Global Stocks Estimated To Be 10.6% To 27% Below Intrinsic Value

As global markets navigate a holiday-shortened week, U.S. stocks experienced slight declines, with the energy sector standing out due to geopolitical tensions driving oil prices higher. Meanwhile, European and Asian indices showed mixed results, reflecting varied economic conditions and central bank policies across regions. In this context of fluctuating market dynamics, identifying undervalued stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an International Medical Investment (SZSE:000516) | CN¥4.72 | CN¥9.38 | 49.7% |

| Truecaller (OM:TRUE B) | SEK18.50 | SEK36.62 | 49.5% |

| Takara Bio (TSE:4974) | ¥797.00 | ¥1579.25 | 49.5% |

| Recupero Etico Sostenibile (BIT:RES) | €6.56 | €12.99 | 49.5% |

| NEUCA (WSE:NEU) | PLN835.00 | PLN1647.82 | 49.3% |

| Meitu (SEHK:1357) | HK$7.43 | HK$14.80 | 49.8% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.30 | NOK66.22 | 49.7% |

| Kuraray (TSE:3405) | ¥1596.00 | ¥3161.55 | 49.5% |

| CURVES HOLDINGS (TSE:7085) | ¥795.00 | ¥1583.43 | 49.8% |

| Benefit Systems (WSE:BFT) | PLN3590.00 | PLN7095.77 | 49.4% |

We'll examine a selection from our screener results.

Americana Restaurants International (ADX:AMR)

Overview: Americana Restaurants International PLC operates a chain of restaurants across various countries in the Middle East and North Africa, with a market cap of AED14.36 billion.

Operations: The company generates revenue primarily from the Major Gulf Cooperation Council (GCC) region, amounting to $1.78 billion, followed by the Lower Gulf with $240.72 million and North Africa contributing $209.83 million.

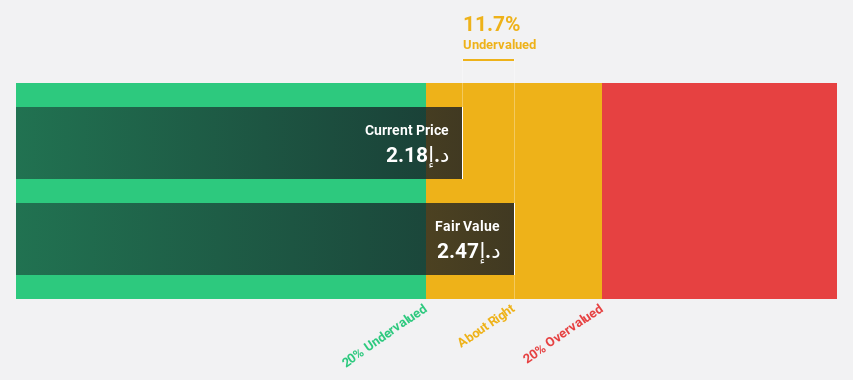

Estimated Discount To Fair Value: 27%

Americana Restaurants International, trading at AED1.71, is considered undervalued with a fair value estimate of AED2.34. Despite earnings growing 17.7% last year and forecasted to grow 15.55% annually, the stock trades 27% below its estimated fair value based on discounted cash flows. Recent earnings showed robust sales growth to US$622.73 million for Q3 2025 from US$555.03 million a year ago, reflecting strong operational performance amidst board changes and strategic planning discussions for 2026.

- Our expertly prepared growth report on Americana Restaurants International implies its future financial outlook may be stronger than recent results.

- Take a closer look at Americana Restaurants International's balance sheet health here in our report.

CICT Mobile Communication Technology (SHSE:688387)

Overview: CICT Mobile Communication Technology Co., Ltd. (ticker: SHSE:688387) operates in the mobile communication technology sector and has a market cap of CN¥44.10 billion.

Operations: Unfortunately, I cannot summarize the company's revenue segments as there is no specific information provided in the text regarding those segments.

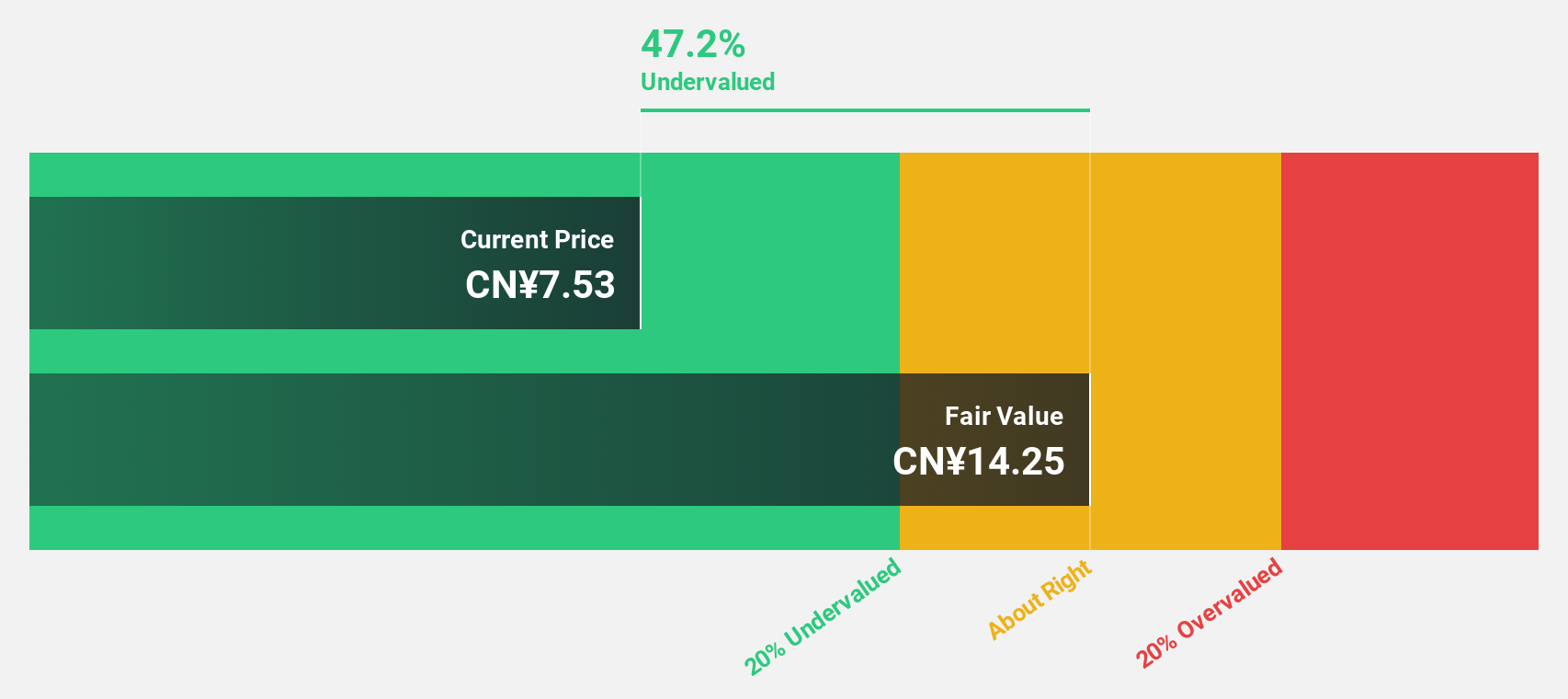

Estimated Discount To Fair Value: 10.6%

CICT Mobile Communication Technology is trading at CN¥12.7, below the estimated fair value of CN¥14.2 based on discounted cash flows, suggesting it may be undervalued. Despite a volatile share price recently, earnings have grown significantly over the past five years and are forecast to grow substantially annually. However, recent results show a decline in sales to CN¥3.76 billion for the first nine months of 2025 compared to last year, with a net loss remaining stable at CN¥165 million.

- The analysis detailed in our CICT Mobile Communication Technology growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in CICT Mobile Communication Technology's balance sheet health report.

Arashi Vision (SHSE:688775)

Overview: Arashi Vision Inc., operating as Insta360, develops and manufactures spherical video cameras with a market cap of CN¥94.19 billion.

Operations: The company's revenue is derived from the development and manufacturing of spherical video cameras.

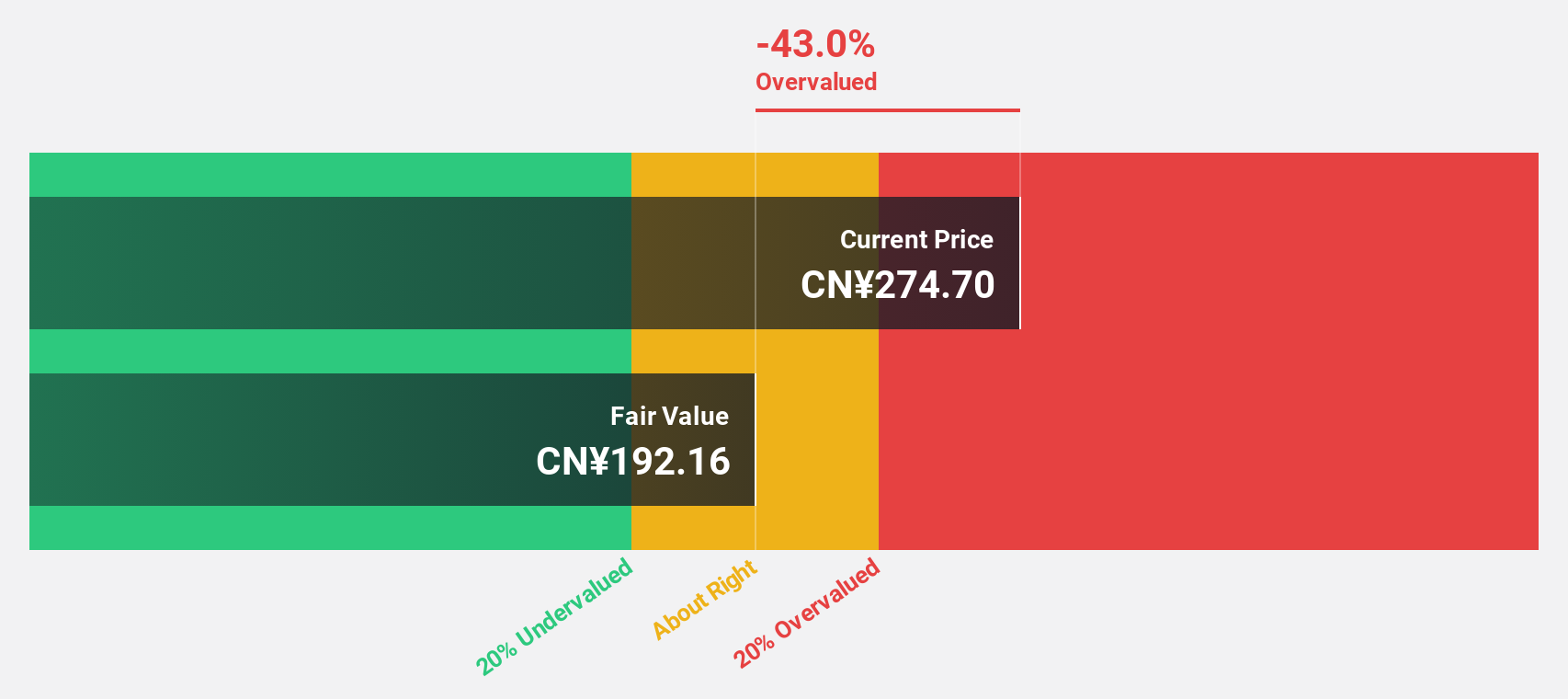

Estimated Discount To Fair Value: 12.4%

Arashi Vision's stock is trading at CN¥245.55, slightly below its estimated fair value of CN¥280.46, indicating potential undervaluation based on cash flows. Despite a drop in net profit margin from 18.7% to 11.5%, earnings are forecast to grow significantly at 40.2% annually, outpacing the Chinese market's growth rate of 27.5%. Recent product launches like the Insta360 Ace Pro 2 bundles may bolster revenue growth forecasts of over 20% per year.

- Upon reviewing our latest growth report, Arashi Vision's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Arashi Vision.

Seize The Opportunity

- Explore the 477 names from our Undervalued Global Stocks Based On Cash Flows screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報