Is Yatirim Menkul Degerler Anonim Sirketi And 2 Other Undiscovered Gems In The Middle East

The Middle East stock markets have recently faced challenges, with most Gulf indices closing lower due to declining oil prices and geopolitical uncertainties. Despite these hurdles, the region continues to push forward with economic diversification efforts, such as Saudi Arabia's Vision 2030 plan and Qatar's strong LNG-based economy, offering potential opportunities for investors seeking resilient small-cap stocks. In this context, identifying a good stock often involves looking for companies that can withstand market volatility through strategic positioning and robust financial health.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| MOBI Industry | 13.81% | 5.67% | 19.69% | ★★★★★★ |

| Amanat Holdings PJSC | 10.86% | 27.51% | -0.92% | ★★★★★☆ |

| Ajman Bank PJSC | 53.89% | 16.11% | 18.02% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.16% | -34.78% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Is Yatirim Menkul Degerler Anonim Sirketi (IBSE:ISMEN)

Simply Wall St Value Rating: ★★★★★☆

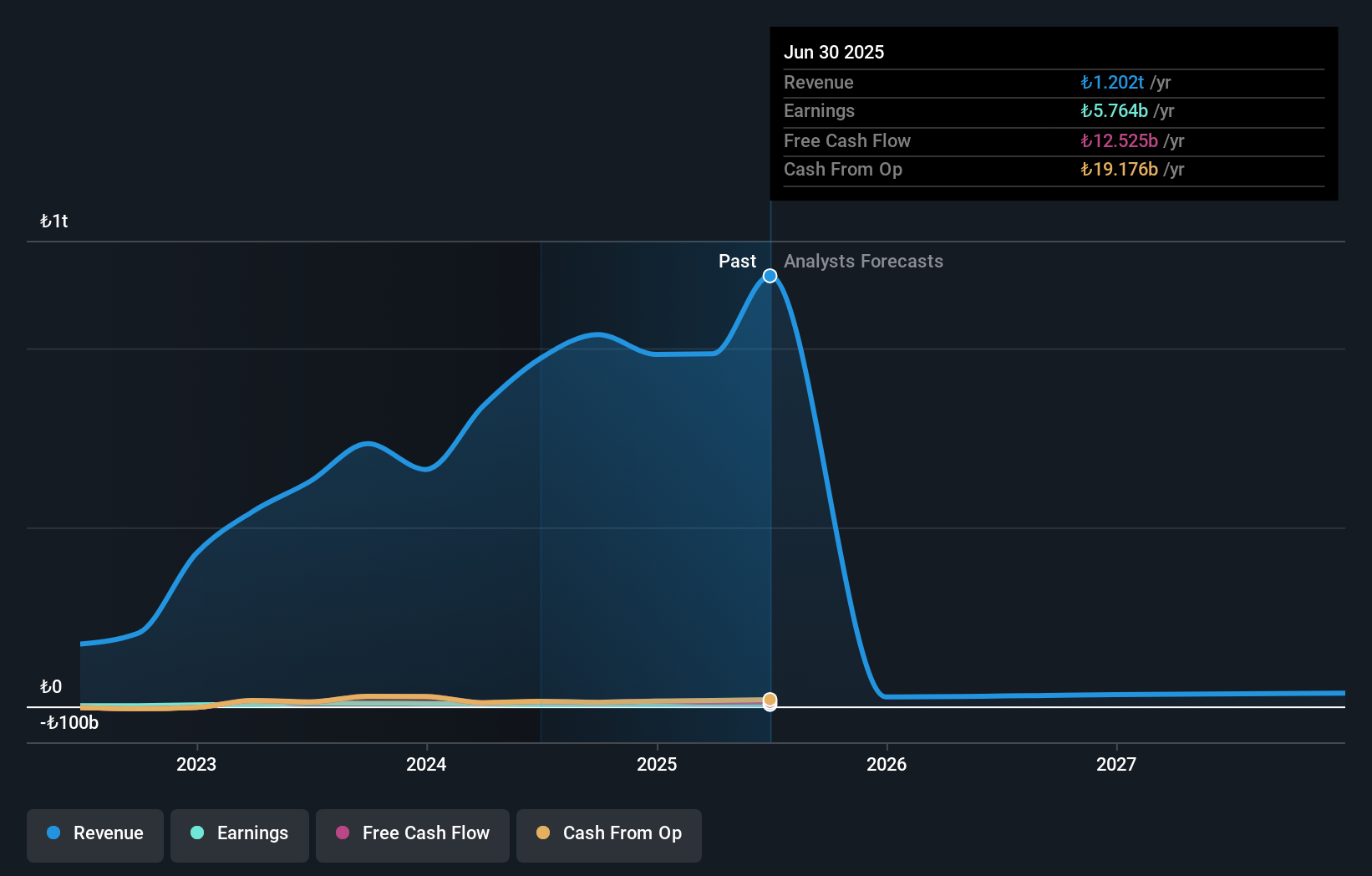

Overview: Is Yatirim Menkul Degerler Anonim Sirketi offers capital market services to both individual and corporate investors across Turkey and internationally, with a market capitalization of TRY60.84 billion.

Operations: Is Yatirim generates revenue primarily from its venture capital segment, which amounts to TRY17.68 billion, and portfolio management services totaling TRY2.91 billion. The company's financial performance is influenced by these core segments, with the venture capital division being a significant contributor to overall revenue.

Is Yatirim Menkul Degerler Anonim Sirketi, a financial player in Turkey, shows mixed signals. The firm has seen its debt to equity ratio improve from 41.5% to 21.3% over five years, indicating better leverage management. However, recent earnings growth is negative at -15.9%, underperforming the Capital Markets industry average of -5.2%. Despite this, it offers value with a price-to-earnings ratio of 11x versus the TR market's 18.4x and maintains high-quality earnings and positive free cash flow status. Recent reports indicate net income for Q3 was TRY 1,514 million compared to TRY 1,768 million last year.

FMS Enterprises Migun (TASE:FBRT)

Simply Wall St Value Rating: ★★★★★★

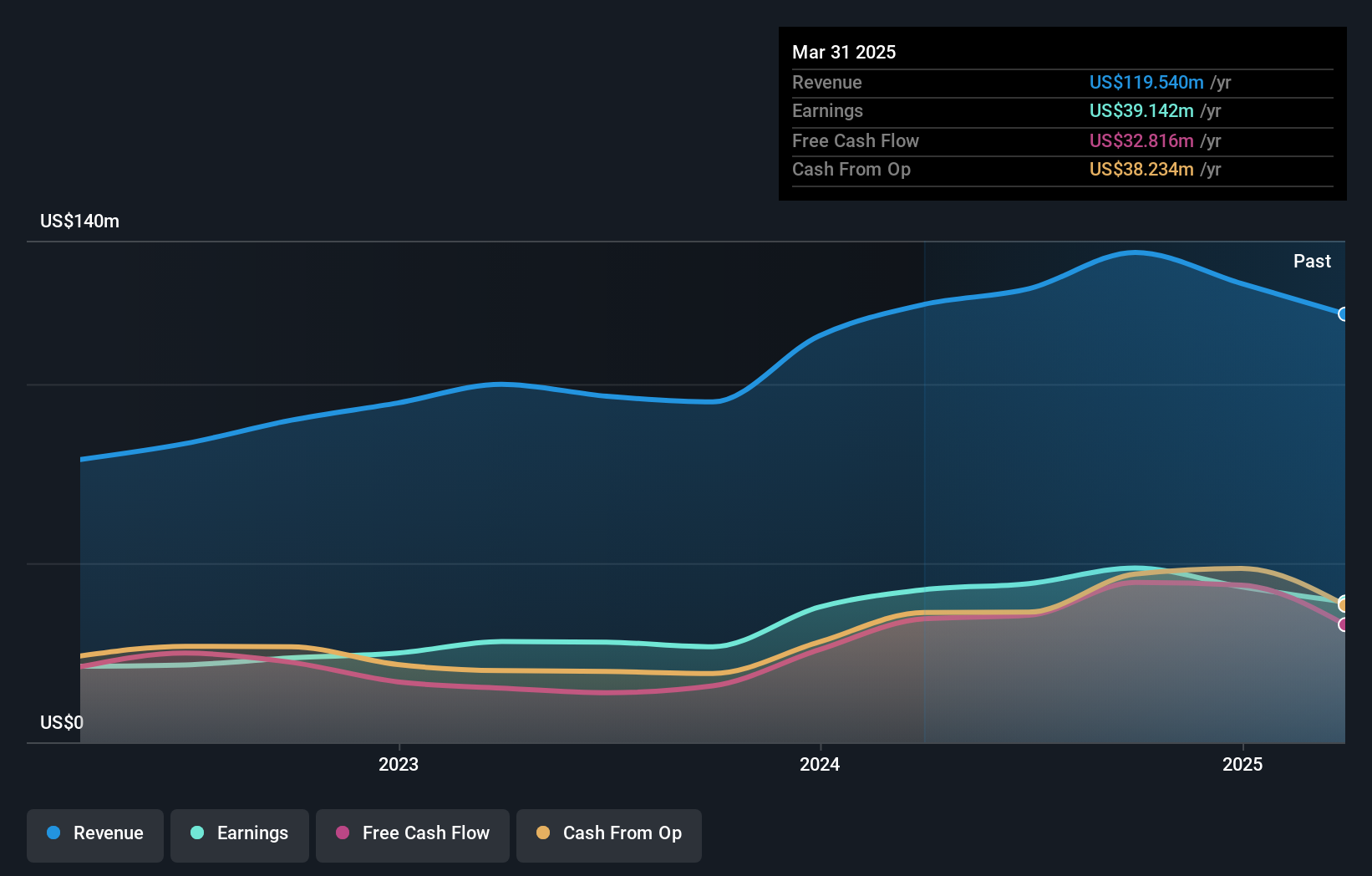

Overview: FMS Enterprises Migun Ltd specializes in the manufacturing and sale of ballistic protection raw materials and products globally, with a market capitalization of ₪2.14 billion.

Operations: FMS Enterprises Migun generates revenue primarily from its Aerospace & Defense segment, amounting to $120.37 million.

FMS Enterprises Migun, a small cap player in the Aerospace & Defense sector, reported a third-quarter net income of US$10.96 million, up from US$10.08 million the previous year, despite sales falling to US$30.36 million from US$32.7 million. Over nine months, sales dipped to US$87.29 million from last year's US$95 million while net income slightly decreased to US$31.29 million compared to US$31.43 million previously; earnings per share held steady at around USD 3.4 for this period. The company seems well-positioned with high-quality non-cash earnings and remains debt-free for over five years, suggesting financial stability amidst industry challenges.

- Navigate through the intricacies of FMS Enterprises Migun with our comprehensive health report here.

Understand FMS Enterprises Migun's track record by examining our Past report.

Lapidoth Capital (TASE:LAPD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lapidoth Capital Ltd, with a market cap of ₪5.94 billion, operates internationally through its subsidiaries to offer drilling and related services across several countries including Israel, Romania, the United States, and Poland.

Operations: Lapidoth Capital generates revenue primarily from its Dania segment, contributing ₪6.58 billion, and Sunny Communications, adding ₪994.25 million. The AFI Residences segment also plays a significant role with revenues of ₪976.67 million.

Lapidoth Capital, a small cap player in the Middle East's energy services sector, has shown impressive earnings growth of 21.6% over the past year, outpacing the industry's 7.5%. The company's debt to equity ratio has significantly improved from 192.3% to a more manageable 47.2% over five years, indicating prudent financial management. A noteworthy one-off gain of ₪120.7M influenced its recent financial results as of June 2025, suggesting some volatility in earnings quality. Additionally, Lapidoth announced a share repurchase program worth up to ₪50 million funded internally and set to expire by December 2026, reflecting confidence in its future prospects.

- Delve into the full analysis health report here for a deeper understanding of Lapidoth Capital.

Explore historical data to track Lapidoth Capital's performance over time in our Past section.

Key Takeaways

- Click this link to deep-dive into the 185 companies within our Middle Eastern Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報