3 Dividend Stocks In Global Yielding Up To 4.3%

As global markets navigate a mixed landscape, with U.S. stocks experiencing a slight decline and European indices reaching new highs, investors are increasingly looking for stability amidst fluctuating economic indicators such as pending home sales and inflation rates. In this context, dividend stocks offer an appealing option for those seeking steady income streams; they can provide resilience against market volatility while potentially benefiting from sectors that remain robust despite broader economic shifts.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.30% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.65% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.24% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.48% | ★★★★★★ |

| NCD (TSE:4783) | 3.85% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.77% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.53% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

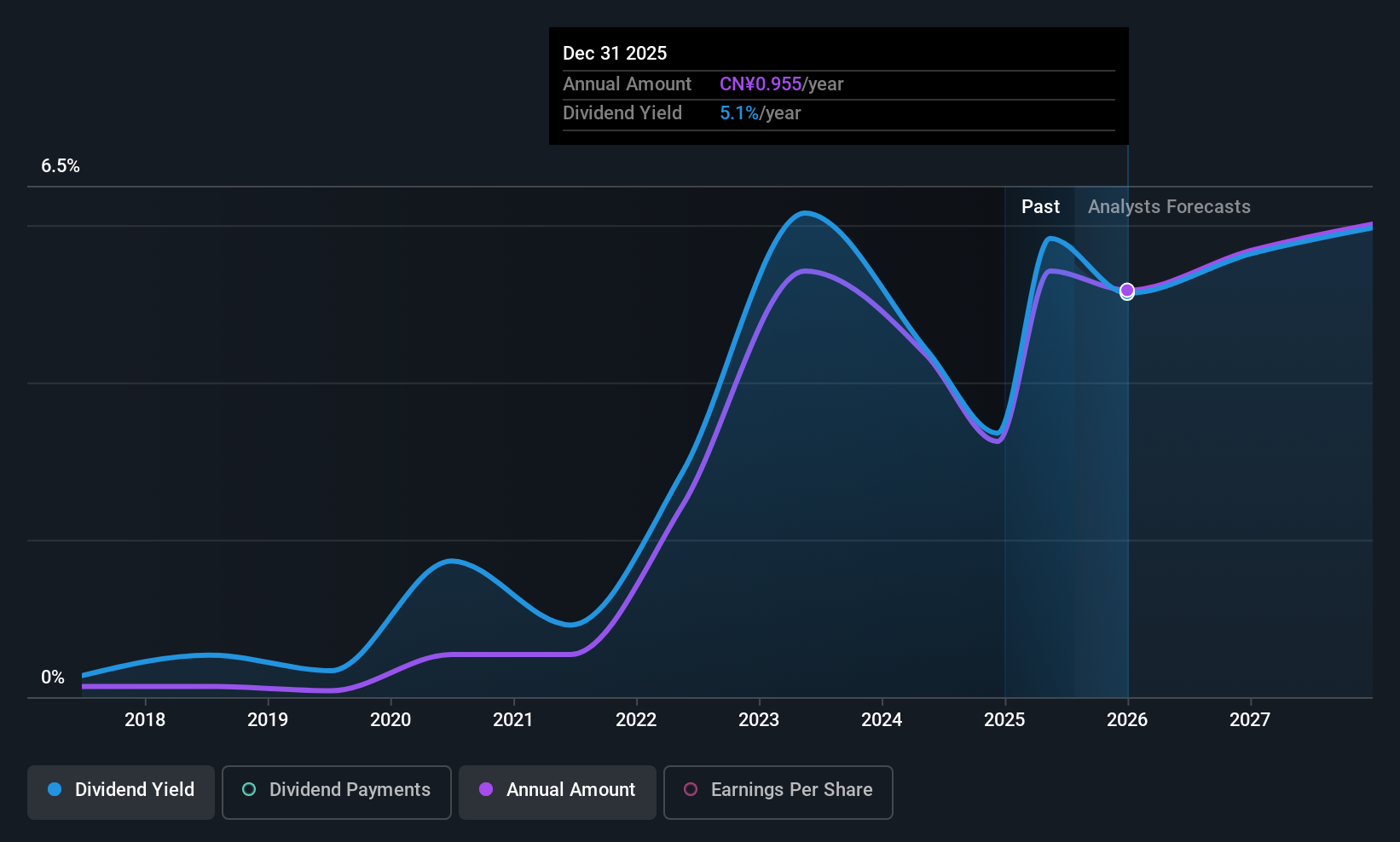

Henan Shenhuo Coal Industry and Electricity Power (SZSE:000933)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Henan Shenhuo Coal Industry and Electricity Power Co. engages in coal mining and electricity generation, with a market cap of CN¥61.36 billion.

Operations: Henan Shenhuo Coal Industry and Electricity Power Co.'s revenue segments include coal mining and electricity generation.

Dividend Yield: 3.5%

Henan Shenhuo Coal Industry and Electricity Power offers a dividend yield in the top 25% of the CN market, with payments well-covered by earnings and cash flows due to low payout ratios. Despite this coverage, its dividends have been volatile over the past nine years, reflecting an unstable track record. Recent financials show net income stability amid slight fluctuations. The company completed a share buyback plan worth CNY 254.98 million, potentially enhancing shareholder value.

- Click here and access our complete dividend analysis report to understand the dynamics of Henan Shenhuo Coal Industry and Electricity Power.

- Our valuation report unveils the possibility Henan Shenhuo Coal Industry and Electricity Power's shares may be trading at a discount.

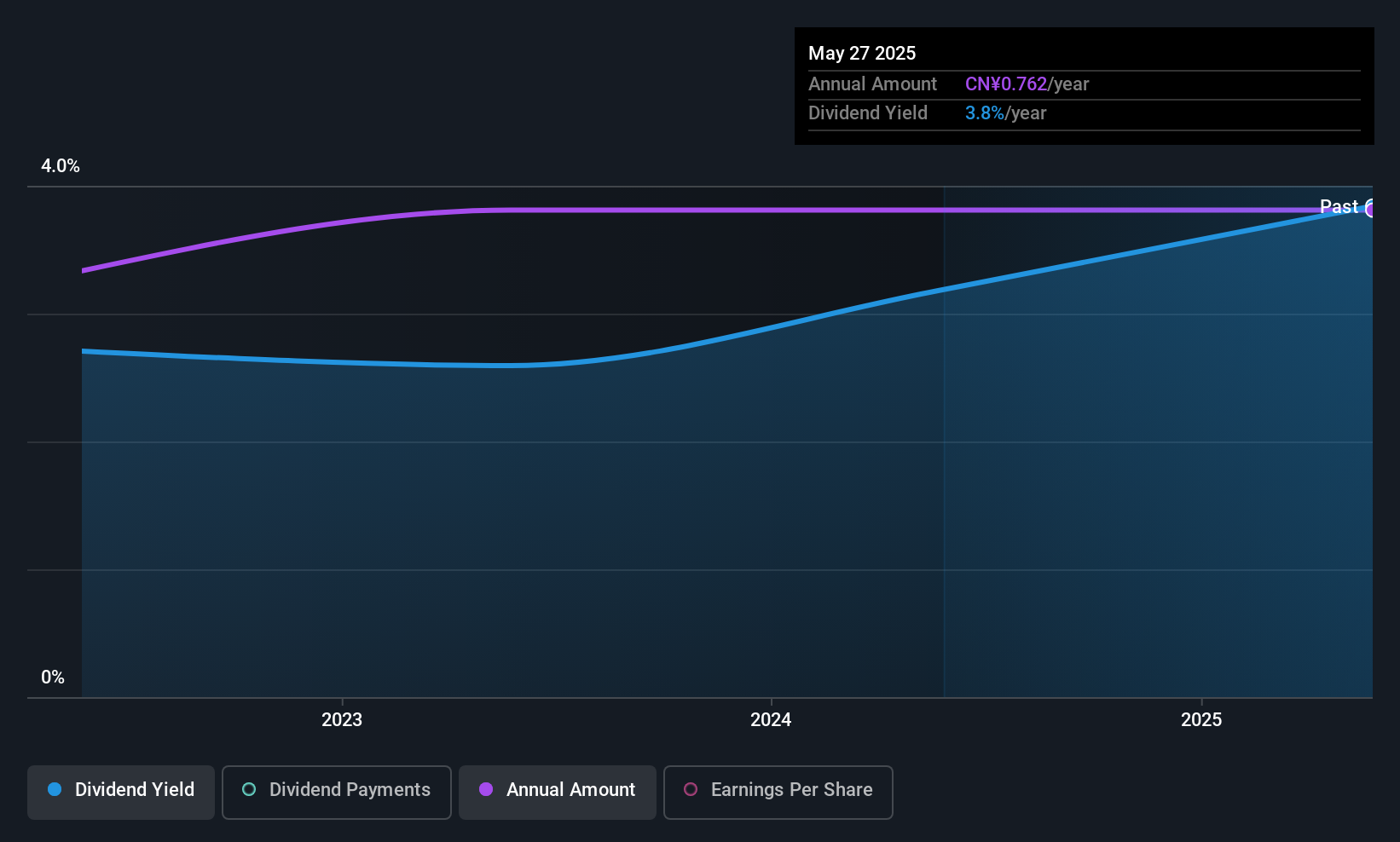

Qingdao Baheal Medical (SZSE:301015)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qingdao Baheal Medical INC. is involved in the research, development, production, wholesale, and retail of pharmaceutical products across China, the United States, Hong Kong, and the United Kingdom with a market cap of CN¥12.40 billion.

Operations: Qingdao Baheal Medical INC. generates its revenue through the research, development, production, and distribution of pharmaceutical products across multiple regions including China, the United States, Hong Kong, and the United Kingdom.

Dividend Yield: 3%

Qingdao Baheal Medical's dividend yield ranks in the top 25% of the CN market, supported by a payout ratio of 75.6%, indicating coverage by both earnings and cash flows. Despite only four years of dividend history, payments have been stable with growth observed. However, recent financials show declining sales and net income for the nine months ending September 2025, which may impact future dividend sustainability. The stock trades below its estimated fair value, offering potential relative value to investors.

- Click here to discover the nuances of Qingdao Baheal Medical with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Qingdao Baheal Medical is trading behind its estimated value.

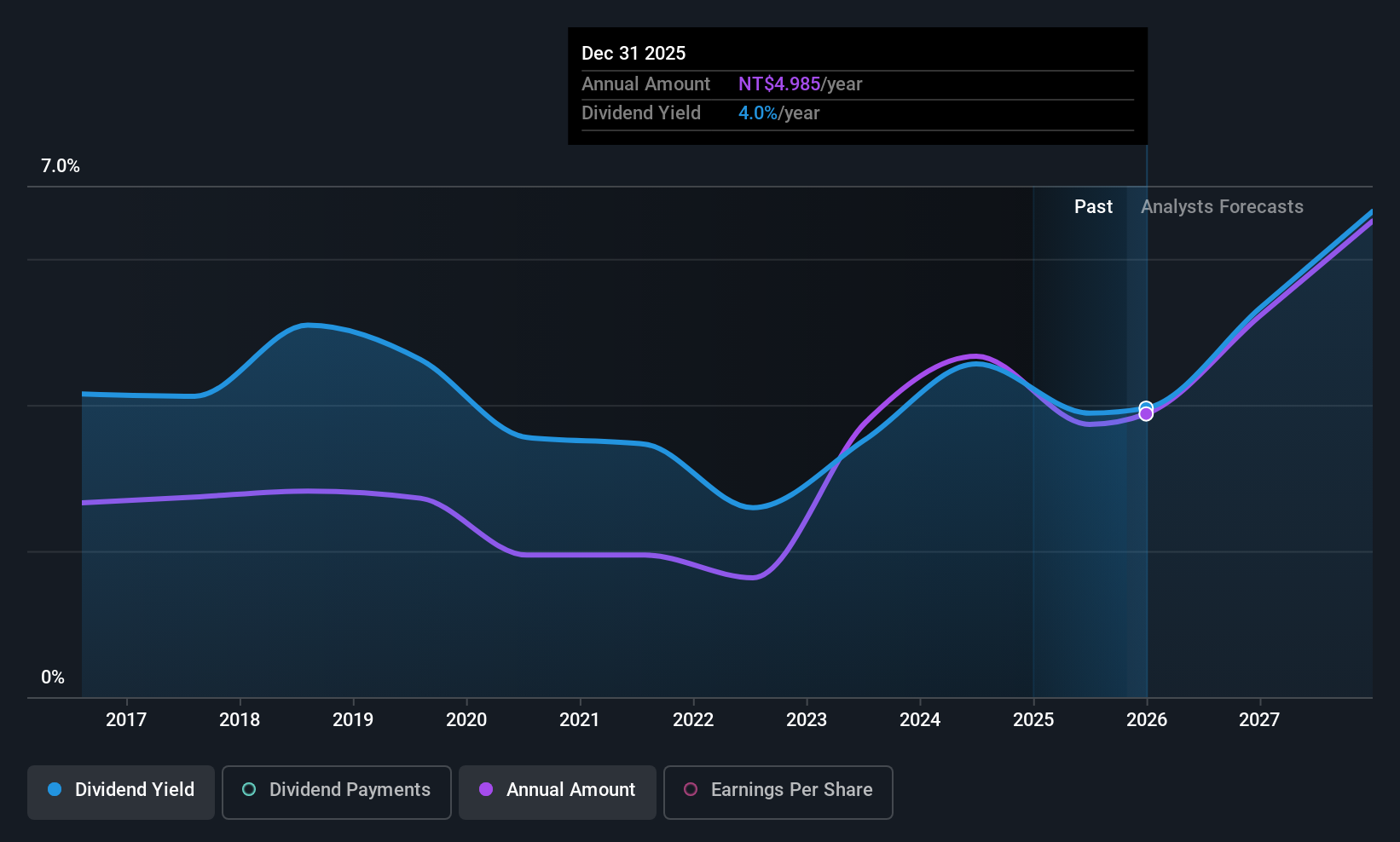

WNC (TWSE:6285)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WNC Corporation, along with its subsidiaries, is involved in the research, development, manufacturing, and sale of satellite, mobile, and portable communication equipment across the Americas, Asia, Europe, and globally; it has a market cap of NT$48.41 billion.

Operations: WNC Corporation generates revenue primarily from its Wireless Communications Equipment segment, amounting to NT$111.18 billion.

Dividend Yield: 4.4%

WNC's dividend payments have been volatile over the past decade, with a reasonable payout ratio of 74.1% and cash payout ratio of 35.3%, indicating coverage by earnings and cash flows. Although its dividend yield is lower than the top tier in the TW market, it remains well-covered financially. Recent earnings show growth with third-quarter sales at TWD 27.38 billion and net income rising to TWD 664.81 million, suggesting operational strength despite an unstable dividend history.

- Dive into the specifics of WNC here with our thorough dividend report.

- According our valuation report, there's an indication that WNC's share price might be on the cheaper side.

Taking Advantage

- Unlock more gems! Our Top Global Dividend Stocks screener has unearthed 1268 more companies for you to explore.Click here to unveil our expertly curated list of 1271 Top Global Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報