GE Vernova (GEV) Valuation Check After Outlook Upgrade, Bigger Buyback, and Dividend Hike

GE Vernova (GEV) started 2026 on a strong note, with shares up about 4% in the first session as investors leaned into its upgraded multi year outlook and richer capital return plans.

See our latest analysis for GE Vernova.

That early 2026 pop builds on a solid run, with a roughly 12.7% 90 day share price return and a standout 1 year total shareholder return of about 92%. This suggests momentum is still building as investors reassess growth and income potential.

If GE Vernova’s surge has you rethinking the energy transition trade, it could be a good moment to explore other aerospace and defense stocks that might be benefiting from similar long term infrastructure themes.

With the stock up sharply and trading only modestly below analyst targets, despite brisk revenue and earnings growth, the key question now is whether GE Vernova still offers upside or if markets are already pricing in future gains.

Most Popular Narrative Narrative: 10% Undervalued

With GE Vernova last closing at 679.55 dollars against a narrative fair value of about 755 dollars, the story leans toward more upside ahead.

Recent supportive legislation and evolving customer priorities (like data center electrification and clean energy tax credits) are accelerating order activity in wind, gas, and grid solutions, which should drive further organic revenue growth and profitability as backlog converts over the next few years.

Curious how double digit growth, rising margins, and a richer earnings multiple all combine to justify that higher fair value? The narrative maps out an aggressive trajectory for revenue, profits, and valuation that looks more like a high growth software name than a traditional industrial. Want to see exactly which forward looking assumptions underpin that target price, and how sensitive it is to even small changes in growth or margins? Read on to unpack the full playbook behind this valuation call.

Result: Fair Value of $755.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent wind losses and tariff headwinds, along with irregular grid project timing, could quickly undermine those upbeat growth and margin assumptions.

Find out about the key risks to this GE Vernova narrative.

Another Way to Look at Value

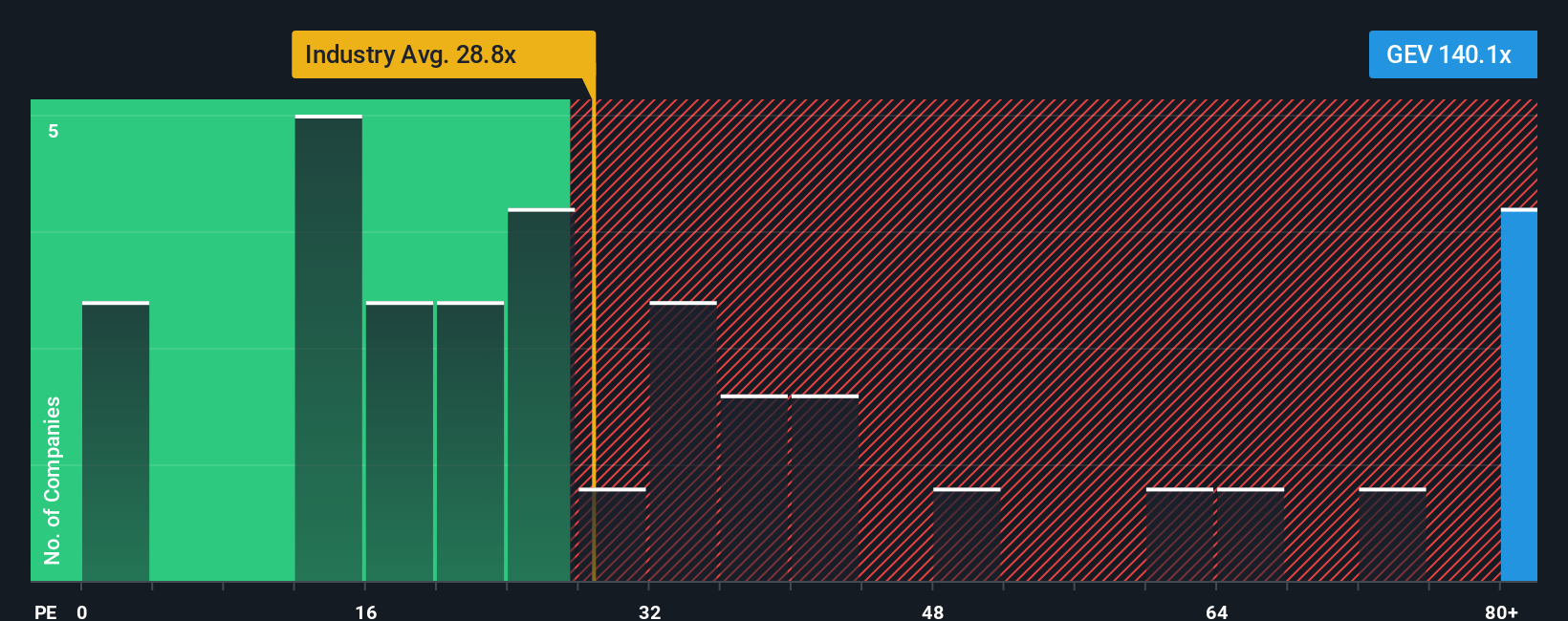

While the narrative fair value points to upside, the earnings multiple tells a different story. At about 108 times earnings versus an industry average near 31 and a fair ratio closer to 67, GE Vernova looks richly priced, raising the risk that sentiment, not fundamentals, is doing more of the work.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GE Vernova Narrative

If this perspective does not quite fit your view, or you would rather lean on your own research, you can build a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GE Vernova.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to surface fresh ideas and avoid missing the next wave of market beating winners.

- Capitalize on powerful cash generation by reviewing these 875 undervalued stocks based on cash flows that the market has not fully priced, while their fundamentals continue to strengthen.

- Position yourself early in transformative innovation by scanning these 25 AI penny stocks pushing boundaries in automation, analytics, and intelligent products.

- Strengthen your income stream by focusing on these 14 dividend stocks with yields > 3% that aim to balance reliable payouts with long term resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報