Nvidia (NVDA): Evaluating the Stock’s Valuation as CES 2026 AI Announcements Drive Investor Focus

Nvidia (NVDA) heads into CES 2026 with the spotlight firmly on its AI roadmap, as investors gauge how new accelerators, China reopening and massive orders from customers like ByteDance could shape the stock’s next leg.

See our latest analysis for NVIDIA.

Those catalysts are arriving after a choppy few months, with a modest 30 day share price return of 3.53% but a powerful 1 year total shareholder return of 30.75%. This suggests momentum is cooling rather than broken.

If Nvidia's AI story has you interested, it might be worth seeing what else is out there in high growth tech and AI stocks that could benefit from the same structural tailwinds.

With Nvidia now trading about 34% below the average analyst target and earnings still racing ahead, investors face a critical question: Is this a rare reset in a long term AI leader, or has the market already priced in the next wave of growth?

Most Popular Narrative: 19.6% Undervalued

Restinglion's narrative pegs NVIDIA's fair value well above the last close of $188.85, implying meaningful upside if its AI engine keeps compounding.

High revenue and gross margins (insane profits): NVIDIA has profited 72 billion, some publicly traded companies will never reach 72 billion in revenue. And this number is only expected to grow as AI will continue to grow, innovating under the fingertips of NVIDIA.

To see how this growth story turns into a higher price tag, the narrative focuses on rapid top line expansion, rich margins and a punchy future earnings multiple. For those curious which assumptions really move that valuation needle, the full breakdown reveals the specific forecasts behind that upside case.

Result: Fair Value of $235.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained margin compression or a faster than expected slowdown in AI infrastructure spending could quickly challenge the idea that Nvidia remains meaningfully undervalued.

Find out about the key risks to this NVIDIA narrative.

Another View: Paying Up for Quality

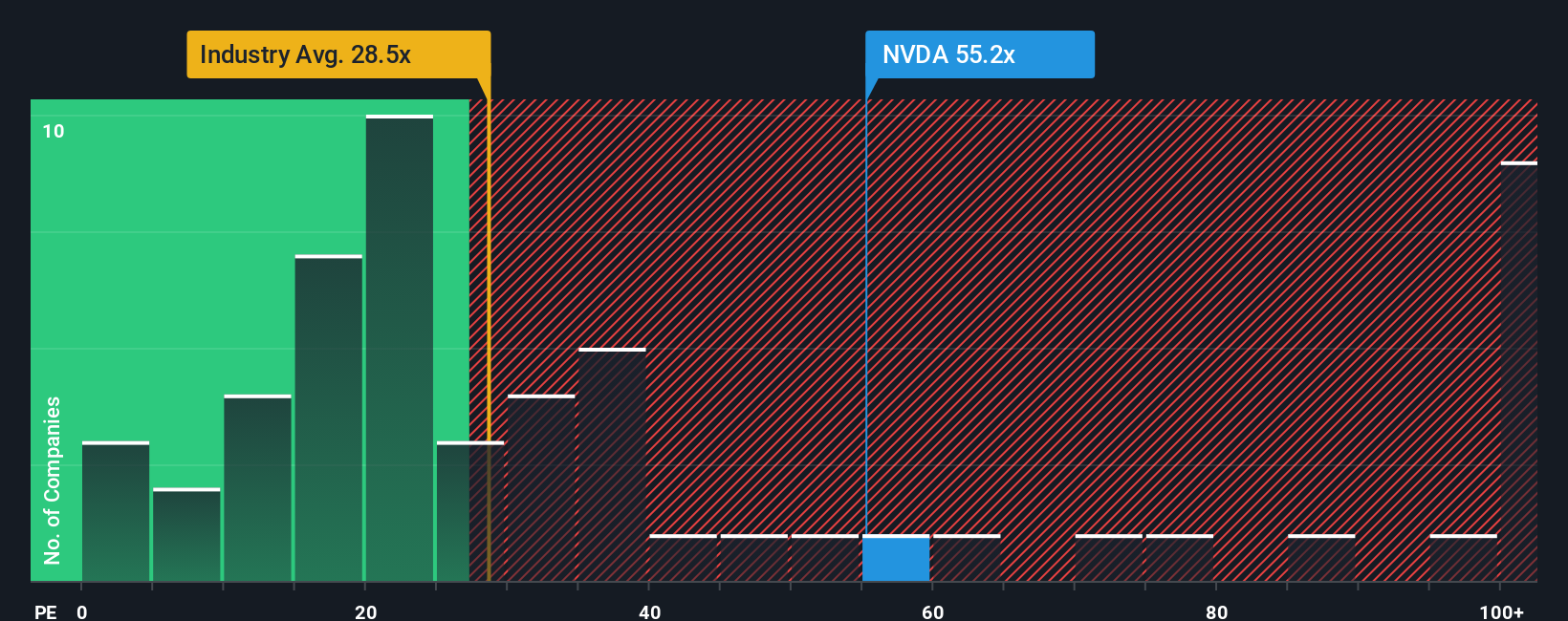

On earnings, the picture is less generous. Nvidia trades at 46.3 times earnings, richer than the US semiconductor average of 37.3 times, yet still below a 57.9 times fair ratio and 62.6 times for close peers. This raises a simple question: is this premium protection or downside risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own NVIDIA Narrative

If you see things differently or want to stress test the numbers yourself, you can build a complete narrative in just a few minutes: Do it your way.

A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using the Simply Wall St Screener to find stocks that may complement your portfolio.

- Explore potential early-stage opportunities by targeting these 3571 penny stocks with strong financials that already show signs of financial strength instead of relying on hype.

- Focus on these 25 AI penny stocks that are involved in the growing field of artificial intelligence.

- Consider these 875 undervalued stocks based on cash flows that appear to be trading below their estimated value based on current market pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報