ATI (ATI): Valuation Check After Strong Quarter, Analyst Upgrade and Aerospace Growth Tailwinds

ATI (ATI) just delivered a stronger than expected quarter and picked up an analyst upgrade, and the market noticed, with shares recently pushing to a fresh 52 week high above 117.

See our latest analysis for ATI.

Those numbers help explain why the share price has climbed to about 119.2 dollars, with an 18.71 percent 30 day share price return and a 112.44 percent 1 year total shareholder return, suggesting momentum is still very much on ATI's side.

If ATI's run has you rethinking where growth could come from next, it might be worth scanning other aerospace and defense names through aerospace and defense stocks for fresh ideas.

With ATI now trading just shy of analyst targets and sporting triple digit 1 year returns, investors face a tougher call: is there still a mispriced growth runway here, or has the market already baked in the upside?

Most Popular Narrative Narrative: 1% Overvalued

With ATI closing at 119.2 dollars against a narrative fair value of 118.25 dollars, the story leans toward slight overpricing rather than a deep discount.

Discrete investments in advanced alloys production, process automation, and supply chain partnerships are already yielding step-changes in manufacturing efficiency and output, evidenced by expanding High Performance Materials & Components margins (to >24%) and stronger incremental margin capture, accelerating EBITDA and free cash flow conversion.

Want to see what kind of steady growth, margin lift, and future earnings multiple are baked into that near full valuation signal? The full narrative unpacks the precise revenue trajectory, profitability shift, and long term earnings power behind this price, and the numbers may surprise you.

Result: Fair Value of $118.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering exposure to concentrated aerospace customers and ongoing heavy capital needs could quickly challenge the margin expansion narrative if demand or execution weakens.

Find out about the key risks to this ATI narrative.

Another Lens on Value

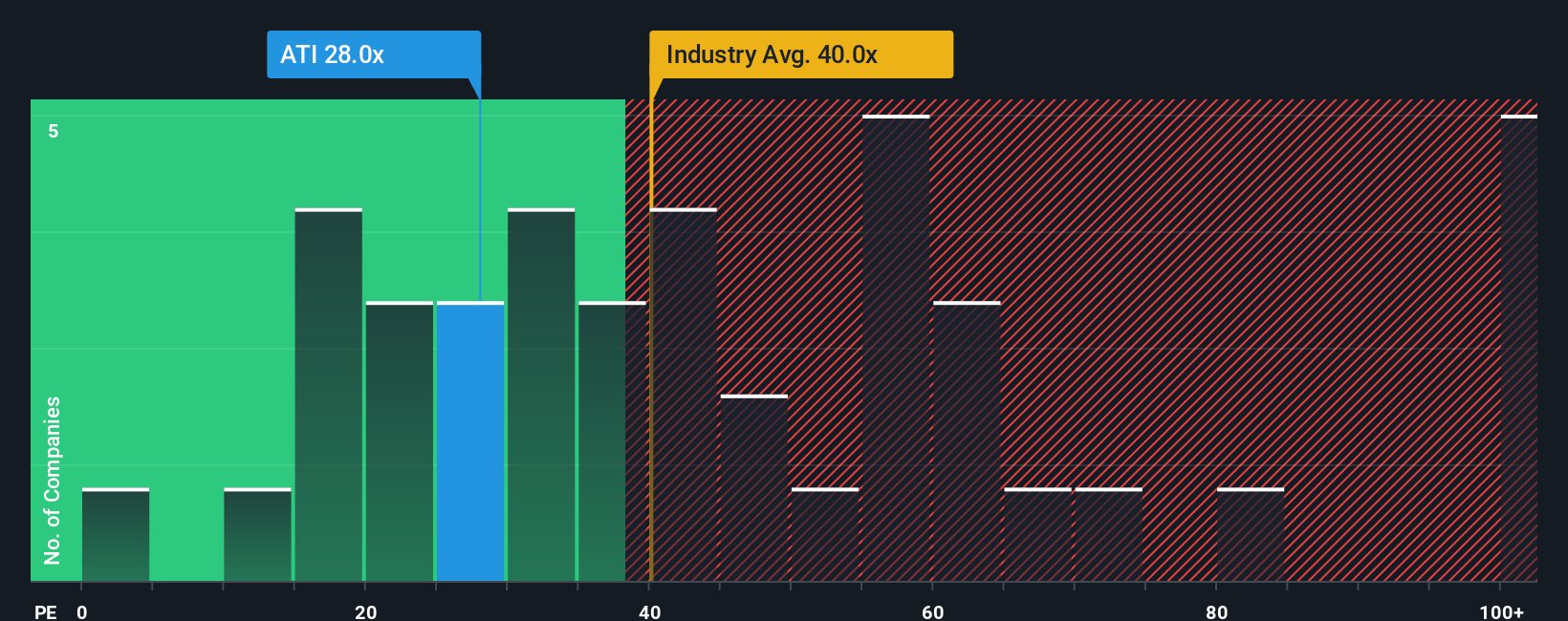

While the narrative fair value suggests ATI is only about 1 percent overvalued, the earnings multiple tells a louder story. ATI trades on a 36.4 times price to earnings ratio, richer than its 31.8 times fair ratio and above peer and industry levels. This leaves less margin for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ATI Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized ATI story in minutes using Do it your way.

A great starting point for your ATI research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

ATI might be working now, but the next potential winner could already be on your radar if you act promptly and use targeted stock screens today.

- Target long term wealth building by focusing on reliable income streams with these 14 dividend stocks with yields > 3% that can keep paying you while markets shift.

- Explore the next major technology trend by examining innovation leaders with these 25 AI penny stocks before their stories attract wider attention.

- Strengthen your portfolio’s upside potential with these 875 undervalued stocks based on cash flows that the market has not fully appreciated yet, before sentiment changes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報