Assessing Vestas (CPSE:VWS) Valuation After a 12% Monthly and 40% Three-Month Share Price Rebound

Outlook for Vestas Wind Systems Shares After Recent Gains

Vestas Wind Systems (CPSE:VWS) has quietly staged a strong comeback, with the stock up about 12% over the past month and roughly 40% in the past 3 months, drawing fresh investor attention.

See our latest analysis for Vestas Wind Systems.

That recent rebound comes after a tougher few years, with a 1 year total shareholder return of about 72% contrasting sharply with weaker 3 and 5 year total shareholder returns. This suggests momentum has only recently started to build again around Vestas and the sector’s growth story.

If Vestas’ move has you rethinking where the energy transition could create upside next, it is worth exploring other renewable focused names via fast growing stocks with high insider ownership.

With earnings now recovering and the share price already well above consensus targets, the key question is whether Vestas still trades below its long term potential, or if the market is already pricing in its next growth phase.

Most Popular Narrative: 14.3% Overvalued

With Vestas Wind Systems last closing at DKK178.65 against a most popular narrative fair value of DKK156.26, expectations for future growth are doing heavy lifting in this story.

The analysts have a consensus price target of DKK139.905 for Vestas Wind Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of DKK195.99, and the most bearish reporting a price target of just DKK60.0.

Curious what kind of revenue path, margin rebuild, and future earnings multiple could justify a price above today’s level, even with that analyst gap? Explore the detailed growth and profitability assumptions, and see how a single discount rate brings all those moving parts together into one fair value estimate.

Result: Fair Value of DKK156.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn offshore losses and policy driven order volatility could quickly undermine those upbeat margin and growth assumptions that investors are leaning on.

Find out about the key risks to this Vestas Wind Systems narrative.

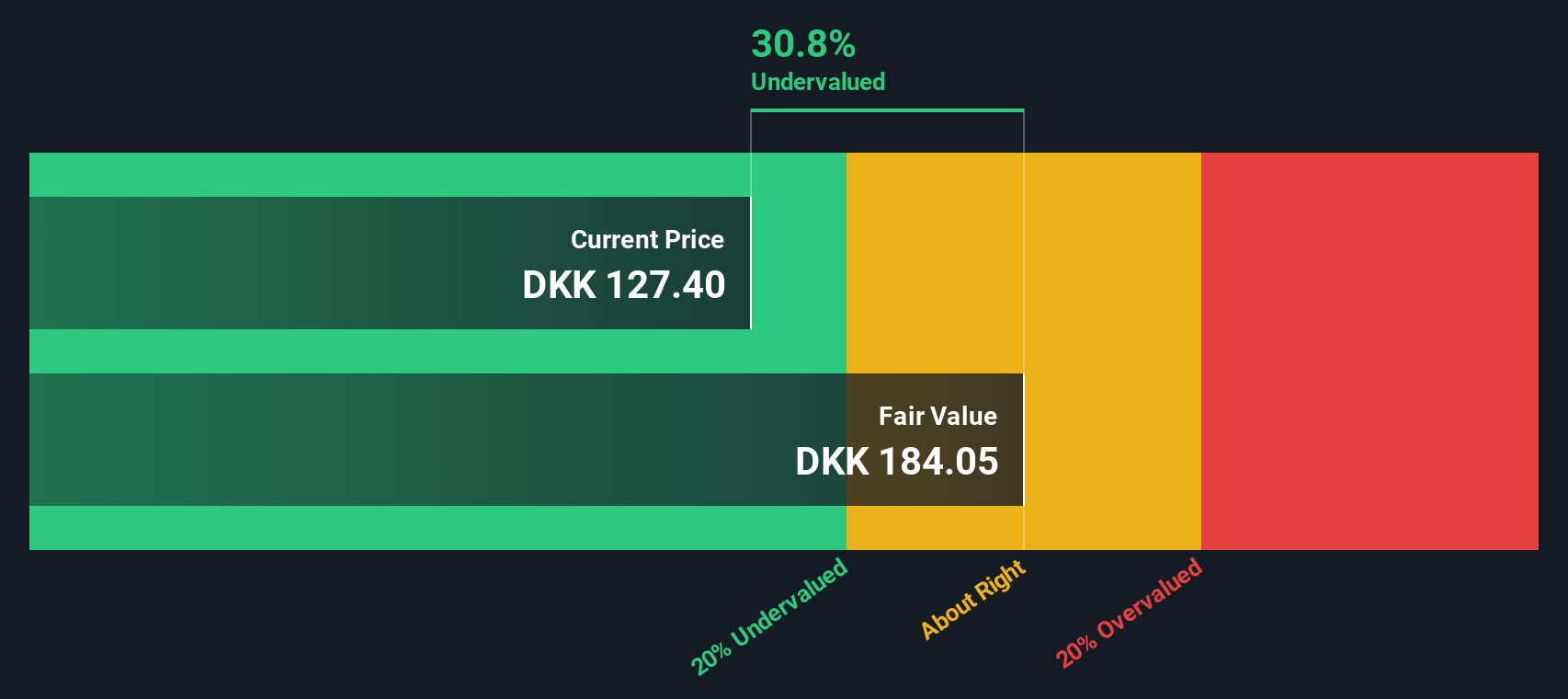

Another View: DCF Points to Mild Undervaluation

Our DCF model paints a softer picture than the narrative fair value, with Vestas trading around 3% below its estimated fair value of DKK184.10. That is hardly a deep discount, but it suggests the recent rally may not have fully exhausted upside yet.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vestas Wind Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vestas Wind Systems Narrative

If you see things differently or simply want to dig into the numbers yourself, you can build a personalised view in just minutes, Do it your way.

A great starting point for your Vestas Wind Systems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop with a single opportunity. Use the Simply Wall St Screener to quickly uncover fresh stocks that match your strategy before the market catches on.

- Capture high potential growth by targeting these 25 AI penny stocks that are reshaping industries with transformative automation and intelligent software.

- Lock in income focused opportunities through these 14 dividend stocks with yields > 3% that can strengthen portfolio cash flow while rates and inflation keep shifting.

- Position yourself early in emerging digital finance themes with these 80 cryptocurrency and blockchain stocks shaping the future of payments, security and decentralized networks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報