BAIOO Family Interactive Leads The Charge In Asian Penny Stocks

As global markets navigate a complex landscape, Asian indices have shown resilience amid economic shifts and evolving trade dynamics. Penny stocks, though often considered relics of past market eras, continue to offer intriguing opportunities for investors seeking growth at lower price points. By focusing on smaller or newer companies with strong financials, these stocks can provide a unique blend of affordability and potential returns that remain relevant in today's investment climate.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.46 | HK$903.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.60 | THB1.09B | ✅ 3 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.96 | THB888M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.45 | SGD13.58B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.81 | HK$21.27B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$137.01M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.52 | HK$52.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.91 | NZ$244.72M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 959 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

BAIOO Family Interactive (SEHK:2100)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BAIOO Family Interactive Limited is an investment holding company that offers internet content and services both in China and internationally, with a market cap of approximately HK$1.22 billion.

Operations: The company generates revenue primarily from its Online Entertainment Business, which accounts for CN¥573.95 million.

Market Cap: HK$1.22B

BAIOO Family Interactive, with a market cap of approximately HK$1.22 billion, operates without debt and boasts a seasoned management team with an average tenure of 12.8 years. Despite its stable weekly volatility at 6%, the company is currently unprofitable, with earnings declining significantly over the past five years. Its short-term assets (CN¥933.8 million) comfortably cover both short-term and long-term liabilities, indicating sound liquidity management. However, the unstable dividend track record and negative return on equity (-0.47%) highlight ongoing profitability challenges in its Online Entertainment Business generating CN¥573.95 million annually.

- Click to explore a detailed breakdown of our findings in BAIOO Family Interactive's financial health report.

- Assess BAIOO Family Interactive's previous results with our detailed historical performance reports.

CMGE Technology Group (SEHK:302)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CMGE Technology Group Limited is an investment holding company that develops and publishes intellectual property-based games in Mainland China and internationally, with a market cap of HK$1.23 billion.

Operations: The company generates revenue primarily from game publishing (CN¥1.32 billion), game development (CN¥96.12 million), and licensing of intellectual property (CN¥44.69 million).

Market Cap: HK$1.23B

CMGE Technology Group, with a market cap of HK$1.23 billion, is currently unprofitable but maintains a solid financial position as its short-term assets (CN¥1.3 billion) exceed both short-term and long-term liabilities. Despite the company's negative return on equity (-77.58%) and increasing losses over the past five years, it has not diluted shareholders recently and trades at good value compared to peers. The board's recent appointment of Mr. Liu Shanshan as a non-executive director may bring valuable financial expertise to support strategic initiatives amidst ongoing challenges in achieving profitability within the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of CMGE Technology Group.

- Review our growth performance report to gain insights into CMGE Technology Group's future.

Value Partners Group (SEHK:806)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Value Partners Group Limited is a publicly owned investment manager with a market cap of approximately HK$4.51 billion.

Operations: The company generates revenue primarily from its Asset Management Business, totaling HK$528.88 million.

Market Cap: HK$4.51B

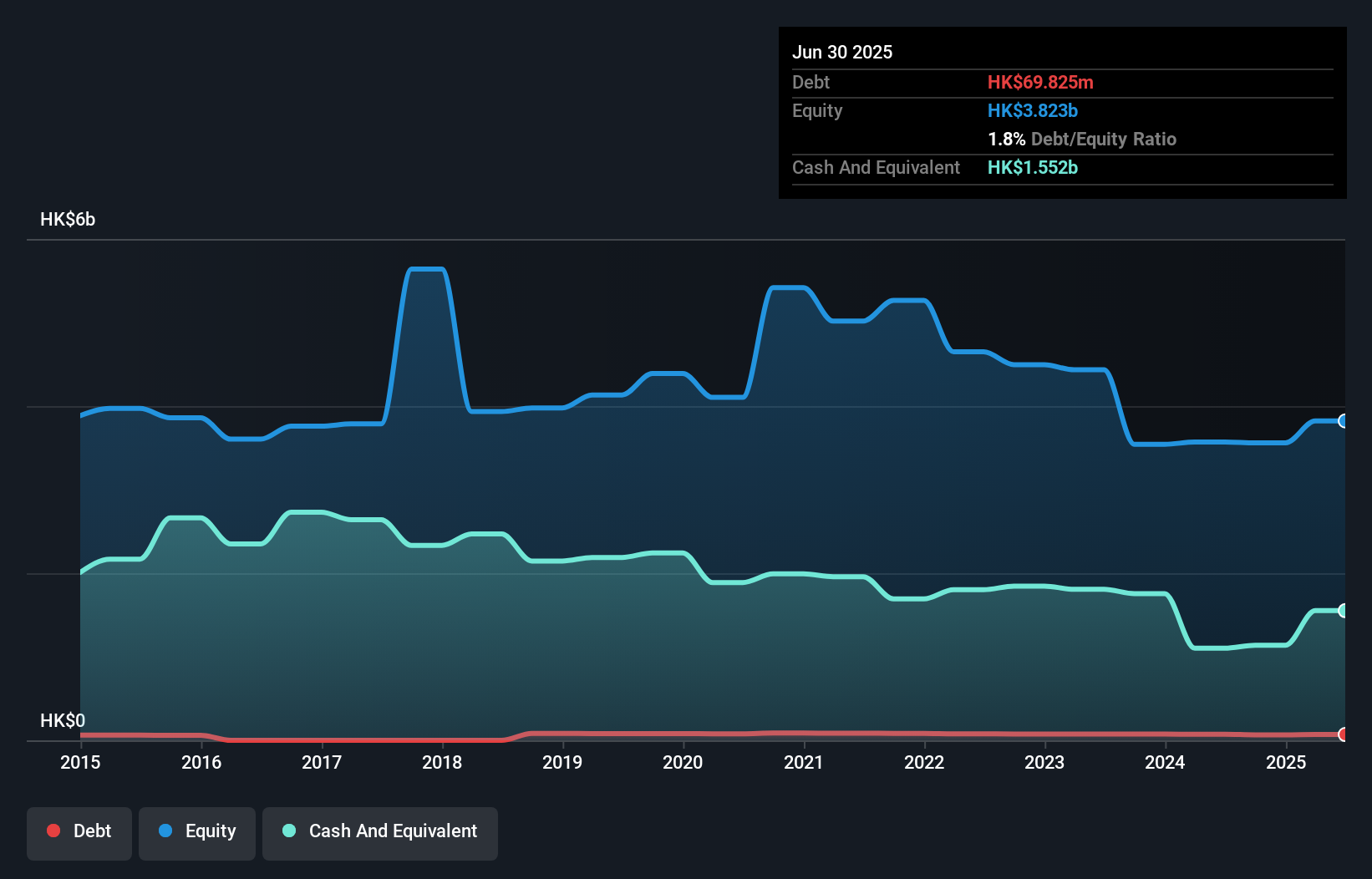

Value Partners Group, with a market cap of HK$4.51 billion, has shown substantial earnings growth of 341.6% over the past year, driven by a significant one-off gain of HK$251.7 million. The company's short-term assets (HK$1.6 billion) comfortably cover both its short and long-term liabilities, highlighting strong liquidity. Despite a low return on equity (6.4%), the company maintains more cash than total debt and trades at a price-to-earnings ratio below the industry average, suggesting potential value for investors. Recent board changes include appointing Mr. Ouyang Xi as an executive director to potentially strengthen leadership amidst these developments.

- Navigate through the intricacies of Value Partners Group with our comprehensive balance sheet health report here.

- Examine Value Partners Group's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 956 more companies for you to explore.Click here to unveil our expertly curated list of 959 Asian Penny Stocks.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報