Undiscovered Gems in Global Markets for January 2026

As global markets navigate a period of mixed performances, with U.S. stocks experiencing slight declines and European indices reaching new highs, investors are keenly observing the impact of economic indicators such as rising pending home sales and fluctuating interest rates on small-cap companies. Amidst this backdrop, identifying promising stocks involves looking for those that demonstrate resilience and potential growth in sectors buoyed by current trends, such as energy or technology-driven industries.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| Arendals Fossekompani | 26.72% | 2.84% | 7.78% | ★★★★★★ |

| CNMC Goldmine Holdings | 1.29% | 25.42% | 72.91% | ★★★★★☆ |

| Sing Investments & Finance | 0.21% | 8.60% | 11.10% | ★★★★★☆ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| JB Foods | 113.93% | 31.03% | 41.46% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Hang Zhou Radical Energy-Saving Technology (SZSE:300652)

Simply Wall St Value Rating: ★★★★★★

Overview: Hang Zhou Radical Energy-Saving Technology Co., Ltd. focuses on the production and development of energy-saving automotive parts, with a market capitalization of CN¥7.32 billion.

Operations: Radical Energy-Saving Technology generates revenue primarily from automotive parts, amounting to CN¥1.03 billion. The company has a market capitalization of approximately CN¥7.32 billion.

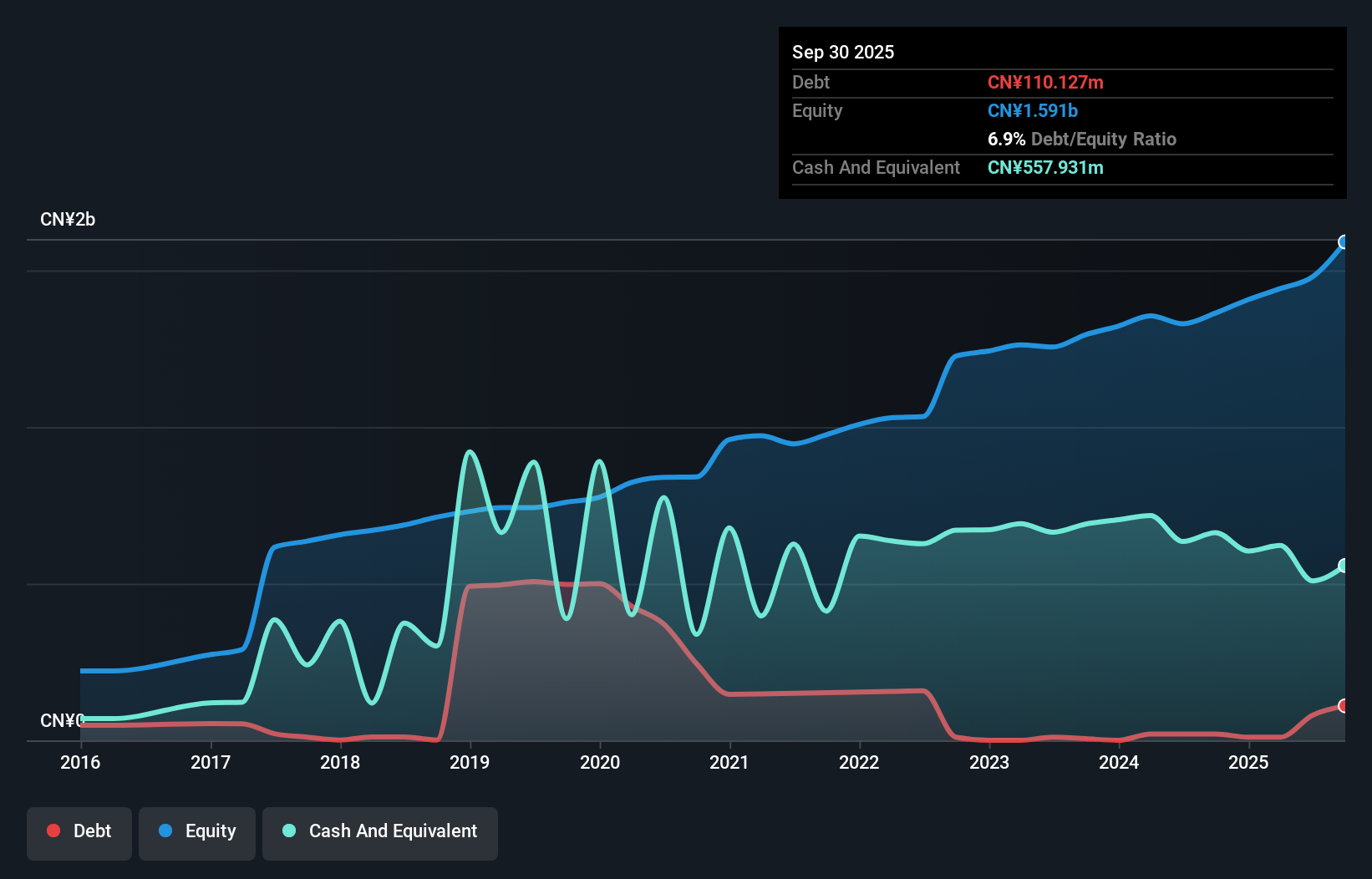

Hang Zhou Radical Energy-Saving Technology, a relatively small player in the energy-saving sector, has shown impressive growth with earnings surging 36.9% over the past year, outpacing the Auto Components industry's 8%. The company's financial health appears solid as it holds more cash than its total debt and has reduced its debt-to-equity ratio from 29.1% to 6.9% over five years. Recent earnings reports highlight a revenue jump to CNY 805 million from CNY 515 million last year, alongside net income rising to CNY 138 million from CNY 93 million. However, share price volatility remains a concern amidst these positive developments.

BMC Medical (SZSE:301367)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BMC Medical Co., Ltd. is a Chinese company that focuses on the research, development, manufacturing, and supply of medical equipment and consumables for respiratory health, with a market capitalization of CN¥7.62 billion.

Operations: BMC Medical generates revenue primarily from its Surgical & Medical Equipment segment, which amounted to CN¥1.05 billion. The company's gross profit margin is a notable aspect of its financial performance, standing at 53.45%.

BMC Medical, a player in the medical equipment sector, has shown impressive growth with earnings surging 38.3% last year, outpacing the industry’s modest 0.6%. The company's price-to-earnings ratio of 41.4x is appealing compared to the CN market average of 44.7x, suggesting potential value for investors. With a healthy balance sheet where cash exceeds total debt and interest payments are well-covered by profits, financial stability seems assured. Recent announcements highlight robust performance with sales reaching CNY 808 million for nine months ending September 2025, up from CNY 602 million previously, while net income rose to CNY 180 million from CNY 125 million.

- Click to explore a detailed breakdown of our findings in BMC Medical's health report.

Gain insights into BMC Medical's historical performance by reviewing our past performance report.

Eternal Materials (TWSE:1717)

Simply Wall St Value Rating: ★★★★★☆

Overview: Eternal Materials Co., Ltd. is engaged in the manufacturing and sale of resin, high-performance, and electronic materials, with a market capitalization of NT$49.43 billion.

Operations: Eternal Materials generates revenue primarily from synthetic resin, special materials, and electronic materials, with synthetic resin contributing NT$22.53 billion. The company faces adjustments and write-offs amounting to NT$6.54 billion.

Eternal Materials, a small cap player in the chemicals sector, has seen its earnings grow by 0.4% over the past year, outperforming the industry average of -1.6%. Despite this growth, earnings have declined by 16.2% annually over five years. The company repurchased 4.85 million shares for TWD 122.76 million recently, reflecting strategic financial maneuvers amidst high debt levels with a net debt to equity ratio of 49.1%. Interest payments are well covered at 5.2 times EBIT, indicating strong operational cash flow support despite recent executive changes due to health reasons affecting leadership stability.

- Dive into the specifics of Eternal Materials here with our thorough health report.

Explore historical data to track Eternal Materials' performance over time in our Past section.

Where To Now?

- Dive into all 3005 of the Global Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報