BrightSpring Health Services (BTSG): Assessing Valuation After a Strong 3-Month Share Price Rally

BrightSpring Health Services (BTSG) has been quietly rewarding patient investors, with the stock up roughly 3% this week, 7% over the past month, and about 33% across the past 3 months.

See our latest analysis for BrightSpring Health Services.

That strength is not just a short burst either. A 33.01% 3 month share price return has contributed to a substantial 117.69% 1 year total shareholder return, suggesting momentum is still building as investors re rate its growth and risk profile.

If BrightSpring’s run has you thinking more broadly about healthcare opportunities, it is a good moment to explore other potential leaders across healthcare stocks.

With earnings growing faster than revenue, a modest discount to analyst targets, and a sizable gap to some intrinsic value estimates, investors face a key question: Is BrightSpring still mispriced or already reflecting its future growth?

Most Popular Narrative: 8.4% Undervalued

With the narrative fair value set around 9% above the latest 38.40 close, the story leans toward further upside driven by operational growth.

Ongoing investments in integrated service delivery, technology, procurement, and automation are enabling enhanced operating efficiencies and cross selling, expected to deliver sustained improvements in net margins and EBITDA through 2026 and beyond.

Want to see how this efficiency push turns into a richer valuation story? The narrative quietly stacks aggressive revenue gains on top of expanding margins and a reset earnings multiple. Curious how those moving parts combine into today’s fair value call?

Result: Fair Value of $41.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained labor cost pressures and any tightening in government reimbursement could quickly compress margins and challenge the upbeat growth assumptions that underpin this narrative.

Find out about the key risks to this BrightSpring Health Services narrative.

Another Lens on Value

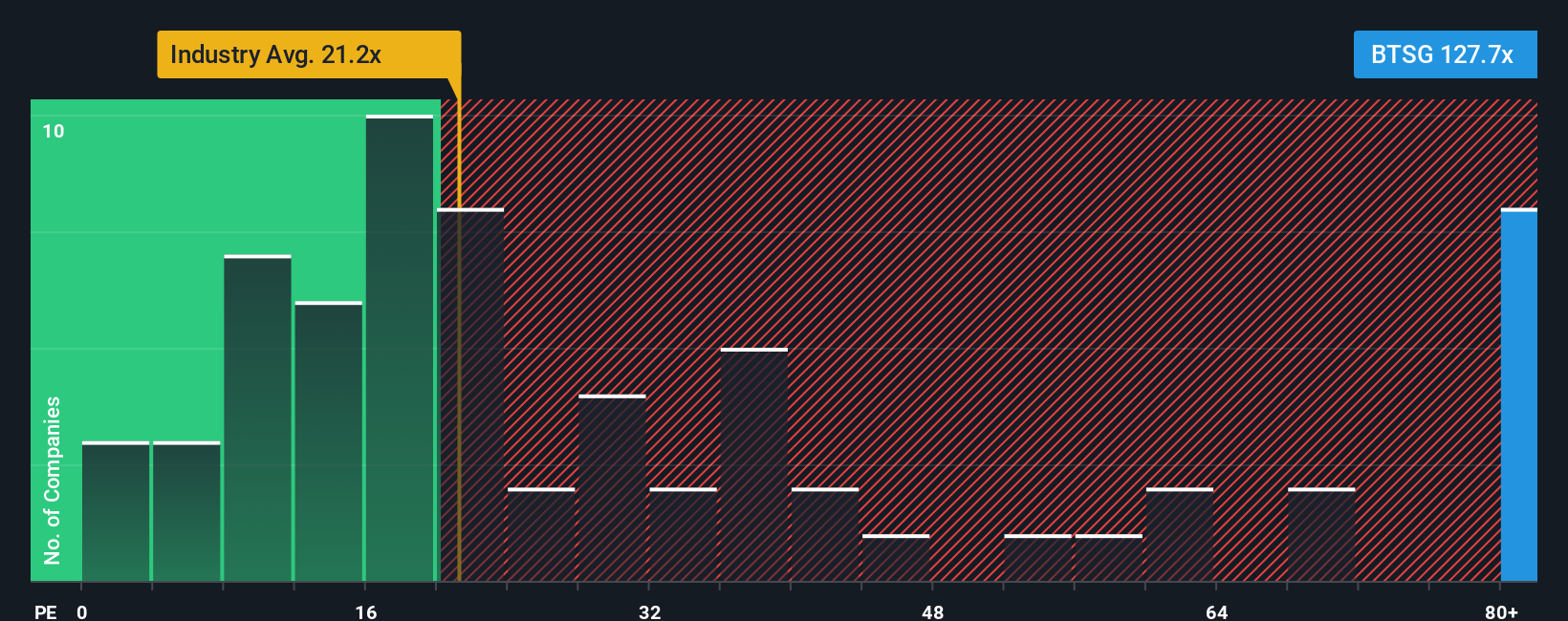

Step away from narrative fair value and the picture gets sharper but more demanding. On earnings, BrightSpring trades at about 71.9 times profit, far richer than peers at 28.3 times and the wider US Healthcare sector at 22.2 times, and well above a 35.8 times fair ratio our work points to.

That kind of premium can disappear fast if growth or margins wobble, so how much multiple risk are you really willing to carry for this story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BrightSpring Health Services Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view of BrightSpring in minutes, Do it your way.

A great starting point for your BrightSpring Health Services research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Right now is the moment to broaden your watchlist with high conviction opportunities that fit your strategy, before the market fully prices in their potential.

- Secure your edge in the growth race by tracking these 25 AI penny stocks that are turning cutting edge innovation into accelerating revenue and earnings.

- Lock in value while it is still overlooked by targeting these 875 undervalued stocks based on cash flows that trade below what their cash flows suggest they are worth.

- Strengthen your income stream with these 14 dividend stocks with yields > 3% offering reliable payouts that can support returns even when markets turn volatile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報