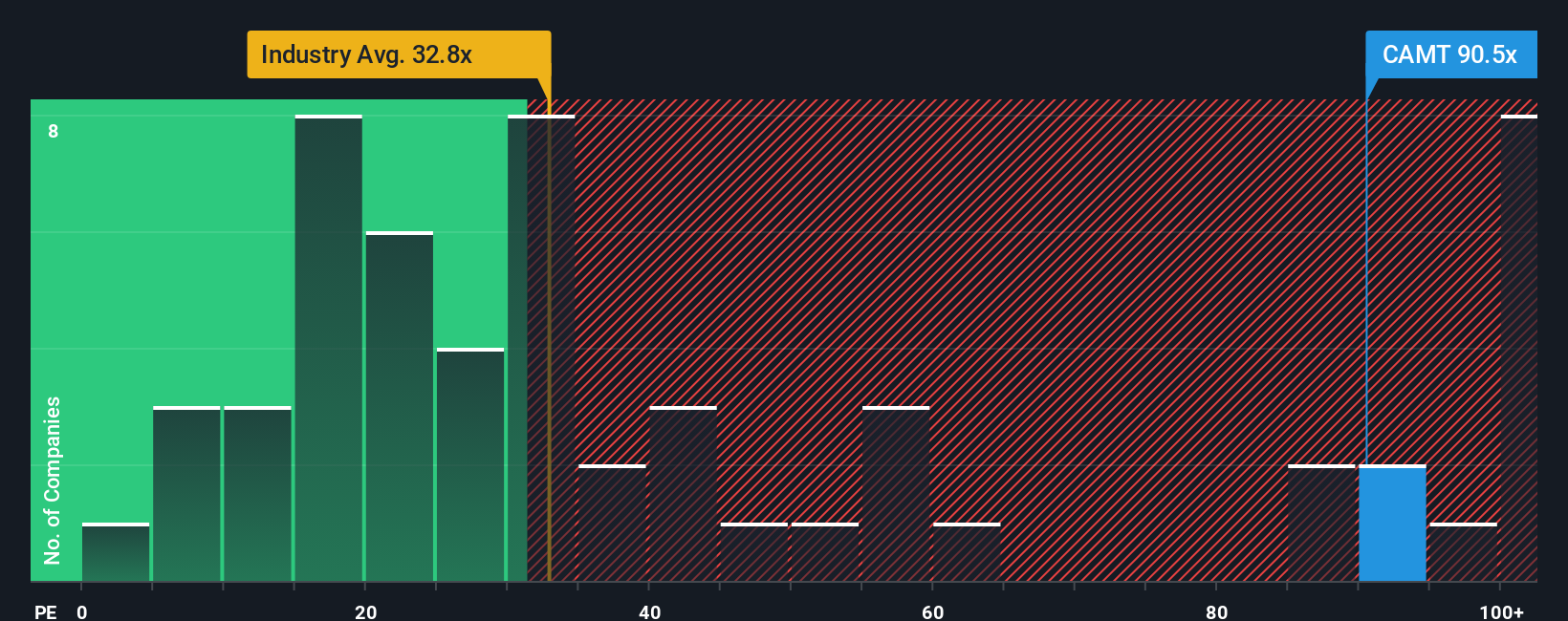

The narrative fair value of $126.75 suggests upside from the current $115.50 share price. But on a simple P/E basis, Camtek looks expensive, trading at 110.5x earnings versus 37.3x for the US Semiconductor industry, 56.6x for peers, and a fair ratio of 52.6x.

That gap points to meaningful valuation risk if sentiment cools and the market shifts closer to the fair ratio instead of the AI driven narrative. Investors may therefore wish to consider whether Camtek’s earnings path truly justifies such a premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Camtek Narrative

If you see the numbers differently or prefer to test your own view, you can create a custom Camtek narrative in minutes, Do it your way.

A great starting point for your Camtek research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Camtek has sharpened your focus, do not stop here. Broaden your watchlist with a few targeted screens that could reveal names you have not considered.

- Kickstart your hunt for value by checking out these 870 undervalued stocks based on cash flows, where pricing and cash flows point to stocks that may warrant a closer look.

- Spot potential income ideas by scanning these 14 dividend stocks with yields > 3%, highlighting companies that offer dividend yields above 3%.

- Explore developments in digital assets with these 79 cryptocurrency and blockchain stocks, focusing on businesses tied to cryptocurrency and blockchain themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報