Auto market switching to slow lane

MALAYSIA’S automotive market, after three years of unprecedented growth, is set to decelerate in 2026 as demand stabilises, policy support diminishes, and competition intensifies across both the electric and conventional vehicle segments.

Industry data reveals a 4.6% month-on-month decline in November sales to 72,509 units, following October’s peak of 75,992 vehicles.

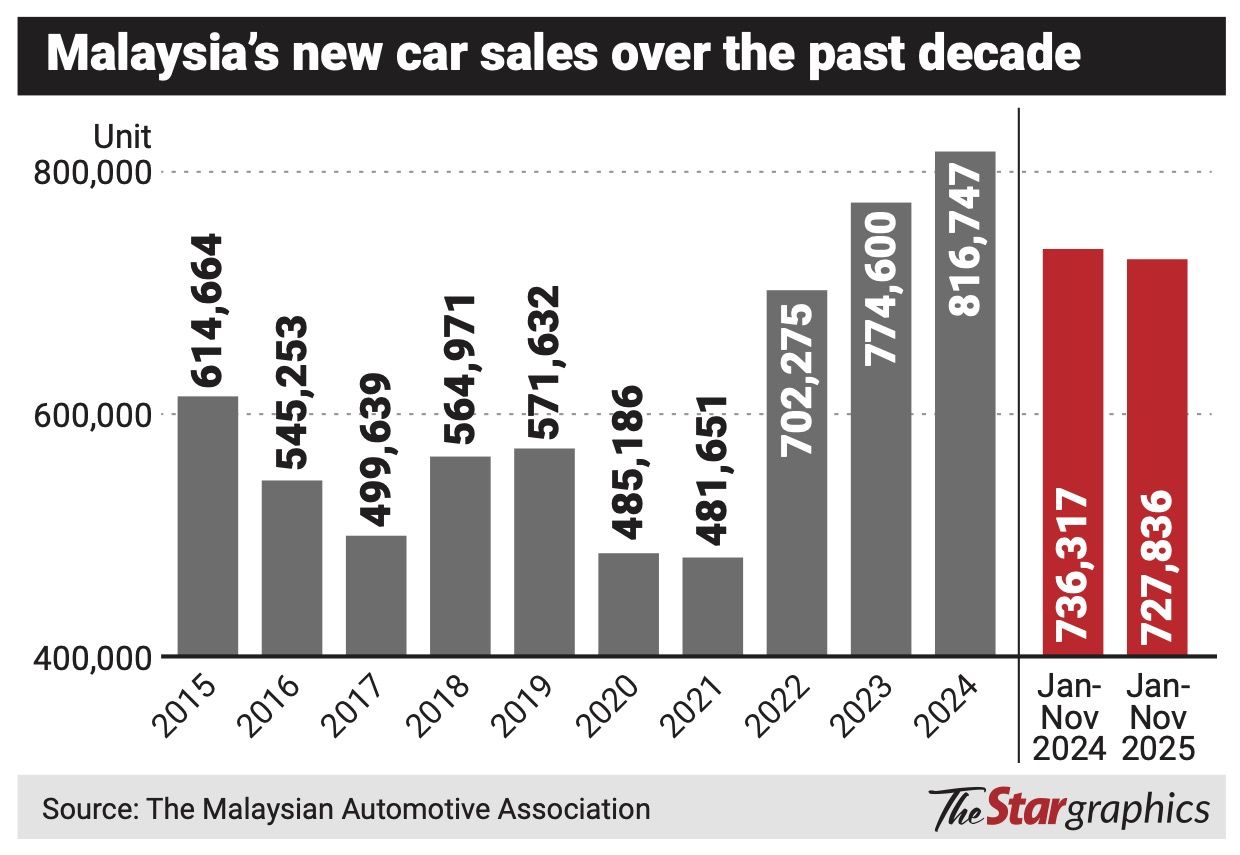

Year-to-date deliveries totalled 727,836 units, 1.15% lower than the same period last year. For perspective, 2024 sales reached a record high of 816,747 units.

Analysts anticipate a gradual return to a more sustainable demand environment, with a notable adjustment expected heading into 2026.

Policy changes to shape 2026 demand

A key factor shaping 2026 is the expiry of tax exemptions for fully imported (CBU) electric vehicles (EVs) at the end of 2025.

From Jan 1, CBU EVs will be subject to import and excise duties.

While the government has not yet disclosed the detailed tax framework, estimates suggest that prices for CBU EV models could rise by 20% to 40% once these taxes are reinstated.

This is driving a buying rush in the fourth quarter of 2025 as consumers rush to lock in lower prices.

Analysts, however, predict that the subsequent price shock may slow EV adoption over the next two years, particularly in the premium and luxury segments reliant on imports.To counter this, automakers are accelerating localisation efforts, enabling their EV models to remain eligible for tax incentives on locally assembled (CKD) vehicles, which continue until the end of 2027.

Xpeng plans to start EV assembly in Malaysia in 2026, while national brands Proton and Perodua are expanding CKD production as part of their broader localisation strategies.

Other manufacturers are also moving in the same direction.

BYD is building a CKD facility in Tanjung Malim, with operations slated to begin in 2026, while Leapmotor, through its partnership with Stellantis, is planning CKD production at its Gurun facility.

Chery and Great Wall Motor are expanding or preparing CKD plans as part of their wider Asean strategies.

Beyond EV-specific policies, the broader automotive market will also be shaped by structural changes beginning in 2026.

A revised open market value (OMV) excise duty framework for CKDs – originally slated for January 2026 but recently pushed to July 1, 2026 – could push vehicle prices higher by 10% to 30%, depending on model specifications and localisation levels, according to industry players.

The continuation of the RON95 petrol subsidy under initiatives such as Budi95 is expected to support demand for internal combustion engine (ICE) vehicles, particularly in the mass-market segment, dampening the incentive for some consumers to switch to EVs in the near term.

TIV to moderate, margins under pressure

TA Securities automotive analyst Angeline Chin Swee Tyng expects affordability and competition to be the key defining themes in 2026.

“The market will be driven by more affordable EVs and increased competition in the mass market.

“Locally assembled EVs will help bring prices down, making EVs a practical choice for everyday buyers and lowering overall ownership costs,” she notes.

At the same time, she says ICE vehicles will continue to dominate.

“ICE cars will continue to be widely purchased and remain the dominant power train in Malaysia. Automakers are still launching petrol and diesel models and updating existing ones to stay competitive, particularly in the entry- and mid-priced segments where most buyers are concentrated.

“ICE cars are expected to remain the dominant choice in Malaysia in 2026. Hybrids may see slightly faster growth than ICE, but they will still represent a smaller share of TIV.”

Chin expects the automotive sector to see a decline in TIV in 2025, driven by a slowdown in new bookings as post-pandemic pent-up demand fades.

She says the adjustment is expected to deepen.

“TIV is projected to moderate further in 2026 to around 750,000 units, reflecting a return to more sustainable demand levels after several years of anomalies,” she notes.

She adds that competition across the industry is set to intensify, prompting automakers to adopt more aggressive pricing strategies, accelerate model refresh cycles and expand variant offerings to defend market share.

“However, these measures may have limited impact as consumers are becoming increasingly value-driven and have a wider range of options than ever.

“Malaysia’s EV landscape would remain crowded and highly competitive with an influx of new entrants, exerting further pressure on both pricing and margins,” she adds.

The expiry of the EV CBU tax exemption is also expected to weigh on demand.

“Overall, we anticipate the operating environment for the automotive industry to stay challenging in 2026 with profit margins likely to come under even greater strain,” she says.

As such, TA Securities maintains an “underweight” stance on the sector.

Still, Chin notes that a stronger ringgit could benefit the automotive sector through lower costs for imported components, raw materials and CKD kits, particularly for mass-market models.

Kenanga Research, meanwhile, maintains a “neutral” stance and projects a lower TIV of 725,000 units in 2026, representing a 9.9% decline from its 2025 forecast of 805,000 units.

The research house says the moderation would partly mirror the post-goods and service tax (GST) holiday tax holiday correction seen in 2015, when TIV reached a peak, then fell 13% post-GST tax holiday.

It adds that the outlook would be shaped by factors such as the implementation of the new OMV excise duty framework, rising market share of Chinese automakers’ localised vehicles, sustained demand in the affordable segment, and new hire purchase loan policies starting in 2026, including the abolition of the Rule of 78 and flat rate loans.

“In general, the industry’s earnings visibility is still good, backed by a booking backlog of 130,000 units as at end-November 2025,” it notes.

As for the EV transition, Kenanga Research has a nuanced view of EV adoption eventually picking up and petrol demand will eventually peak, “but we do not think that will happen in the next five years due to infrastructure challenges.”

“This new petrol subsidy mechanism, in our view, could make the transition even slower than earlier expected as the middle-and lower-income group now have less incentive to switch from ICE to EV for the time being,” it notes.

Battery electric vehicle (BEV) registrations have nonetheless risen steadily, from 274 units in 2021 to over 3,400 units in 2022, 13,301 units in 2023 and 21,789 units in 2024.

In the latest announcement, BEV registrations for January to November 2025 surged to 36,690 units, surpassing full-year 2024 levels, largely driven by CBU models.

Malaysia’s long-term target is for EVs and hybrids to account for 20% of new car sales by 2030, 50% by 2040 and 80% by 2050.

Currently, BEVs make up about 5% of total industry volume.

Nasdaq

Nasdaq 華爾街日報

華爾街日報