US Infrastructure Tailwinds and Local Dominance Might Change The Case For Investing In Vulcan Materials (VMC)

- Recently, Vulcan Materials was highlighted as being well positioned to benefit from strong US infrastructure spending, resilient housing demand, and large public projects, supported by a defensible business model and pricing power.

- An interesting takeaway is that Vulcan is increasingly viewed as a long-term infrastructure play built on local market dominance and long-term contracts, rather than a short-term trading idea.

- Next, we’ll explore how this infrastructure-driven outlook, particularly the boost from US government spending, could influence Vulcan Materials’ broader investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Vulcan Materials Investment Narrative Recap

To own Vulcan Materials, you need to believe that US infrastructure spending and non-residential projects can more than offset any softness in weather exposed and affordability challenged residential markets. The latest commentary about Vulcan as a long-term infrastructure play reinforces that view, but does not materially change the near term catalyst of IIJA driven project awards or the key risk around potential disruptions to future public funding flows.

The recent confirmation that Ronnie Pruitt will become CEO in early 2026 is particularly relevant here, as it ties leadership continuity to Vulcan’s M&A focused, infrastructure driven growth plan. For investors watching how the company executes on long term contracts and potential bolt on deals, stable leadership through this transition could matter for how effectively Vulcan converts strong public project backlogs into sustained profitability and cash generation.

Yet, behind this positive infrastructure story, there is an important funding risk that investors should be aware of if...

Read the full narrative on Vulcan Materials (it's free!)

Vulcan Materials' narrative projects $9.6 billion revenue and $1.5 billion earnings by 2028.

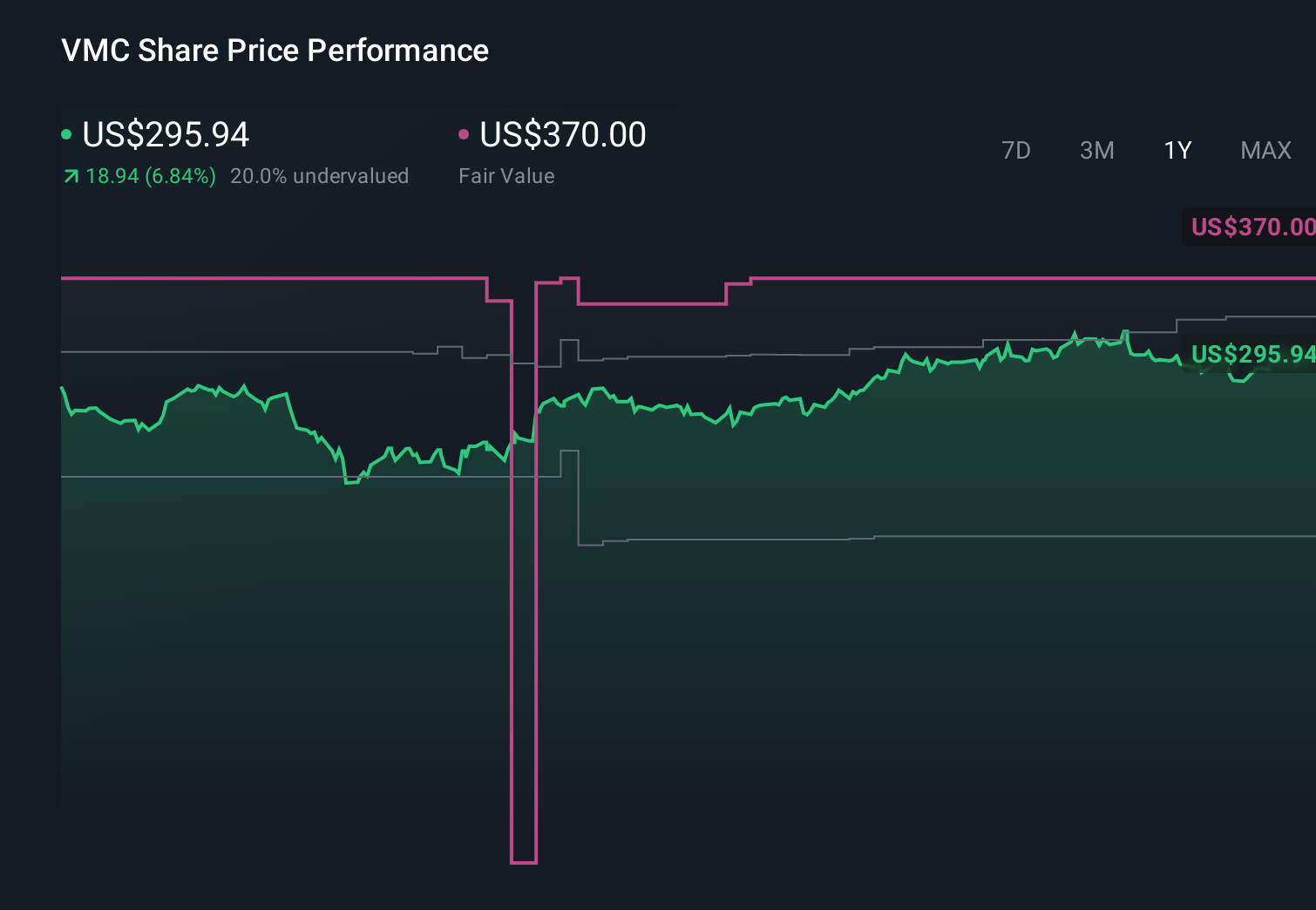

Uncover how Vulcan Materials' forecasts yield a $317.70 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently place Vulcan’s fair value between US$115 and about US$317, showing how far apart individual views can be. As you weigh these opinions against the company’s heavy reliance on ongoing US infrastructure funding, it is worth exploring several contrasting scenarios for how policy or project timing could affect Vulcan’s future results.

Explore 4 other fair value estimates on Vulcan Materials - why the stock might be worth less than half the current price!

Build Your Own Vulcan Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vulcan Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Vulcan Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vulcan Materials' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報