Western Digital (WDC): Reassessing Valuation After AI-Driven Storage Demand and HDD Business Separation

Western Digital (WDC) is back in the spotlight after a 7% intraday jump, as investors respond to fresh reports of tight supply in high capacity storage and intensifying demand from artificial intelligence infrastructure build outs.

See our latest analysis for Western Digital.

The latest pop sits on top of a powerful trend, with Western Digital’s share price up strongly over the past quarter and its one year total shareholder return nearing 290 percent. This suggests that momentum is firmly building as AI driven storage demand accelerates.

If Western Digital’s move has you rethinking your tech exposure, it could be a good moment to scout other high growth tech and AI stocks that are riding similar structural shifts.

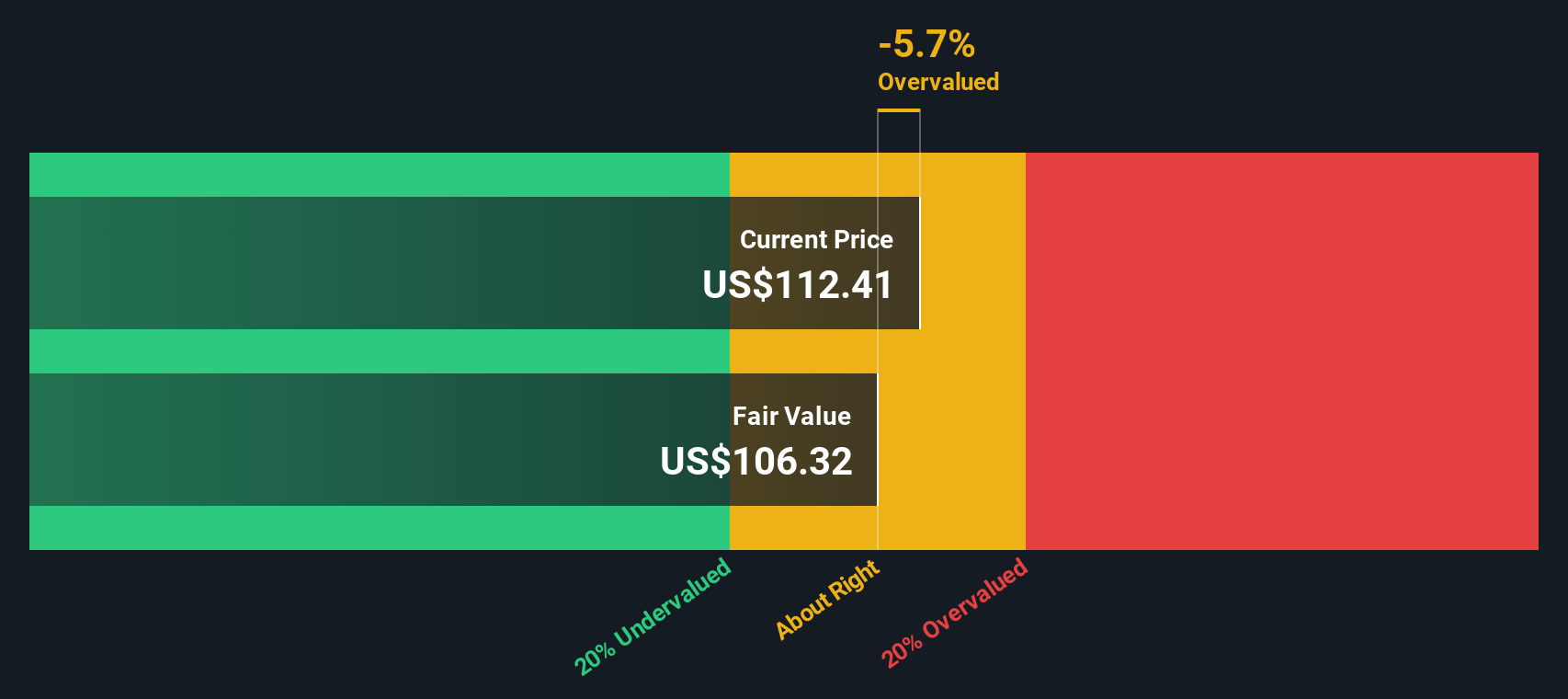

With Western Digital now flirting with analyst targets, yet still trading at a sizeable intrinsic discount, the key question is whether today’s price underestimates its AI storage upside or if the market is already baking in the next leg of growth.

Most Popular Narrative Narrative: 0.4% Overvalued

With Western Digital last closing at $187.70 against a narrative fair value near $187, the story hinges less on price gaps and more on what powers that valuation.

The explosive increase in unstructured data generated by AI applications, Agentic AI, and cloud based services across industries is driving unprecedented storage needs. Western Digital's deep integration with leading hyperscalers (e.g., all top 5 with firm POs/LTAs covering the next 12 to 18 months) positions the company to benefit from secular demand, directly fueling higher long term revenue growth.

Want to see what kind of revenue runway and margin expansion this narrative is baking in, and how a premium earnings multiple ties it all together? Read on.

Result: Fair Value of $187.0 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a handful of hyperscale customers, along with potential disruption from newer storage technologies, could quickly challenge the current AI storage bull case.

Find out about the key risks to this Western Digital narrative.

Another View: Cash Flows Point to Deeper Value

While the narrative fair value calls Western Digital slightly overvalued, our DCF model presents a different view, indicating the shares are about 18.5% undervalued. If the cash flow assumptions prove closer to reality than sentiment based multiples, today’s rally could still be in its early stages.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Western Digital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Western Digital Narrative

If you see the numbers differently or want to pressure test your own thesis, you can build a personalized narrative in just minutes with Do it your way.

A great starting point for your Western Digital research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Use the Simply Wall Street Screener now to uncover fresh stock ideas, sharpen your edge, and avoid missing opportunities that others only notice after they move.

- Capture early growth by targeting these 3571 penny stocks with strong financials that already back up their potential with solid fundamentals and financial strength.

- Ride transformative innovation by focusing on these 25 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Lock in quality at a discount by zeroing in on these 875 undervalued stocks based on cash flows that look mispriced based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報