Taking a Fresh Look at BioMarin Pharmaceutical’s (BMRN) Valuation After Its Recent Share Price Rebound

BioMarin Pharmaceutical (BMRN) has quietly shifted gears lately, with the stock gaining about 11% over the past month even as its one year return is still negative and trailing the broader biotech space.

See our latest analysis for BioMarin Pharmaceutical.

That recent 11.3% 1 month share price return at around 59.45 looks more like a cautious reset than a full comeback. This is especially the case with the 1 year total shareholder return still down double digits and longer term TSR deeply negative, suggesting sentiment may be stabilising but not yet convinced the growth story has fully turned.

If BioMarin has put you back on the hunt for resilient healthcare names, this could be a good moment to scan other opportunities across healthcare stocks.

With shares still well below analyst targets despite solid revenue and profit growth, investors face a key question: Is BioMarin an underappreciated rare disease leader, or has the market already baked in its next leg of growth?

Most Popular Narrative: 32.8% Undervalued

With the narrative fair value at $88.48 versus a $59.45 last close, the current price gap hinges on optimistic long term earnings and margin plans.

Analysts expect earnings to reach $1.1 billion (and earnings per share of $5.75) by about September 2028, up from $657.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.3 billion in earnings, and the most bearish expecting $758 million.

Want to know what powers that earnings jump, and why margins and future valuation multiples have to stretch to make it work? Unlock the full narrative to see which revenue trajectory and profit expansion path this story quietly assumes, and how sensitive that $88.48 fair value is to even small changes in those forecasts.

Result: Fair Value of $88.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition in rare disease therapies and persistent pricing pressure could derail margin expansion and undermine the current undervaluation thesis.

Find out about the key risks to this BioMarin Pharmaceutical narrative.

Another Lens on Value

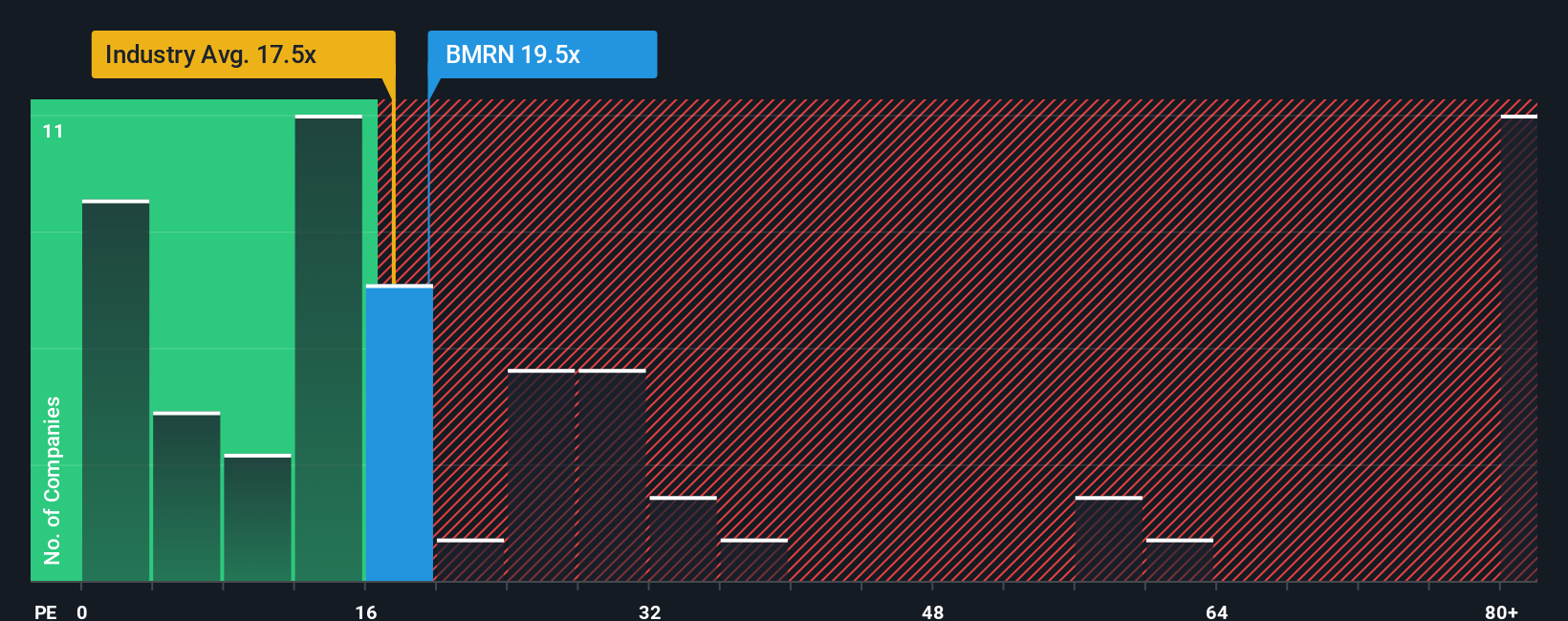

While the narrative points to a 32.8% discount to fair value, a simple earnings lens is less generous. BioMarin trades on 21.9 times earnings, slightly richer than both the US biotech average at 21.1 times and its own 23.1 times fair ratio, hinting at less obvious upside. Is this a margin of safety or just a fully priced quality name?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioMarin Pharmaceutical Narrative

If you see the numbers differently or want to stress test your own thesis, you can create a personalised narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding BioMarin Pharmaceutical.

Looking for more investment ideas?

Before you move on, consider exploring targeted stock ideas on Simply Wall Street that match your strategy rather than focusing only on recent headlines.

- Explore potential turnarounds by scanning these 3571 penny stocks with strong financials that already show strong balance sheets and improving fundamentals.

- Prepare for potential changes in the technology landscape by focusing on these 25 AI penny stocks involved in automation, data insight, and intelligent infrastructure.

- Review these 14 dividend stocks with yields > 3% that aim to reward shareholders through reliable and sustained payouts as part of an income-focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報