European Undervalued Small Caps With Insider Activity For January 2026

As the pan-European STOXX Europe 600 Index hit a new high, buoyed by an improving economic backdrop and closing 2025 with its strongest yearly performance since 2021, investor interest in small-cap stocks is rising. In this environment, identifying promising small-cap companies often involves examining those with solid fundamentals and notable insider activity, which can signal confidence from within the company amidst broader market optimism.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| A.G. BARR | 14.1x | 1.6x | 49.53% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 41.52% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.5x | 0.3x | 44.69% | ★★★★★☆ |

| Norcros | 14.5x | 0.8x | 38.14% | ★★★★☆☆ |

| Eurocell | 16.4x | 0.3x | 39.75% | ★★★★☆☆ |

| Eastnine | 12.1x | 7.6x | 49.13% | ★★★★☆☆ |

| Senior | 26.4x | 0.8x | 21.89% | ★★★★☆☆ |

| Gooch & Housego | 47.5x | 1.1x | 20.88% | ★★★☆☆☆ |

| SmartCraft | 41.5x | 7.5x | 33.90% | ★★★☆☆☆ |

| CVS Group | 47.7x | 1.3x | 23.69% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

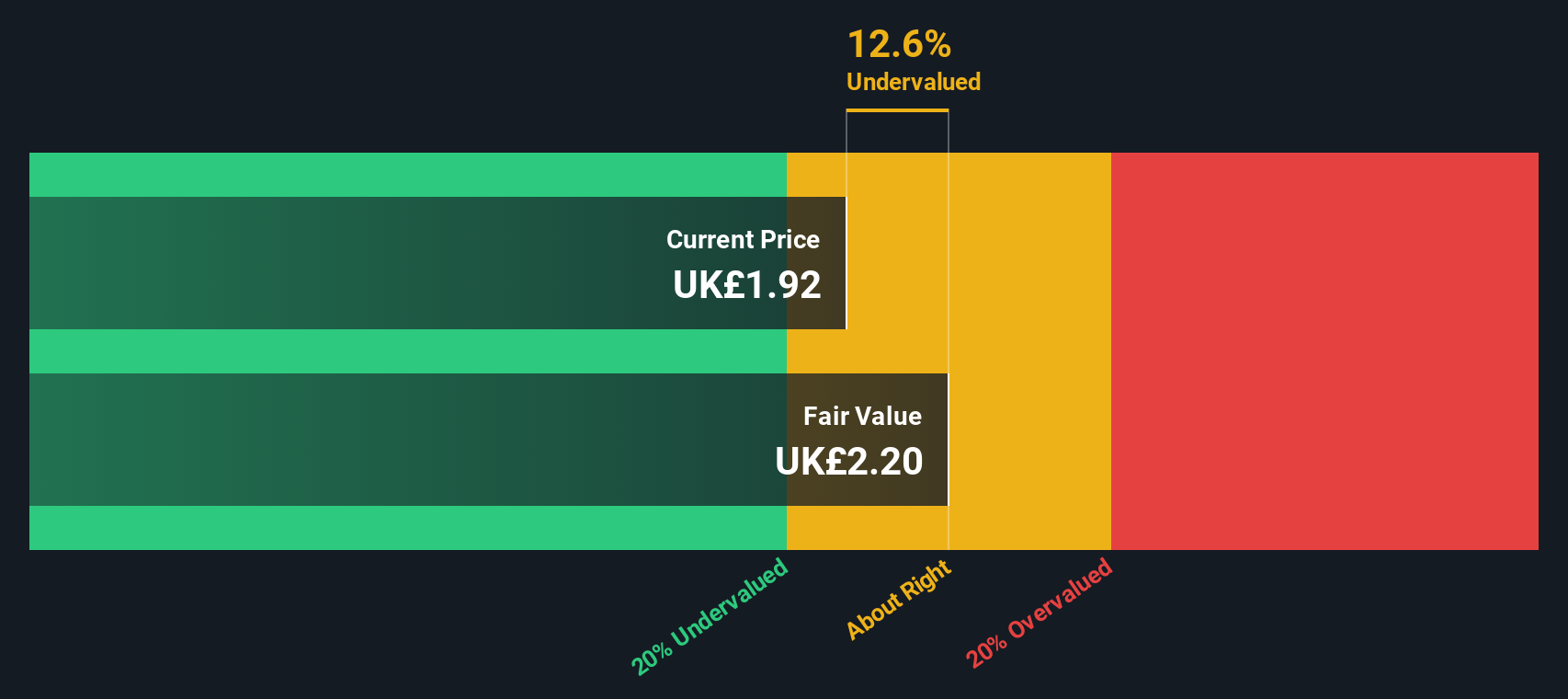

ASA International Group (LSE:ASAI)

Simply Wall St Value Rating: ★★★★★☆

Overview: ASA International Group is a microfinance institution that operates across South Asia, East Africa, West Africa, and South East Asia with a market capitalization of approximately $1.23 billion.

Operations: The company generates revenue primarily from its operations in East Africa, West Africa, South Asia, and South East Asia. Operating expenses are a significant component of the cost structure, with general and administrative expenses representing a notable portion. The net income margin has shown variability over time but was 19.70% as of the latest period.

PE: 6.2x

ASA International Group, a smaller European company, is capturing attention with its promising growth prospects. Despite recent volatility in share price and reliance on external borrowing for funding, the company forecasts earnings growth of 20.83% annually. Insider confidence is evident as executives have shown increased engagement through strategic appointments like Mark Schwartz and Geert Embrechts. The firm anticipates exceeding its net profit forecast of US$48.3 million for 2025 due to strong client demand and loan portfolio expansion, indicating potential value for investors seeking opportunities in this segment.

- Take a closer look at ASA International Group's potential here in our valuation report.

Learn about ASA International Group's historical performance.

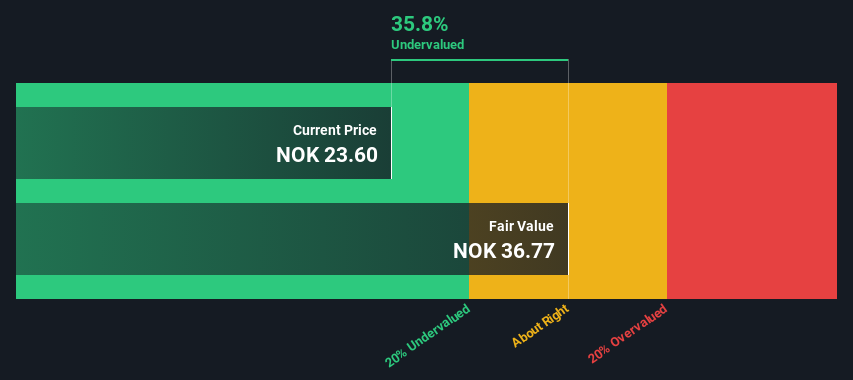

SmartCraft (OB:SMCRT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SmartCraft specializes in providing software solutions tailored for the construction and building industry, with a market capitalization of approximately NOK 2.62 billion.

Operations: SmartCraft generates revenue primarily from its sales activities, with a notable increase in revenue over recent periods, reaching NOK 551.46 million by the latest reporting date. The company's cost structure includes significant COGS and operating expenses, impacting net income margins, which have shown fluctuations but reached 18.00% recently. Gross profit margins have been observed at 51.86%, reflecting the company's ability to manage production costs relative to sales revenues effectively.

PE: 41.5x

SmartCraft, a smaller player in Europe's construction software sector, shows potential for growth with projected earnings increases of 30.17% annually. Recent financials reveal Q3 sales at NOK 137.77 million and net income at NOK 23.35 million, indicating steady performance despite lower nine-month net income compared to the previous year. Insider confidence is evident through share purchases between July and September 2025 totaling NOK 6 million. Leadership changes include Jeremias Jansson as CEO from January 2026, bringing extensive SaaS experience to drive future expansion strategies.

- Click here and access our complete valuation analysis report to understand the dynamics of SmartCraft.

Gain insights into SmartCraft's historical performance by reviewing our past performance report.

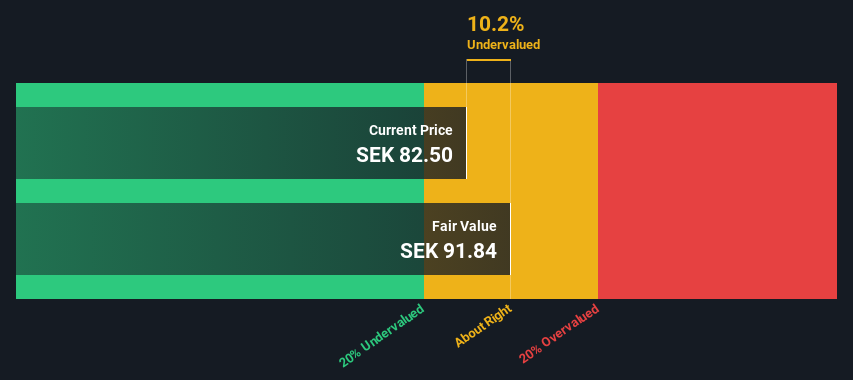

AcadeMedia (OM:ACAD)

Simply Wall St Value Rating: ★★★★★☆

Overview: AcadeMedia operates as a leading education provider in Europe, offering services across adult education, compulsory schooling, upper secondary schools, and preschools with a market capitalization of approximately SEK 6.57 billion.

Operations: AcadeMedia generates revenue primarily from its Upper Secondary Schools, Preschool & International, and Compulsory School segments. The company experienced a gross profit margin of 31.24% in the most recent quarter ending September 2025. Operating expenses are significant, with general and administrative expenses being a notable component.

PE: 11.9x

AcadeMedia, a European education provider, is catching attention as a potentially undervalued stock. The company reported Q1 2025 sales of SEK 4,101 million and net income of SEK 82 million. Insider confidence is evident with their CFO purchasing 3,000 shares for approximately SEK 299,000 in late November 2025. This move increased their holdings by over 33%, suggesting optimism about future growth. Additionally, AcadeMedia's dividend increase to SEK 2.25 per share underscores its commitment to shareholder returns amidst forecasted earnings growth of nearly 14% annually.

- Navigate through the intricacies of AcadeMedia with our comprehensive valuation report here.

Assess AcadeMedia's past performance with our detailed historical performance reports.

Seize The Opportunity

- Embark on your investment journey to our 70 Undervalued European Small Caps With Insider Buying selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報