Microsoft (MSFT) Valuation Check As AI Spending And Stock Volatility Refocus Investor Attention

Microsoft (MSFT) has drawn fresh attention after filing a US$110.08b shelf registration for up to 226,000,000 common shares related to employee stock ownership plans, raising questions about dilution, capital use, and long term incentives.

See our latest analysis for Microsoft.

Despite a series of strong AI and cloud headlines, Microsoft’s recent 90 day share price return of a 10.52% decline, including a 2.21% drop to US$472.94 on the latest close, contrasts with a 12.54% 1 year total shareholder return. This suggests shorter term momentum has cooled while longer term holders have still seen gains.

If this kind of AI heavy story has your attention, it could be a good time to compare Microsoft with other high growth tech and AI stocks that are shaping the next phase of growth.

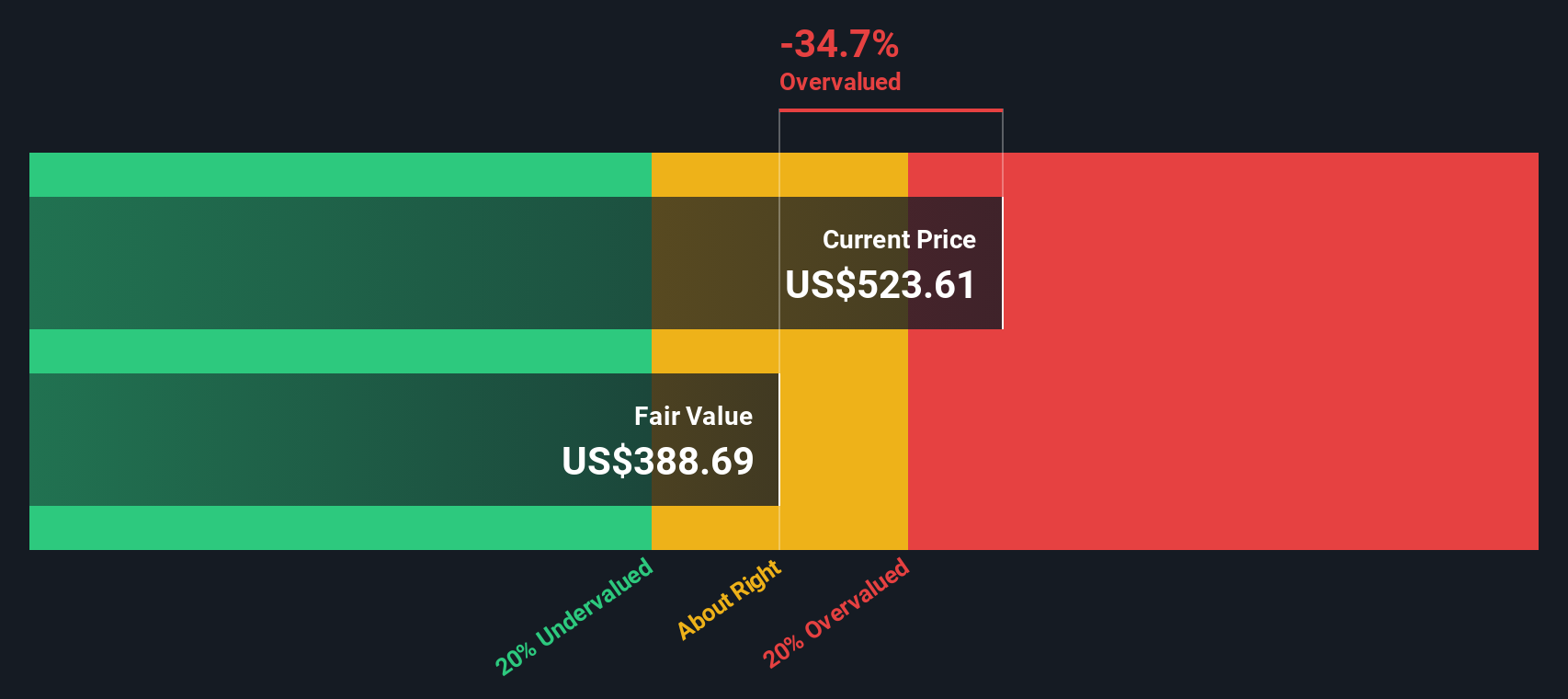

With Microsoft trading at US$472.94 and screens flagging an intrinsic discount and a gap to the average analyst target, has the recent pullback created a genuine entry point, or is the market already accounting for years of AI driven growth?

Most Popular Narrative Narrative: 12.6% Overvalued

According to PicaCoder, the narrative fair value of US$420 sits below Microsoft’s last close at US$472.94. This frames a more cautious view on today’s price.

Microsoft is currently digging away the foundation that makes it different. It is trapped in a perfect storm: losing the AI tech war to Google, burning cash on infrastructure without guaranteed ROI, cannibalizing its own seat-based revenue, and antagonizing users with a buggy, bloatware-filled operating system.

Curious how this narrative gets to a lower fair value? It leans on pressured margins, tempered growth assumptions, and a future earnings multiple that undercuts recent market enthusiasm.

Result: Fair Value of $420 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bearish view could be challenged if Microsoft’s US$293.8b revenue and US$104.9b net income help sustain confidence in its model, or if AI investments deliver clearer payback.

Find out about the key risks to this Microsoft narrative.

Another Angle On Value

While the user narrative pins fair value at US$420 and calls Microsoft overvalued, our DCF model points the other way. With fair value at US$604.22 versus a US$472.94 share price, it suggests the stock is trading at roughly a 21.7% discount. Which story do you think fits the risk you are willing to take?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Microsoft Narrative

If this view does not quite line up with your own, or you would rather test the numbers yourself, you can build a fresh thesis in just a few minutes by starting with Do it your way.

A great starting point for your Microsoft research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you only stick with one stock, you might miss other opportunities that fit your style, so consider broadening your watchlist with a few focused idea sets.

- Explore potential mispricing by checking out these 875 undervalued stocks based on cash flows, which screens for companies priced below what their cash flows may suggest.

- Approach the AI theme more selectively by reviewing these 25 AI penny stocks, which concentrates on businesses building and commercializing artificial intelligence.

- Emphasize your income focus by scanning these 14 dividend stocks with yields > 3%, which highlights companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報