A Look At SiteOne Landscape Supply (SITE) Valuation After Mixed Recent Shareholder Returns

Why SiteOne Landscape Supply is on investors’ radar today

SiteOne Landscape Supply (SITE) has moved onto many watchlists after recent share performance data showed mixed returns, with a decline over the month but a small gain over the past 3 months.

See our latest analysis for SiteOne Landscape Supply.

At a share price of $125.06, SiteOne’s recent 1 month share price return of 4.8% decline comes alongside a 1 year total shareholder return of 4.81% decline and a 5 year total shareholder return of 27.34% decline, which points to fading momentum despite pockets of short term strength.

If SiteOne’s mixed performance has you rethinking where you focus your time, this could be a good moment to broaden your search with fast growing stocks with high insider ownership.

The share price now sits well below some analyst targets despite annual revenue of US$4.7b and net income of US$139.9m. Is SiteOne quietly offering value, or is the market already pricing in its future growth potential?

Most Popular Narrative: 20% Undervalued

At US$125.06, the most followed narrative sees SiteOne’s fair value materially higher, creating a gap between current pricing and long term expectations.

Ongoing acquisition of smaller, high-margin businesses in a fragmented market allows SiteOne to consolidate market share, introduce higher-margin products, and leverage operational synergies, leading to long-term revenue growth and potential margin expansion.

Curious how steady revenue assumptions, rising margins and a richer future earnings multiple combine into that valuation gap? The full narrative lays out a detailed earnings and cash flow roadmap that the current share price does not fully reflect yet.

Result: Fair Value of $156.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could be challenged if cyclical end markets stay weak or if acquisition integration issues begin to pressure margins and earnings.

Find out about the key risks to this SiteOne Landscape Supply narrative.

Another View on SiteOne’s valuation

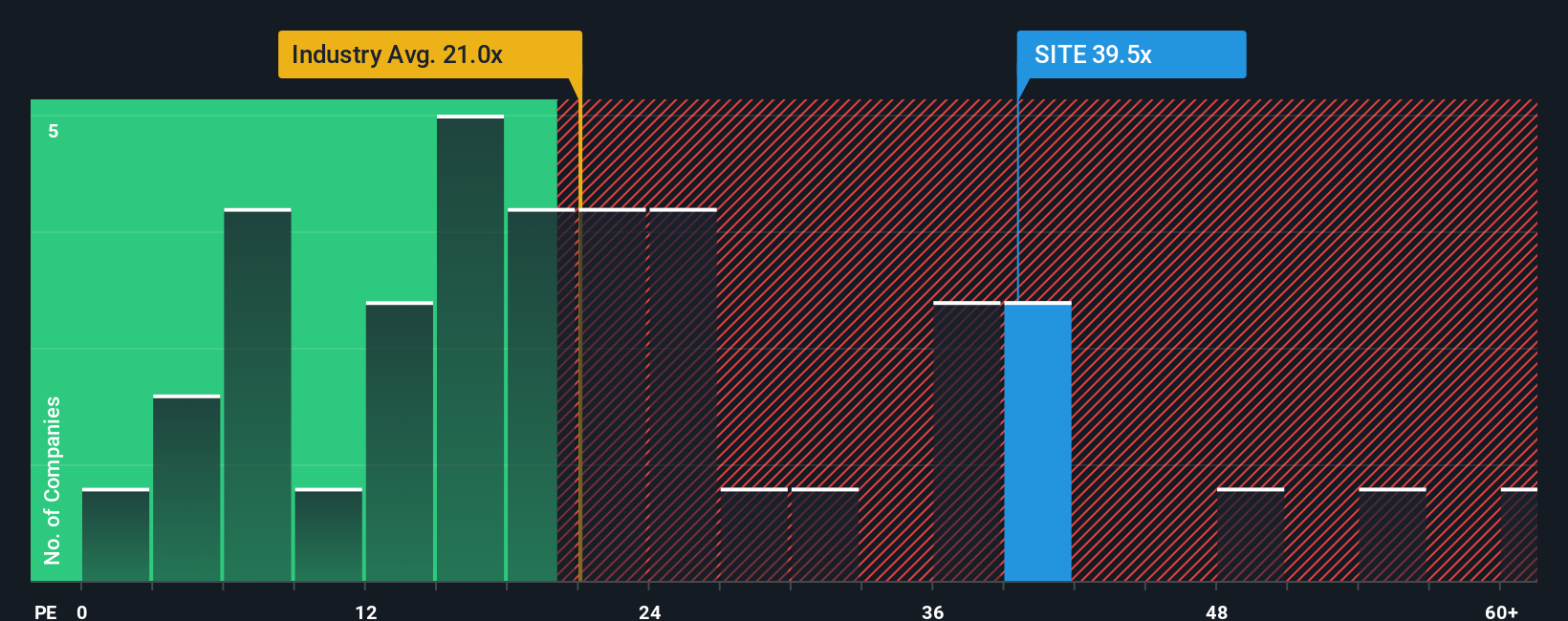

That 20% undervalued fair value of US$156.40 sits awkwardly next to how the market is currently pricing SiteOne. The P/E ratio is 39.8x, which is roughly double the US Trade Distributors industry at 20.5x and well above peers at 16.6x. Our fair ratio estimate is 28.3x, suggesting the share price could also move closer to that lower multiple over time. Is this a quality premium that holds up, or a valuation risk you are taking on at today’s price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SiteOne Landscape Supply Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a complete valuation story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding SiteOne Landscape Supply.

Looking for more investment ideas?

If SiteOne has sharpened your thinking, do not stop here. Broaden your watchlist with focused stock ideas that match how you like to invest.

- Spot potential high-upside names early by scanning these 3571 penny stocks with strong financials that already show stronger financial footing than many of their peers.

- Explore artificial intelligence by focusing on these 25 AI penny stocks that are tying revenue streams to practical AI use cases.

- Look for value-led opportunities by filtering for these 874 undervalued stocks based on cash flows where share prices sit below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報