IPO News | Celebrity Marketing Leader World Show (600556.SH) reports that the Hong Kong Stock Exchange has led the industry in market share for five consecutive years

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on January 5, Tianxiao Digital Technology (Group) Co., Ltd. (600556.SH) submitted a listing application to the main board of the Hong Kong Stock Exchange, with Deutsche Bank and Cathay Pacific Haitong as co-sponsors.

Company profile

According to the prospectus, Tianxiaxiu is the first company in China to operate a mature celebrity marketing solution platform. As a celebrity marketing technology group driven by AI, data and algorithm capabilities, the company is committed to becoming a “superconnector” of the global celebrity marketing industry by building a bridge between advertiser customers and UGC platforms of influencers, MCN and major third party UGC platforms to achieve efficient collaboration, marketing content dissemination, and commercial monetization across multiple digital channels.

Since its establishment in 2009, Tianxiaxiu has played a leading role in developing and improving the celebrity economic ecosystem. According to Frost & Sullivan's data, according to 2024 revenue, Tianxia Xiaxiu ranked first in the Chinese celebrity marketing solution platform industry with a market share of 26.1%, and has maintained the largest market share in the industry for five consecutive years. In terms of 2024 revenue, the company also ranked first in the global celebrity marketing solution platform industry with a market share of 16.5%, far ahead of other competitors.

Tianxia Show operates under two business divisions, namely the Celebrity Marketing Solution Platform Business and the Celebrity Economic Ecological Chain Innovation Business. The company's celebrity marketing solution platform business is the main source of revenue. Through WEIQ, the company's main proprietary platform provides advertiser customers with celebrity marketing solutions, connecting advertiser customers with celebrities, and enabling them to carry out celebrity marketing activities on major third-party UGC platforms in China (covering short videos, lifestyle sharing, micro-blog posts, and interactive community platforms). These platforms support large-scale user interaction and content dissemination.

Tianxiaxiu's celebrity marketing solution platform can flexibly provide different ranges and depths of services according to the specific needs, budgets and marketing activity goals of advertisers and customers. By using WEIQ's integrated celebrity marketing mechanism, the company can provide a full range of services for advertisers and customers, from full-process celebrity marketing solutions to selected service combinations to ensure accurate and adaptable execution of marketing activities.

Specifically, for more complex marketing scenarios, the company's SMART full-service team is responsible for designing and implementing celebrity marketing solutions. These solutions cover influencer screening and matching, marketing campaign strategy formulation, marketing content planning and celebrity content creation and publication coordination, marketing campaign launch, performance tracking and evaluation, and post-marketing campaign review.

For advertiser customers with more accurate needs or clear marketing campaign goals, the company also provides customized support covering a selected service package, such as celebrity screening and matching, marketing content planning and content creation support, or marketing campaign effectiveness tracking. In a more autonomous operating situation, advertiser customers can independently use the company's celebrity marketing solution platform to screen celebrities and place orders from mainstream third-party UGC platforms.

Financial data

revenue

In 2023, 2024, and 2025 for the nine months ended September 30, the company achieved revenue of approximately RMB 4.202 billion, RMB 4,066 billion, and RMB 2,734 billion, respectively.

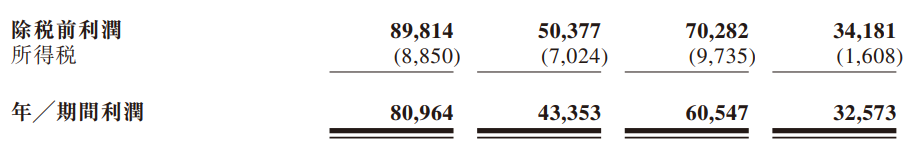

Profit for the year/period

For the nine months ended September 30 in 2023, 2024, and 2025, the company recorded annual/period profits of RMB 809.64 million, RMB 43.353 million, and RMB 32.573 million, respectively.

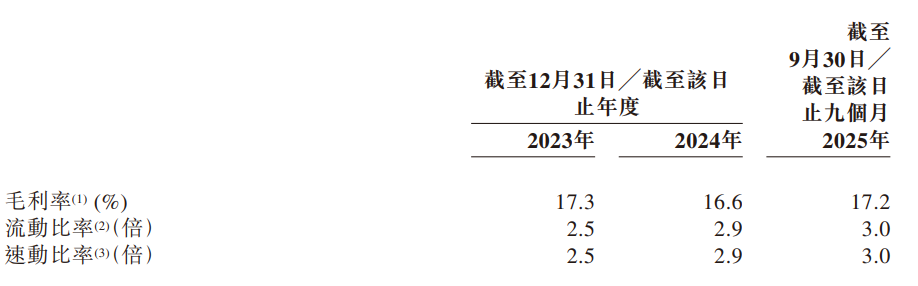

gross profit margin

In 2023, 2024, and 2025 for the nine months ended September 30, the company recorded gross margins of 17.3%, 16.6%, and 17.2%, respectively.

Industry Overview

The celebrity economy refers to an emerging economic model centered on celebrities. It uses social media, short video platforms, and live streaming channels to form a comprehensive ecosystem combining content creation, audience interaction, and commercial monetization. The celebrity economy covers business activities led by celebrities (such as brand endorsements, content marketing, live e-commerce operations, and paid content), as well as broader support industries that support and promote such activities. Such support participants include social and short video platforms, MCN, digital marketing service providers, brand advertisers, e-commerce platforms, and payment and data analysis providers.

From 2020 to 2024, the global celebrity economy expanded from RMB 2,066.1 billion to RMB 31,16.4 billion, with a compound annual growth rate of 10.8%. This rapid growth was driven by a surge in global social media users, the growing popularity of short videos and live streaming formats, and increased brand investment in digital marketing.

Looking ahead, the global celebrity economy is expected to continue to grow from 2024 to 2029, reaching RMB 4,480.7 billion in 2029, and is expected to grow at a CAGR of 7.5%. Although growth is expected to slow, the industry will continue to benefit from a more mature ecosystem, improved standardization, and wider use of AI-based celebrity matching, cross-platform marketing strategies, virtual influencers, and overseas expansion. Overall, these developments are expected to further enhance global monetization opportunities and audience engagement.

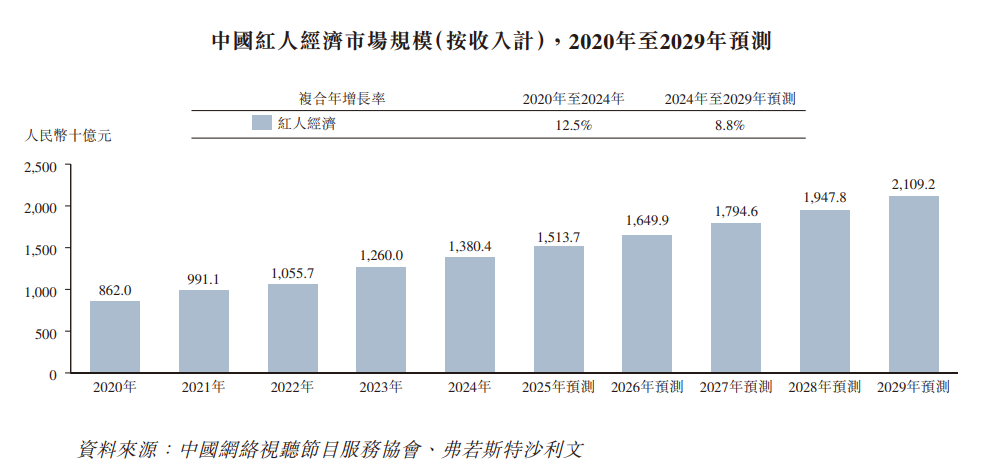

The Chinese celebrity economy grew from RMB 862 billion in 2020 to RMB 1,380.4 billion in 2024, with a CAGR of 12.5%. This accelerated growth reflects the rapid expansion of social media penetration, the strong popularity of short videos and live streaming content, and the brand's significant investment in influencer-driven partnerships.

From 2024 to 2029, China's celebrity economy is expected to expand to RMB 2109.2 billion, with a compound annual growth rate of 8.8%. The Chinese market will continue to be driven by its large digital consumer base, growing social e-commerce ecosystem, and increasing integration of artificial intelligence, cross-platform marketing campaign management, and SaaS-based marketing solutions. These developments are expected to achieve more accurate audience targeting, improve the efficiency of marketing activities, and expand the scale of monetization led by celebrities, thereby supporting long-term participation and deeper commercial transformation within the market.

Board Information

The Board consists of seven directors, including 2 executive directors, 2 non-executive directors and 3 independent non-executive directors. According to the Articles of Association, directors are elected by shareholders for a term of three years and can be re-elected after the term of office expires.

Shareholding structure

As of December 29, 2025, members of the Company's controlling shareholder group (as defined in Hong Kong Listing Rules) include Sina, Weibo, Weibo Singapore, WB Online, Xiutianxia Hong Kong, Mr. Cao (including intermediaries), Mr. Lee, Beihai Rizley, and Beihai Yongmeng, which together hold approximately 38.89% of the total share capital of the Company. WB Online and Xiutianxia Hong Kong (via Weibo Singapore) each directly or indirectly own 100% of the shares of Free Weibo. According to Weibo's 2024 annual report, as of March 31, 2025, Sina held a total of 87,822,024 shares of Weibo Class B common stock, which together held 62.7% of Weibo's voting rights.

Intermediary team

Co-sponsors: Deutsche Securities Asia Ltd., Guotai Junan Finance Co., Ltd.

Company Legal Adviser: Related to Hong Kong Law: Zhou Junxuan Law Firm and Beijing Commerce Law Firm; Related to Chinese Law: Beijing Commerce Law Firm; Regarding China's Personal Information Protection Law: Beijing Commerce Law Firm

Co-sponsor Legal Adviser: Hong Kong Law: Hawking & Lovell Law Firm; Related Chinese Law: Haiwen Law Firm

Auditor and reporting accountant: KPMG

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Compliance Advisor: Guotai Junan Finance Co., Ltd.

Nasdaq

Nasdaq 華爾街日報

華爾街日報