Assessing Aptiv (APTV) Valuation After Recent Share Price Moves And Undervalued Narrative

Aptiv (APTV) is back on watch for investors after recent share price moves, with the stock closing at $78.44. The latest returns across the past week, month, and past 3 months highlight mixed momentum.

See our latest analysis for Aptiv.

The recent 1 day share price return of 3.1% and 7 day gain of 2.1% sit against a 90 day share price return of an 8% decline, while the 1 year total shareholder return of 27.8% contrasts with weaker 3 and 5 year total shareholder returns. This suggests shorter term momentum has picked up after a tougher multi year period.

If Aptiv has you rethinking the auto space, it could be a good moment to widen your watchlist with other auto manufacturers that are moving for similar themes.

With Aptiv trading at $78.44 relative to analyst targets and some measures suggesting the shares sit at a discount, you have to ask whether this is a genuine entry point or whether the market is already pricing in future growth.

Most Popular Narrative Narrative: 21.3% Undervalued

With Aptiv closing at $78.44 against a narrative fair value of about $99.65, the current setup frames a clear valuation gap to examine.

Strong demand for Aptiv's advanced electrical/electronic architectures (including high-voltage and high-speed data connectivity products), driven by the global shift toward electric vehicles and increasingly complex vehicle electrical systems, is supporting robust new business bookings and growth in content per vehicle; this is a positive catalyst for revenue growth and, as volume scales, for operating leverage and margins.

Curious what kind of revenue mix and margin profile could justify that higher fair value. The narrative leans on faster earnings compounding and a lower future earnings multiple than today. Want to see how those moving parts fit together and what they imply for Aptiv’s long term earnings power and cash generation. The full story is in the detailed assumptions behind that valuation gap.

Result: Fair Value of $99.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still have to weigh risks, such as softer global auto production and any hiccups in the EDS spin, which could quickly challenge that undervalued thesis.

Find out about the key risks to this Aptiv narrative.

Another View: What The Market Multiple Is Saying

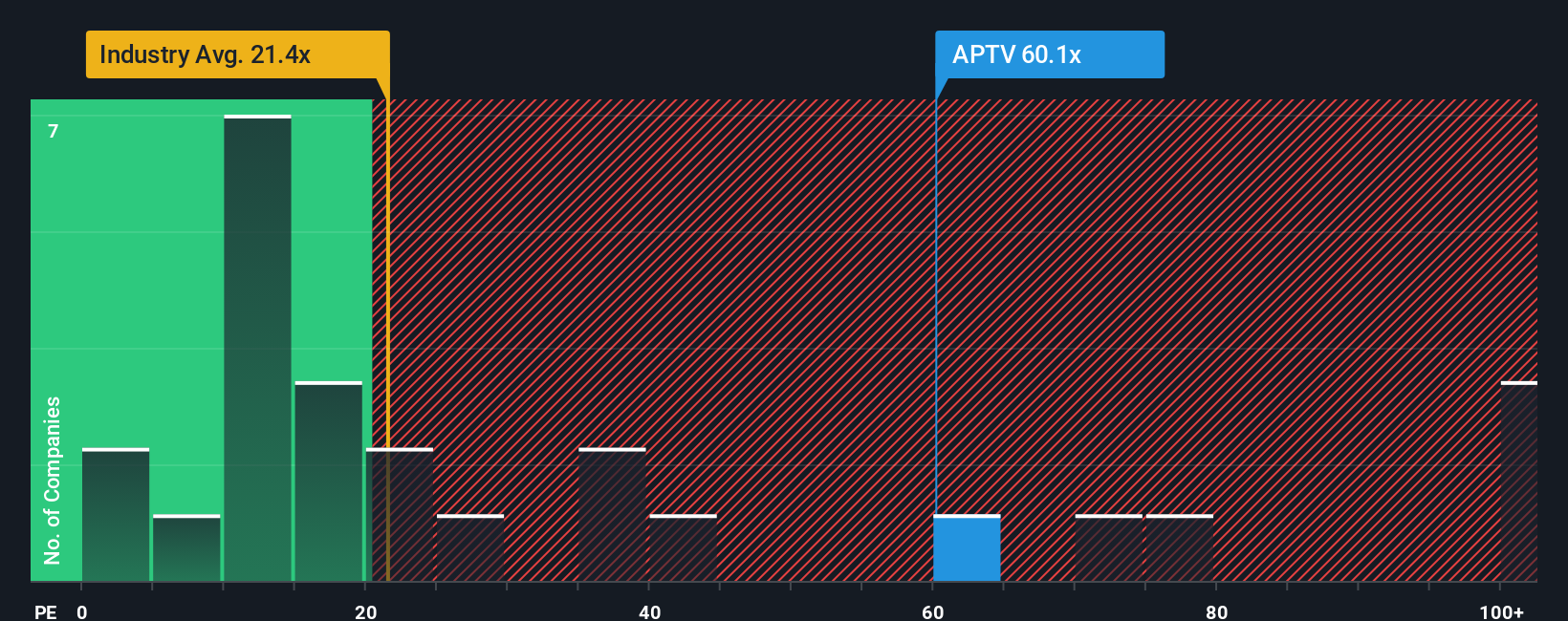

The narrative fair value and DCF style work suggest Aptiv looks undervalued, but the market is telling a different story. On a P/E of 57.5x versus a fair ratio of 56.1x, the shares screen as expensive, and the multiple is roughly double the 28.4x peer average and well above the 19.2x industry mark. That kind of gap can reflect optimism, but it also leaves less room if earnings or margins slip. Which signal do you think deserves more weight right now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aptiv Narrative

If the numbers or narratives here do not quite match your own view, you can test the assumptions yourself and shape a custom Aptiv story in minutes: Do it your way.

A great starting point for your Aptiv research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Aptiv has sharpened your focus, do not stop here. Use the Simply Wall St screener to explore additional opportunities.

- Look for potential mispricings by scanning these 870 undervalued stocks based on cash flows, which may trade at a discount to their underlying fundamentals.

- Consider companies involved in automation by checking out these 25 AI penny stocks, which relate to long term technology themes.

- Explore higher income opportunities by researching these 14 dividend stocks with yields > 3%, which may help add steadier cash returns to a portfolio mix.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報