Assessing MSCI (MSCI) Valuation As Recent Returns Contrast With Long Term Performance

MSCI: recent returns and business mix in focus

MSCI (MSCI) is back on investor radars as its recent share performance, including a small daily decline and mixed short term moves, contrasts with its longer term total returns and is prompting closer attention to the underlying business.

See our latest analysis for MSCI.

Recent trading has been choppy, with a 1 day share price return of 1.48% decline and a 7 day share price return of 3.50% decline, contrasting with a positive 30 day share price return of 5.01%. Over the longer term, total shareholder returns over 3 and 5 years of 21.80% and 31.70% point to momentum that has cooled over the past year, where the total shareholder return is a 4.06% decline.

If MSCI’s recent moves have you reassessing your watchlist, this could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With MSCI sharing mixed recent returns, annual revenue growth of 8.09% and net income growth of 10.56%, the key question is whether the current share price still undervalues that earnings engine or already reflects future growth.

Most Popular Narrative Narrative: 14% Undervalued

With MSCI last closing at $565.25 against a narrative fair value of $657.56, the current pricing gap is central to how this story is framed.

Accelerated development and cross-selling of proprietary data, analytics, and private capital solutions (including recently launched products and business lines like private equity benchmarks and risk tools) will tap into new client bases and increase wallet share among institutional clients, driving durable multi-year compounded revenue growth.

Curious what kind of revenue growth and margin profile underpin that premium status, and how earnings and the future P/E fit together in this narrative? The projections pull together recurring revenue strength, expanding profitability and a valuation multiple that leans on those future cash flows. The key assumptions might surprise you.

Result: Fair Value of $657.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story depends on Sustainability products regaining momentum and competitors not eating into MSCI’s premium pricing power. Both factors could challenge the current narrative.

Find out about the key risks to this MSCI narrative.

Another View: Rich Multiple, Different Story

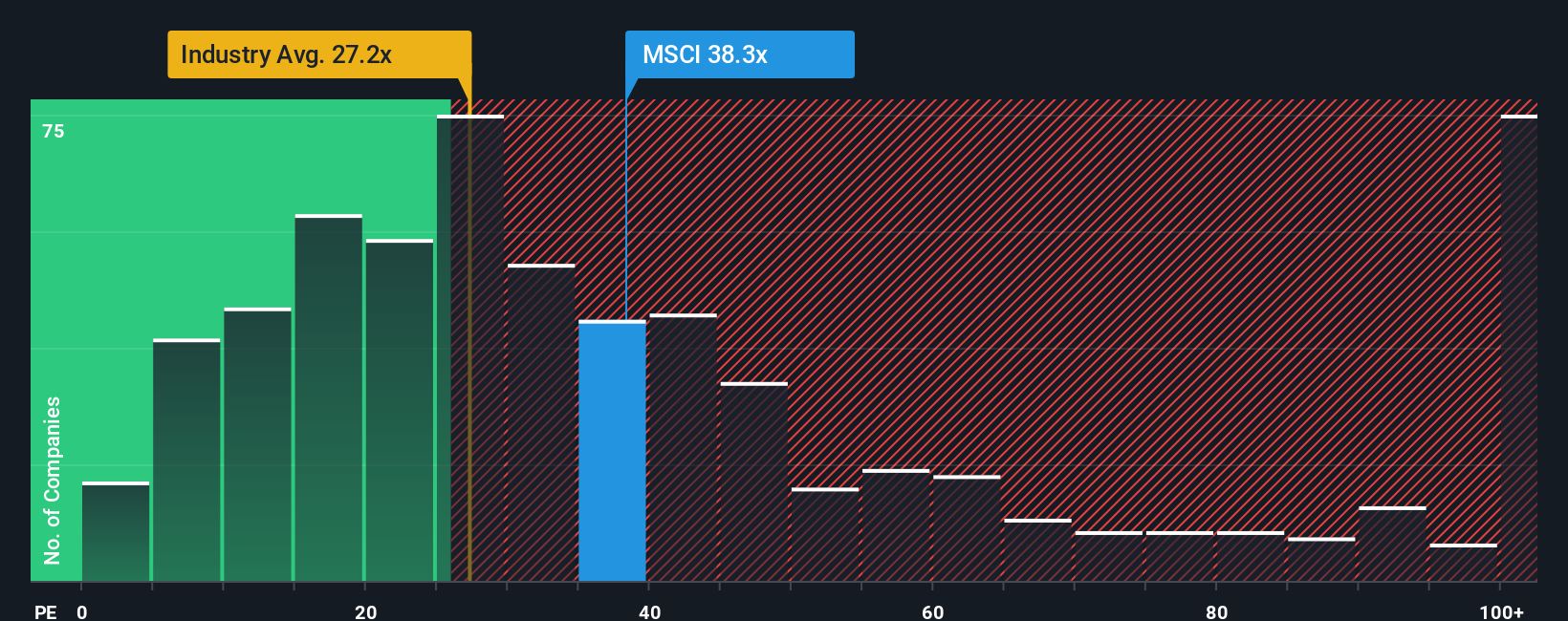

While the narrative fair value points to MSCI being 14% undervalued, the current P/E of 34.7x tells a different story. It sits above the US Capital Markets industry average of 25.6x and well above the fair ratio of 17.1x. This is a level the market could move towards over time.

That gap suggests investors are paying a premium that could limit upside if sentiment or growth expectations cool. The question is whether you think MSCI’s business mix and earnings profile are strong enough to keep that premium in place, or if the market eventually reins it in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MSCI Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a fresh MSCI story yourself in just a few minutes by starting with Do it your way.

A great starting point for your MSCI research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If MSCI has sharpened your focus, do not stop here. Use this momentum to scan other opportunities that could fit your goals just as well.

- Spot potential value candidates by checking out these 868 undervalued stocks based on cash flows that line up with your return expectations and risk comfort.

- Explore structural growth themes by reviewing these 29 healthcare AI stocks shaping the landscape of diagnostics, treatment, and data driven care.

- Consider emerging trends with these 79 cryptocurrency and blockchain stocks that connect equity markets with blockchain and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報