Corcept Therapeutics (CORT): Reassessing Valuation After FDA Complete Response Letter for Relacorilant

Corcept Therapeutics (CORT) was rocked after the FDA issued a Complete Response Letter for relacorilant, rejecting its New Drug Application and demanding more evidence, a decision that immediately reshaped sentiment around the stock.

See our latest analysis for Corcept Therapeutics.

The regulatory shock explains why Corcept’s 7 day share price return is down 53.78 percent and its 30 day share price return is down 55.64 percent, even though the 3 year total shareholder return is still up 85.08 percent. This suggests that long term momentum is bruised but not broken.

If this volatility has you rethinking concentration risk in single drug stories, it could be a good moment to explore pharma stocks with solid dividends as potential stabilisers in your watchlist.

With the share price now trading at a steep discount to analysts’ targets and long term growth still tied to a broad pipeline, is Corcept an over punished mispricing, or is the market rightly repricing future growth risks?

Most Popular Narrative: 70% Undervalued

Compared to Corcept Therapeutics' last close at $38.20, the most followed valuation narrative implies a far higher fair value anchored in aggressive growth assumptions.

The analysts have a consensus price target of $134.5 for Corcept Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $121.0.

Want to see how this story justifies such a big gap between price and potential? The narrative leans on rapid scaling, sharply higher margins and a richer earnings multiple. Curious which specific growth and profitability targets need to hit for that valuation to hold up? The full breakdown reveals the exact financial path this thesis is betting on.

Result: Fair Value of $127.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in relacorilant approvals or renewed Korlym pricing and pharmacy distribution pressure could quickly undermine those upbeat growth and valuation assumptions.

Find out about the key risks to this Corcept Therapeutics narrative.

Another View: Market Multiples Send a Different Signal

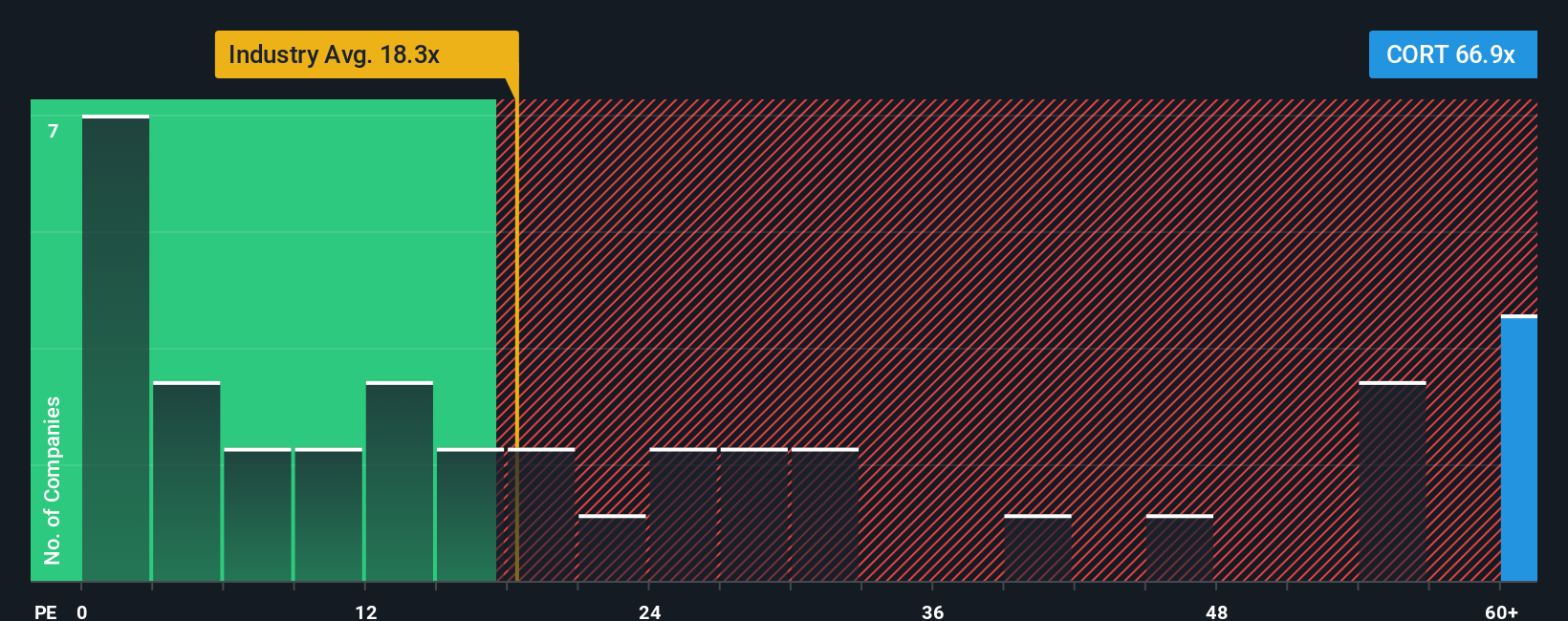

Step away from narratives and our model based fair value, and the basic earnings multiple paints Corcept as pricey today. The stock trades on 38.4 times earnings versus 33 times for peers and 19.9 times for the wider US pharma group, even though its fair ratio is 41.3 times. That narrow gap leaves less room for error, especially if growth stumbles again. Alternatively, it could mark an early entry before sentiment normalises.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corcept Therapeutics Narrative

If you would rather challenge these assumptions and dig into the numbers yourself, you can build a personalised view in minutes with Do it your way.

A great starting point for your Corcept Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Corcept may be central to your thesis, but ignoring other opportunities could mean missing other potential winners. You can use the Simply Wall Street Screener to explore a wider range of ideas.

- Explore high-upside potential among overlooked names by targeting these 3571 penny stocks with strong financials that already show strong balance sheets and resilient cash generation.

- Focus on these 25 AI penny stocks that apply artificial intelligence to real revenue, rather than just headlines.

- Investigate these 875 undervalued stocks based on cash flows, where current prices appear low relative to analysts’ estimates of future cash flows and market expectations are limited.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報