Asian Companies That May Be Priced Below Their Estimated Values

As Asian markets navigate a complex economic landscape, recent data highlights mixed performances across major indices, with Japan's stock market showing declines and China's manufacturing sector witnessing modest improvements. In this environment, identifying stocks that may be priced below their estimated values involves looking for companies with strong fundamentals and potential for growth despite broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Visional (TSE:4194) | ¥10010.00 | ¥19857.16 | 49.6% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1579.26 | 49.7% |

| NEXON Games (KOSDAQ:A225570) | ₩12430.00 | ₩24607.01 | 49.5% |

| Mobvista (SEHK:1860) | HK$15.70 | HK$30.74 | 48.9% |

| Meitu (SEHK:1357) | HK$7.43 | HK$14.80 | 49.8% |

| Kuraray (TSE:3405) | ¥1587.00 | ¥3161.55 | 49.8% |

| Daiichi Sankyo Company (TSE:4568) | ¥3348.00 | ¥6544.37 | 48.8% |

| CURVES HOLDINGS (TSE:7085) | ¥801.00 | ¥1583.43 | 49.4% |

| Andes Technology (TWSE:6533) | NT$242.00 | NT$482.55 | 49.8% |

| Aidma Holdings (TSE:7373) | ¥3160.00 | ¥6305.80 | 49.9% |

Let's uncover some gems from our specialized screener.

KoMiCo (KOSDAQ:A183300)

Overview: KoMiCo Ltd. specializes in semiconductor equipment cleaning and coating products across South Korea, the United States, China, Taiwan, and Singapore, with a market cap of ₩955.71 billion.

Operations: The company's revenue from semiconductor equipment and services amounts to ₩567.89 billion.

Estimated Discount To Fair Value: 43.6%

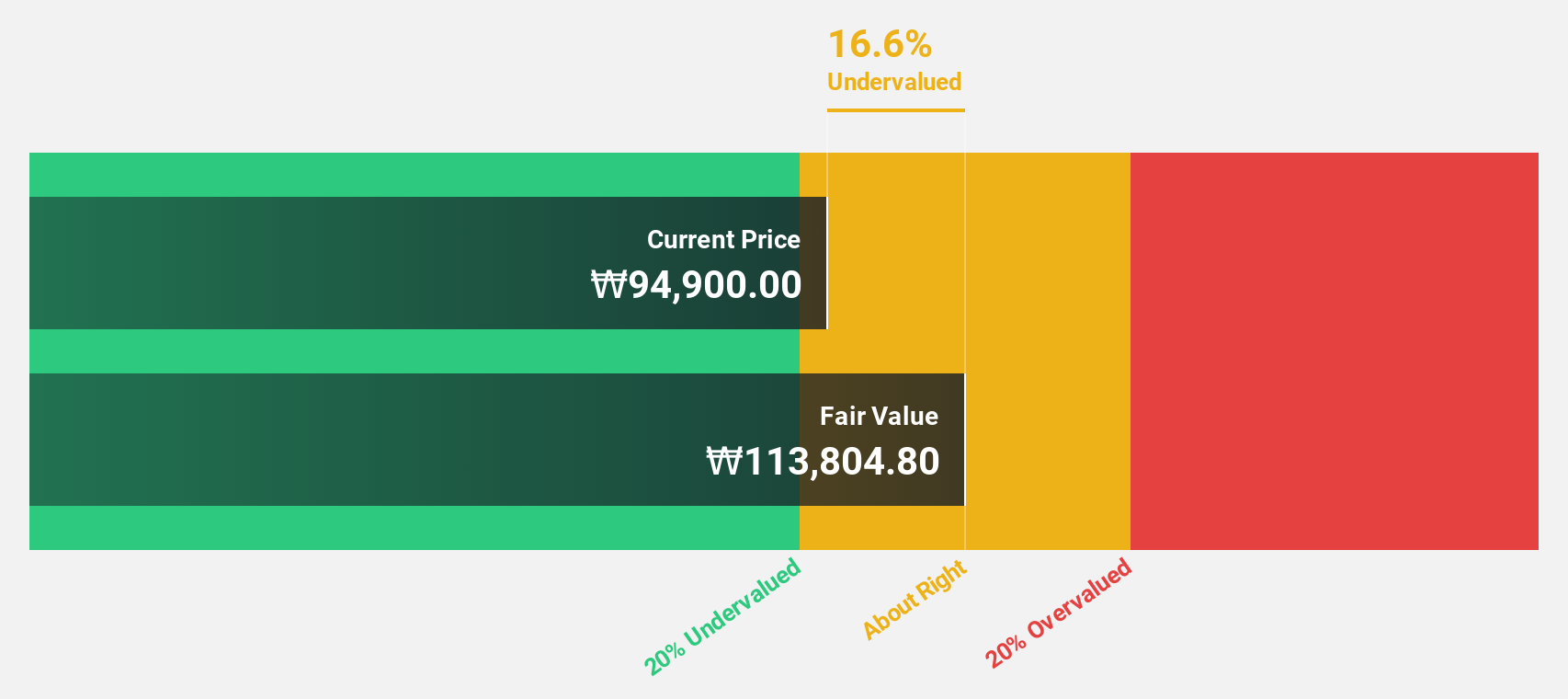

KoMiCo is trading at ₩94,800, significantly below its estimated fair value of ₩167,961.77, making it undervalued based on cash flows. Despite high volatility in recent months and debt not being well covered by operating cash flow, the stock offers good relative value compared to peers. Earnings are expected to grow significantly at 29.19% annually over the next three years, although this is slightly slower than the Korean market average growth rate.

- According our earnings growth report, there's an indication that KoMiCo might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of KoMiCo.

Hyundai Rotem (KOSE:A064350)

Overview: Hyundai Rotem Company manufactures and sells railway vehicles, defense systems, and plants and machinery both in South Korea and internationally, with a market cap of ₩21.11 trillion.

Operations: Hyundai Rotem's revenue is derived from the production and sale of railway vehicles, defense systems, and plants and machinery, serving both domestic and international markets.

Estimated Discount To Fair Value: 40.8%

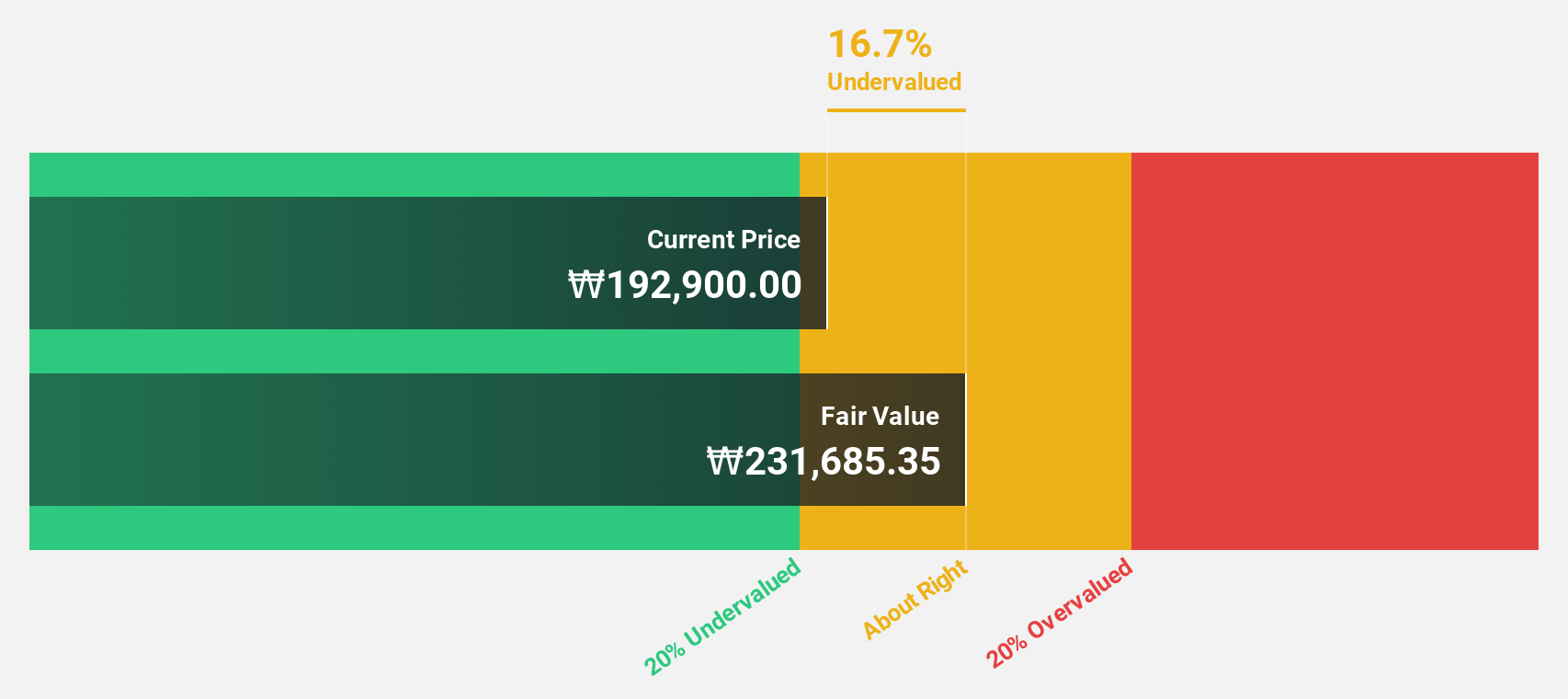

Hyundai Rotem is trading at ₩193,400, significantly below its estimated fair value of ₩326,569.98, highlighting its undervaluation based on cash flows. Recent earnings results show substantial growth with sales reaching ₩4.21 trillion and net income at ₩547.5 billion for the first nine months of 2025. Forecasts suggest revenue will grow faster than the Korean market average while earnings are expected to rise significantly over the next three years despite being below market expectations.

- Our growth report here indicates Hyundai Rotem may be poised for an improving outlook.

- Take a closer look at Hyundai Rotem's balance sheet health here in our report.

Guangzhou Guanggang Gases & EnergyLtd (SHSE:688548)

Overview: Guangzhou Guanggang Gases & Energy Co., Ltd. operates in the industrial gases and energy sector, with a market cap of CN¥19.18 billion.

Operations: Guangzhou Guanggang Gases & Energy Ltd. generates revenue from its operations in the industrial gases and energy sector.

Estimated Discount To Fair Value: 16.2%

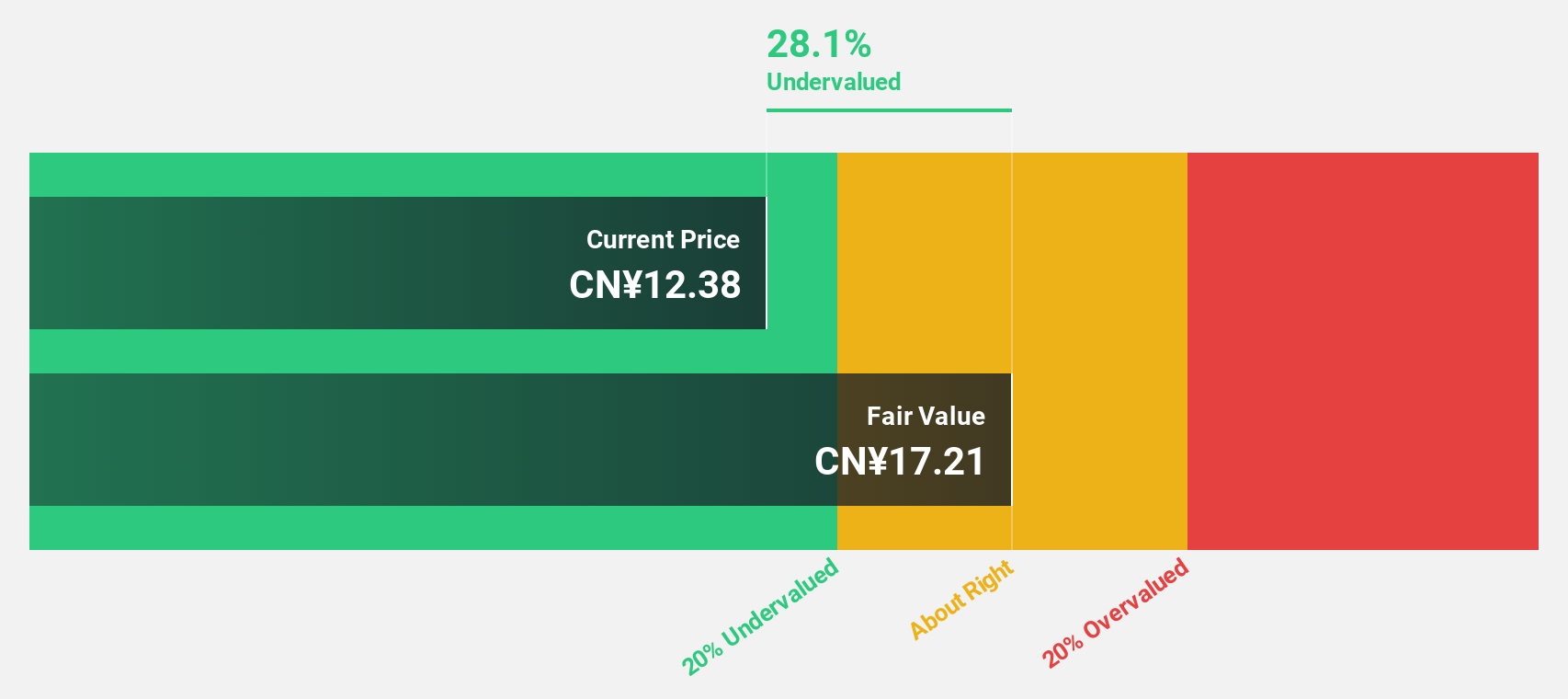

Guangzhou Guanggang Gases & Energy Ltd. is trading at CN¥14.54, slightly under its estimated fair value of CN¥17.35, indicating some undervaluation based on cash flows. Recent earnings reveal sales of CNY 1.72 billion and net income of CNY 200.6 million for the first nine months of 2025, showing growth from the previous year. Revenue and earnings are expected to grow faster than the Chinese market average over the next three years, although dividend coverage by free cash flow remains weak.

- The growth report we've compiled suggests that Guangzhou Guanggang Gases & EnergyLtd's future prospects could be on the up.

- Dive into the specifics of Guangzhou Guanggang Gases & EnergyLtd here with our thorough financial health report.

Next Steps

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 259 more companies for you to explore.Click here to unveil our expertly curated list of 262 Undervalued Asian Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報