Assessing American Electric Power’s (AEP) Valuation After Its Strong 30% One-Year Total Return

American Electric Power Company (AEP) has been quietly grinding higher over the past year, and that 30% 1 year total return is catching income focused investors attention again.

See our latest analysis for American Electric Power Company.

That climb has come even as the share price has cooled slightly in recent weeks, with investors reassessing utilities after a strong run and warming to AEP’s steady earnings growth and regulated cash flows, so momentum still looks more constructive than not.

If AEP’s steady grind higher has you rethinking your income and defensives mix, it could be a good moment to scan other regulated names and explore healthcare stocks as a different source of resilient growth.

With AEP trading near 52 week highs yet still sitting below consensus price targets, investors face a familiar dilemma: is the utility’s resilient earnings power still underestimated, or is the market already baking in the next leg of growth?

Most Popular Narrative Narrative: 10.2% Undervalued

With American Electric Power Company last closing at $115.81 versus a narrative fair value near $128.97, the latest consensus view implies more upside than the market is currently pricing.

AEP is capitalizing on increased load growth, expecting retail load growth of 8% to 9% annually through 2027, driven by commercial and industrial demand, which should significantly boost revenue. The company has a substantial capital investment plan of $54 billion over the next 5 years, with an additional potential of $10 billion, primarily aimed at expanding transmission and distribution, indicating future growth in earnings.

Curious how a regulated utility earns a premium style multiple without tech-like growth rates? The narrative leans on steady expansion, firmer margins and a finely tuned discount rate to justify that higher fair value.

Result: Fair Value of $128.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the narrative hinges on smooth regulatory approvals and data center execution, and setbacks on either front could quickly erode that implied upside.

Find out about the key risks to this American Electric Power Company narrative.

Another Angle on Valuation

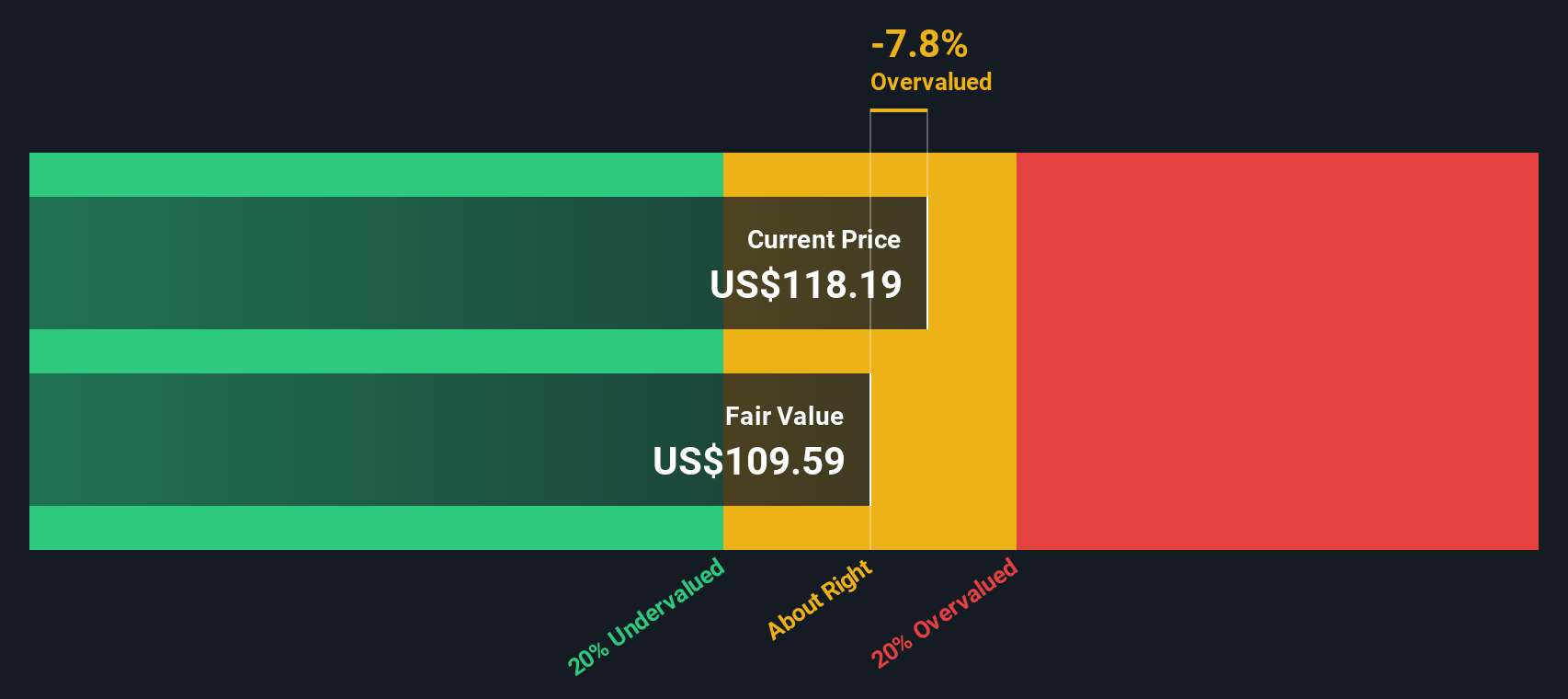

While the narrative fair value suggests AEP is about 10% undervalued, our DCF model is more cautious, indicating the shares trade above an intrinsic value near $109 per share, or modestly overvalued. Which lens you trust more likely depends on how confident you are in the long term load and capex story.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Electric Power Company Narrative

If this framing does not match your own view, or you would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way

A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few fresh opportunities by using the Simply Wall Street Screener to uncover focused, data driven stock ideas built around clear themes.

- Capitalize on potential mispricings by reviewing these 875 undervalued stocks based on cash flows that our models flag as trading below their intrinsic value based on future cash flows.

- Enhance your income strategy by targeting these 14 dividend stocks with yields > 3% that may offer payouts that are more diversified than relying on a single utility.

- Explore a fast evolving space by scanning these 80 cryptocurrency and blockchain stocks at the intersection of blockchain technology and public markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報