A Look At Valero Energy (VLO) Valuation As Venezuela Turmoil Adds Uncertainty Before Earnings

Valero Energy (VLO) is back in focus after reports that U.S. forces captured Venezuelan President Nicolás Maduro. This development is raising questions about future U.S. policy on Venezuelan crude exports and feedstock availability for refiners.

See our latest analysis for Valero Energy.

The stock’s recent moves reflect that today’s US$165.31 share price comes after a 1 day share price return of 1.55% and a 30 day share price return of 5.07% decline. At the same time, the 1 year total shareholder return of 39.63% and 5 year total shareholder return of 238.26% point to strong longer term momentum. Recent Venezuela headlines and the upcoming earnings date may be reframing this as a fresh test of risk and reward.

If events around Valero have you rethinking energy exposure, this can be a good moment to widen your lens and check out aerospace and defense stocks as another area of the market to assess.

On one side, Valero trades at US$165.31 with an indicated intrinsic discount of about 41%, plus a long run of strong multi year total returns. On the other, recent Venezuela risk and earnings timing complicate the picture. Is this a genuine value gap, or is the market already pricing in whatever growth comes next?

Most Popular Narrative: 11% Undervalued

With a fair value estimate of about US$185.78 versus the US$165.31 last close, the most followed narrative sees upside that rests on very specific operating and capital return assumptions.

Forecasts call for meaningful operating margin and earnings per share expansion over the next two years, which supports arguments that the stock still trades below its earnings power and free cash flow potential.

Curious what kind of margin uplift and earnings trajectory could justify that gap to fair value, even with flat revenue assumptions and a richer future P/E multiple baked in? The full narrative walks through how expected profitability, capital returns, and the chosen discount rate all tie together into that valuation call.

Result: Fair Value of $185.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative could be knocked off course if asset impairments or tougher renewable diesel economics begin to affect earnings and cash generation.

Find out about the key risks to this Valero Energy narrative.

Another View: Earnings Multiple Sends a Different Signal

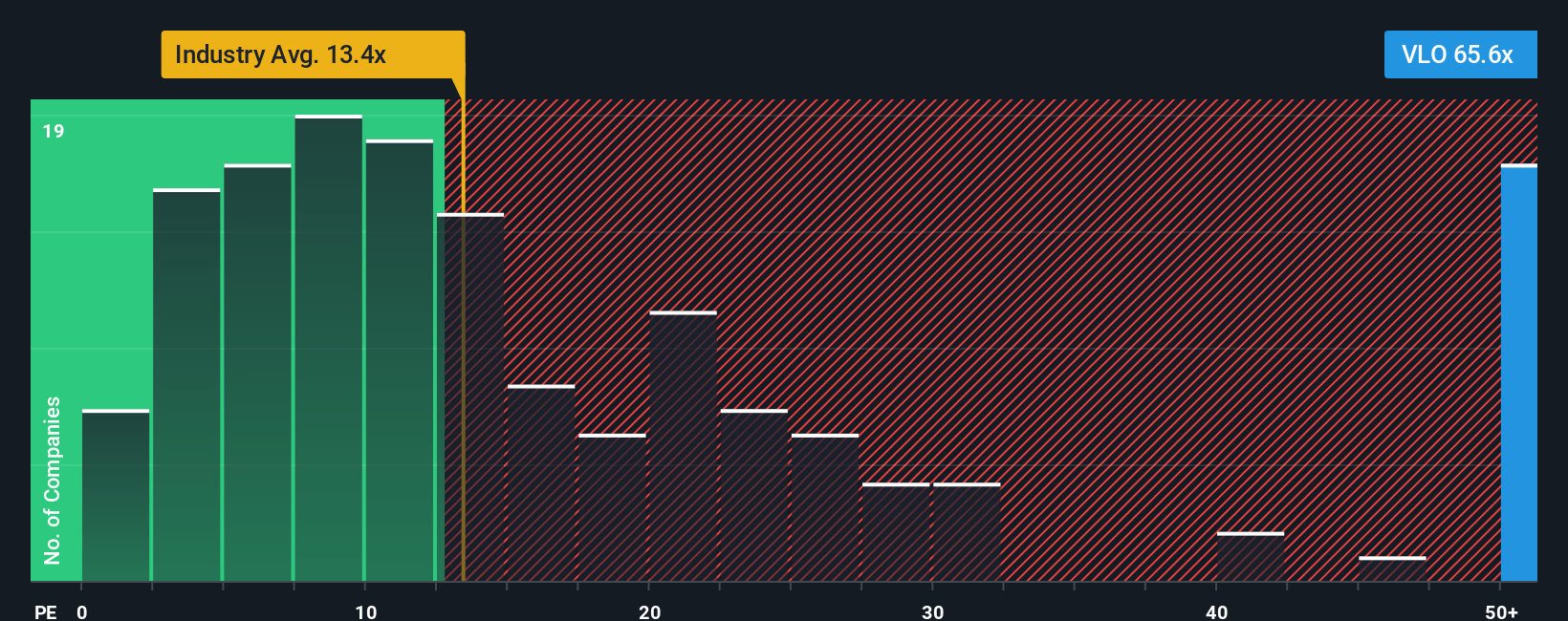

Our fair value estimate points to an 11% undervaluation, but the earnings multiple tells a tighter story. Valero trades on a 33.8x P/E, compared with 24.8x for peers, and a fair ratio of 22.4x that the market could move toward. That gap suggests valuation risk if earnings do not ramp fast enough, so which signal do you put more weight on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valero Energy Narrative

If you see the numbers differently or prefer to work from your own assumptions, you can test them in the model yourself in just a few minutes, then Do it your way

A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Valero has you thinking differently about risk and opportunity, do not stop here. Broaden your watchlist now so you do not miss what comes next.

- Tap into potential mispricings by scanning these 875 undervalued stocks based on cash flows that might suit your return and risk preferences.

- Spot fast moving themes in tech by checking out these 25 AI penny stocks that line up with long term artificial intelligence trends.

- Position for stronger income potential by reviewing these 14 dividend stocks with yields > 3% and see which companies currently offer higher yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報