A Look At Keyera (TSX:KEY) Valuation After Renee Zemljak Joins The Board

Keyera (TSX:KEY) has added Renee Zemljak to its Board of Directors, effective January 1, 2026. She brings more than 30 years of energy sector experience in midstream infrastructure, commodity risk management, and corporate transformations.

See our latest analysis for Keyera.

At a share price of CA$44.61, Keyera has seen short term share price returns soften over the past quarter, while its 1 year and multi year total shareholder returns remain positive. This hints that recent board changes are landing in the context of a longer running story for investors.

If leadership changes at midstream players have your attention, it could also be a good moment to look at aerospace and defense stocks as a different corner of the market with its own set of catalysts.

With revenue of CA$7,094.554m, net income of CA$430.975m, and a share price below the average analyst target, is Keyera quietly trading at a discount, or is the market already factoring in everything that comes next?

Most Popular Narrative: 14.7% Undervalued

With a fair value estimate of CA$52.31 against a last close of CA$44.61, the most followed narrative sees upside grounded in specific operating drivers.

The company's ability to secure over 100,000 barrels per day of new long-term contracted volumes and reach nearly full contracting on expanded fractionation capacity provides visibility to 7-8% annual fee-based EBITDA growth through 2027 and supports ongoing dividend increases, directly impacting revenue stability and margin predictability.

Curious what earnings trajectory and margin profile have to look like to back that kind of contract driven growth story? The narrative leans on rising fee-based cash flows, a richer profit mix, and a future earnings multiple that is usually reserved for higher growth names. If you want to see exactly how those ingredients add up to the current fair value, the full narrative lays out the assumptions in detail.

Result: Fair Value of CA$52.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher exposure to Western Canadian basins and the integration risk from the Plains Canadian NGL acquisition could still challenge margins and the associated forward earnings assumptions.

Find out about the key risks to this Keyera narrative.

Another View: What The Market Multiple Is Saying

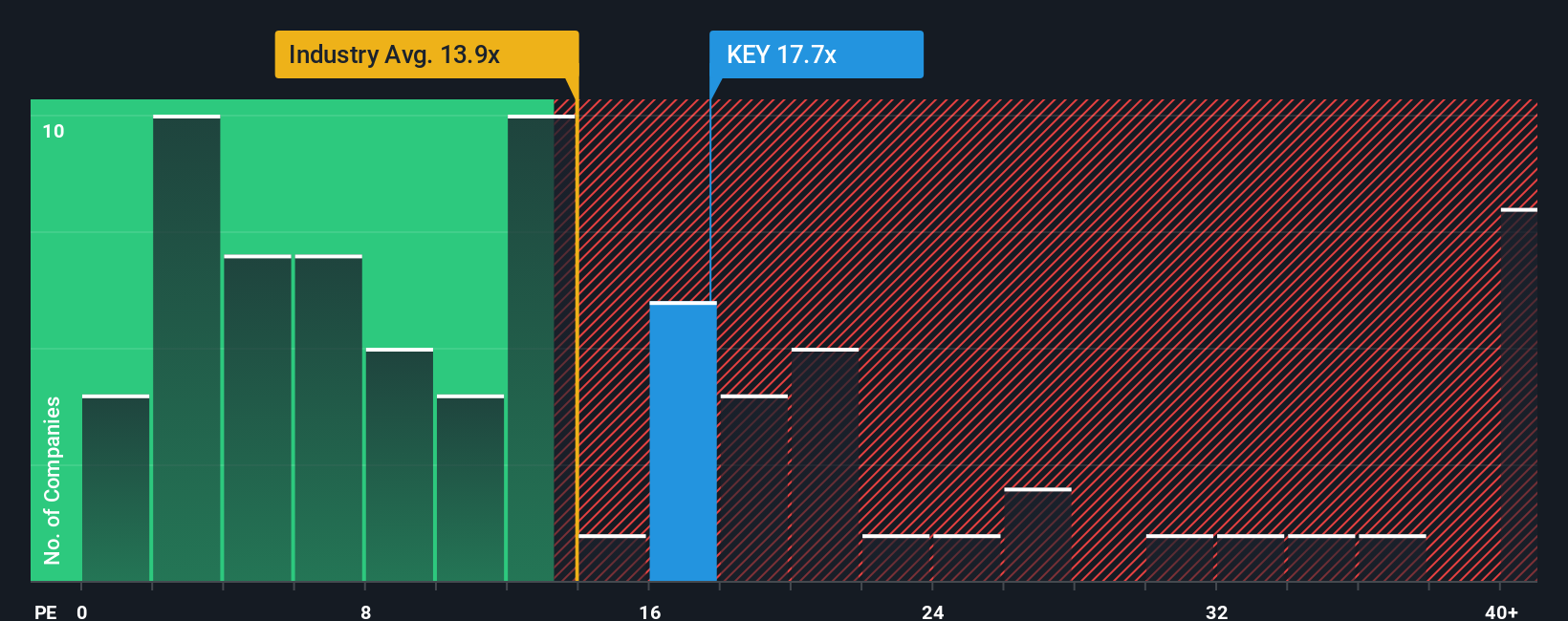

The first narrative leans on growth and cash flows to argue Keyera looks undervalued, but the current P/E of 23.7x tells a tighter story. It sits above the Canadian Oil and Gas industry at 15x, the peer average at 17.4x, and even the 20.7x fair ratio estimate.

That gap suggests investors are already paying a premium for Keyera's earnings, which could limit upside if expectations cool or execution slips. The question for you is whether that premium reflects justified confidence or a margin for error that has already been used up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keyera Narrative

If you see the numbers differently and prefer to stress test the assumptions yourself, you can build a custom thesis in just a few minutes: Do it your way

A great starting point for your Keyera research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Keyera is on your radar, do not stop here. The screener can surface other names that fit your style before they move without you.

- Spot potential value candidates early by checking out these 874 undervalued stocks based on cash flows, built around cash flow based opportunities.

- Ride emerging tech themes by scanning these 25 AI penny stocks for companies tied to artificial intelligence trends.

- Strengthen your income watchlist through these 14 dividend stocks with yields > 3%, focusing on yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報