Exploring Three European Small Caps With Promising Potential

The European market has been buoyed by an improving economic backdrop, with the STOXX Europe 600 Index reaching new highs and closing 2025 with its strongest yearly performance since 2021. Against this optimistic landscape, identifying small-cap stocks that exhibit robust fundamentals and growth potential can be particularly rewarding for investors seeking to capitalize on the region's momentum.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Arendals Fossekompani | 26.72% | 2.84% | 7.78% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Alantra Partners (BME:ALNT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alantra Partners, S.A. provides investment banking and asset management services both in Spain and internationally, with a market cap of €328.80 million.

Operations: Alantra Partners generates revenue primarily through its investment banking and asset management services. The company's net profit margin is a key financial metric to consider, reflecting its profitability after all expenses are deducted from revenues.

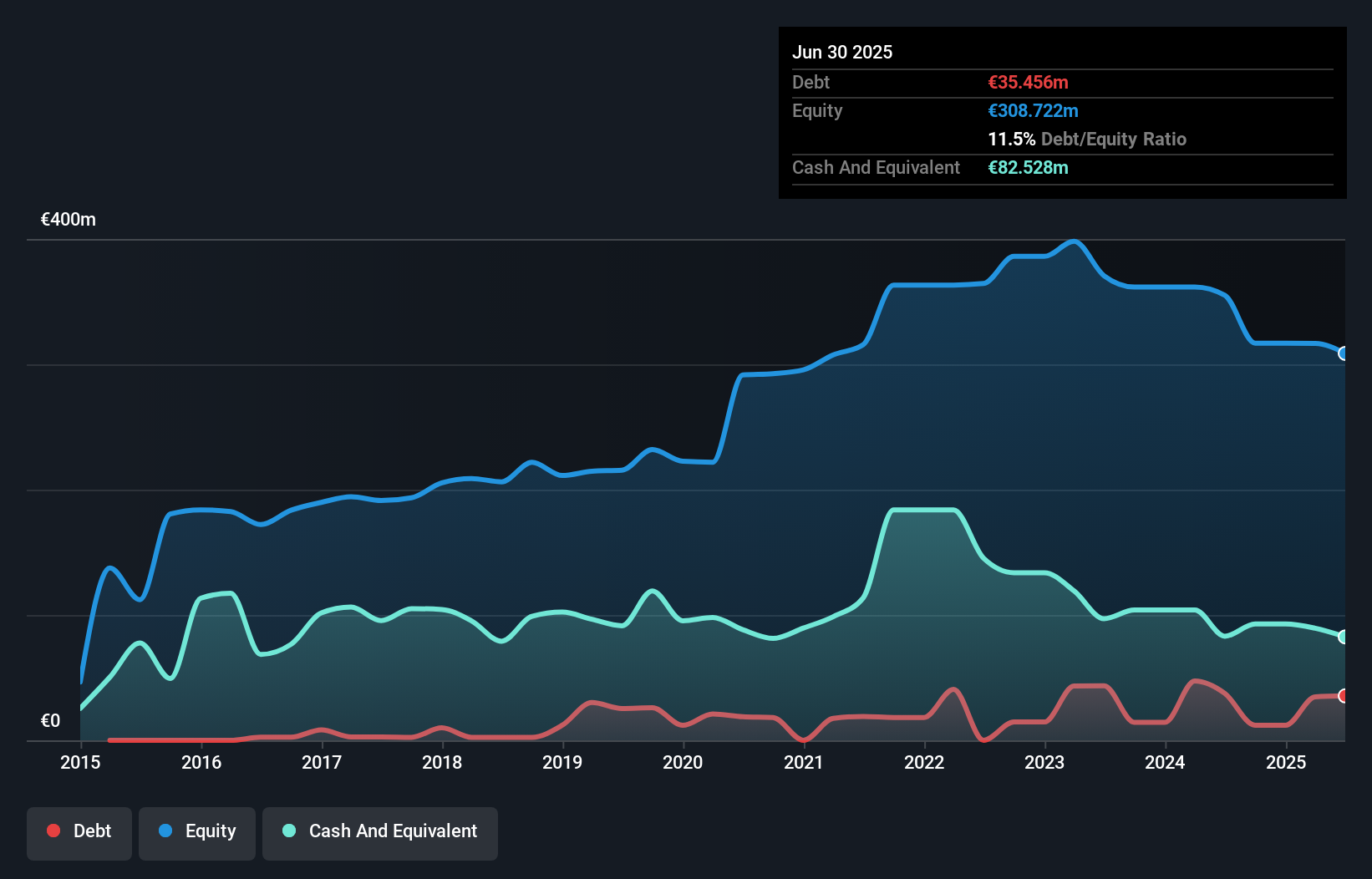

Alantra Partners, a nimble player in the capital markets, has seen its earnings surge by 246% over the past year, outpacing industry growth of 10%. Despite this impressive short-term performance, its earnings have averaged a decrease of 33.7% annually over five years. The firm’s financial health seems robust with cash surpassing total debt and positive free cash flow. However, their debt-to-equity ratio has risen from 6.2 to 11.4 over five years which might raise some eyebrows about leverage strategy. Recent reports show net income at €9.47M for nine months ending September 2025 compared to €3.33M previously.

- Click here and access our complete health analysis report to understand the dynamics of Alantra Partners.

Understand Alantra Partners' track record by examining our Past report.

TotalEnergies EP Gabon Société Anonyme (ENXTPA:EC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TotalEnergies EP Gabon Société Anonyme is involved in the mining, exploration, and production of crude oil in Gabon, with a market capitalization of €846 million.

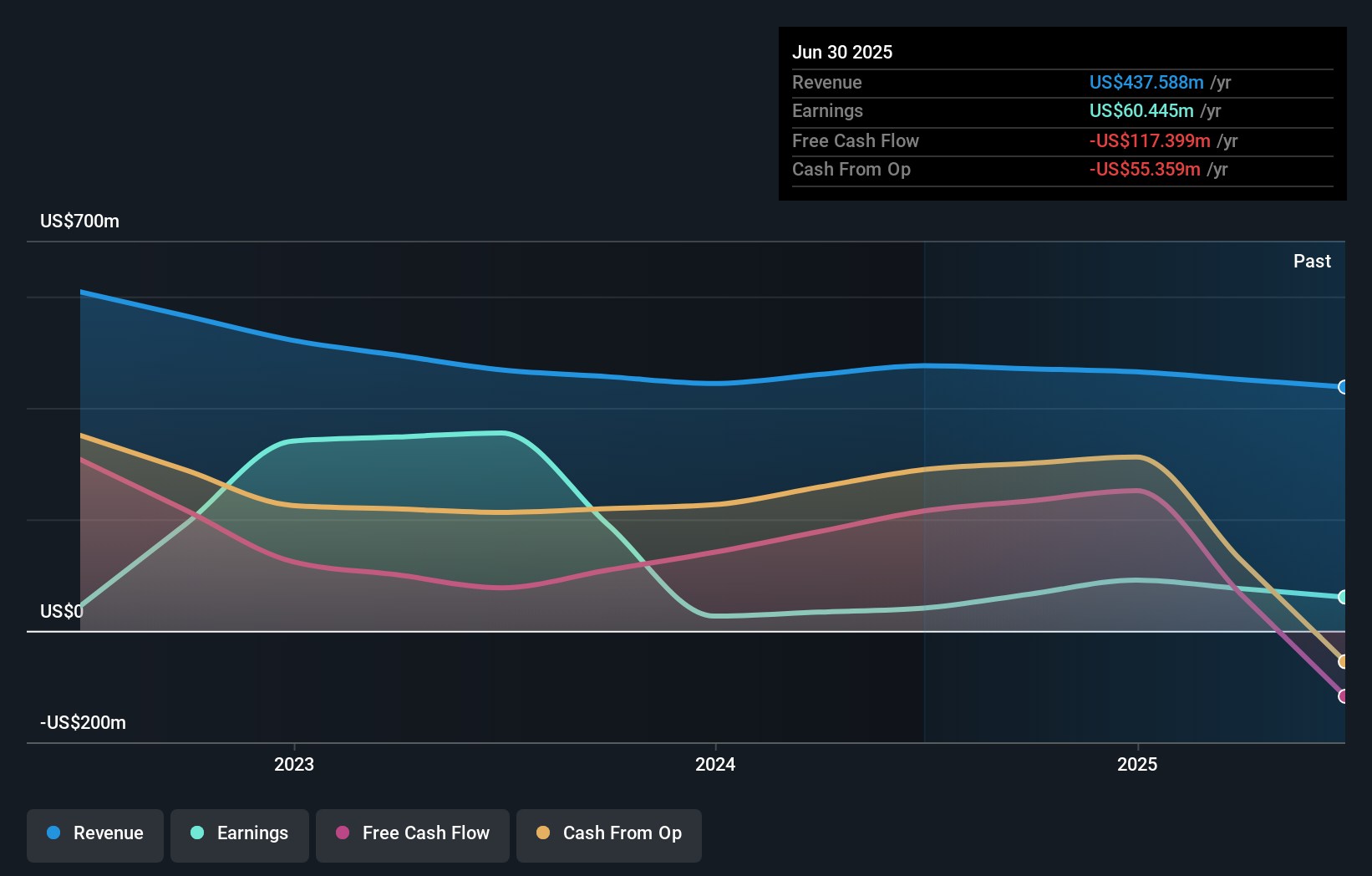

Operations: TotalEnergies EP Gabon generates revenue primarily from its oil and gas exploration and production activities, amounting to $437.59 million. The company's financial performance is influenced by its net profit margin trends over time.

TotalEnergies EP Gabon, a smaller player in the energy sector, showcases an intriguing mix of financial and operational metrics. Over the past year, its earnings surged by 48%, significantly outpacing the broader Oil and Gas industry growth of 7.8%. The company has reduced its debt-to-equity ratio from 1.7 to 0.3 over five years, indicating prudent financial management. Recent production figures reveal a third-quarter output at 16.2 kb/d, up by 15% from the previous quarter due to planned shutdowns earlier in the year; however, nine-month production saw a decrease of about 9%. Trading at approximately half its estimated fair value suggests potential for future appreciation despite current challenges with free cash flow positivity remaining elusive.

Uzin Utz (XTRA:UZU)

Simply Wall St Value Rating: ★★★★★★

Overview: Uzin Utz SE develops, manufactures, and sells construction chemical system products in Germany, the United States, Netherlands, and internationally with a market capitalization of €358.15 million.

Operations: Uzin Utz generates significant revenue from its Germany - Laying Systems segment, contributing €213.88 million, followed by Western Europe at €77.63 million and USA - Laying Systems at €73.12 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability trends over time.

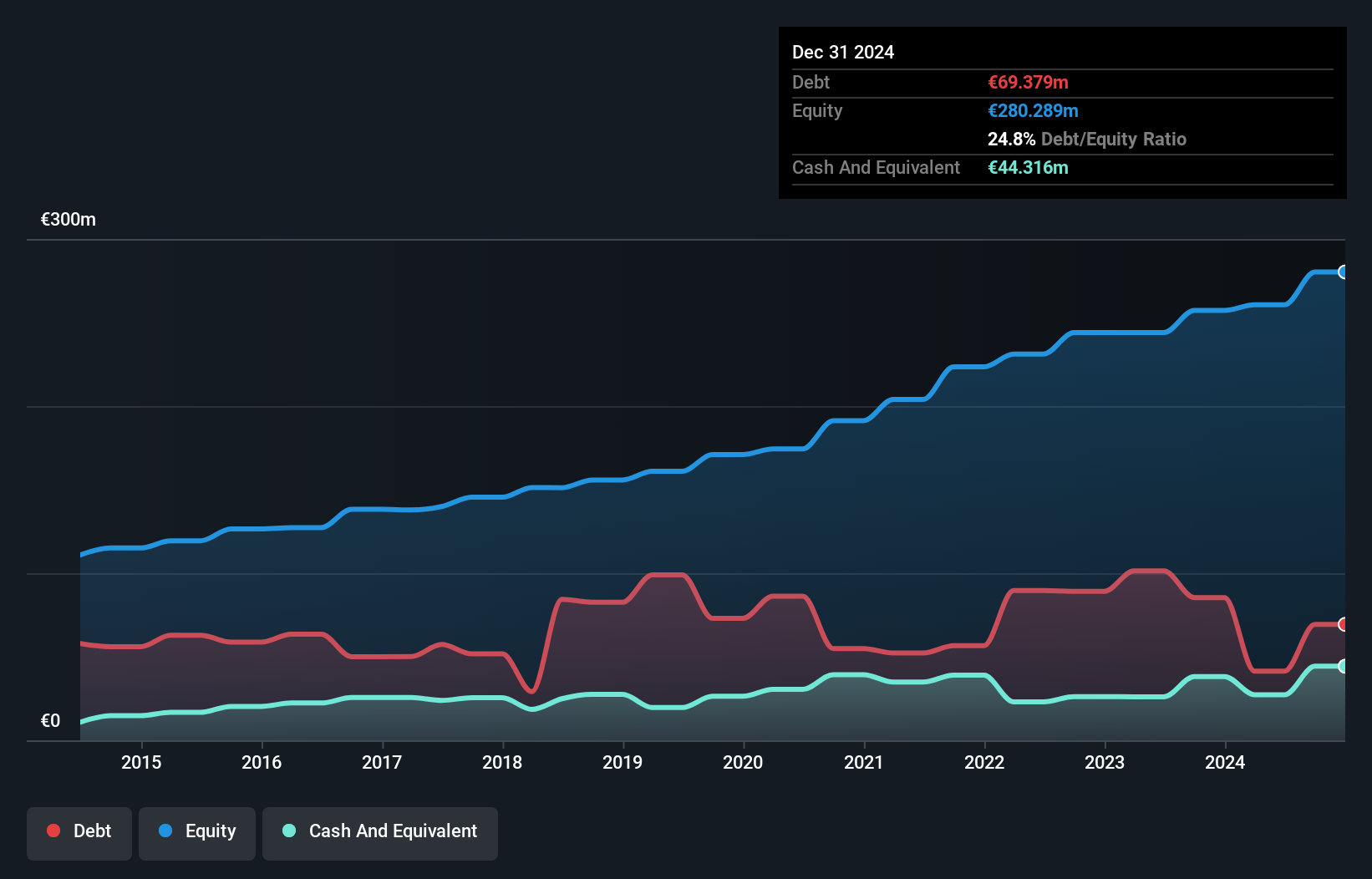

Uzin Utz, a notable player in the European market, has shown impressive financial metrics recently. Its debt to equity ratio improved significantly from 49.5% to 26.4% over five years, indicating strong financial management. The company's earnings grew by 29.5% last year, outpacing the chemicals industry's -9.3%, showcasing its resilience and growth potential in challenging times. With a price-to-earnings ratio of 11.6x compared to the German market's 18.3x, it trades at an attractive valuation for investors seeking value opportunities within this sector while maintaining satisfactory net debt levels at just 15%.

- Navigate through the intricacies of Uzin Utz with our comprehensive health report here.

Explore historical data to track Uzin Utz's performance over time in our Past section.

Key Takeaways

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 296 more companies for you to explore.Click here to unveil our expertly curated list of 299 European Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報