Will Honolulu Rail Change Order and Earnings Beat Shift Tutor Perini's (TPC) Backlog Quality Narrative?

- Tutor Perini Corporation previously announced a US$53.0 million change order for Honolulu’s City Center Guideway and Stations Project, allowing it to design the rail extension linking Kakaʻako to Ala Moana with two additional stations and potential further contract expansion if extra funding is secured.

- The company also recently reported very strong quarterly results, with revenue, earnings, and EBITDA all surpassing analyst expectations, highlighting how large infrastructure wins and improved execution are strengthening its project backlog and earnings profile.

- We’ll now examine how the Honolulu rail expansion change order reshapes Tutor Perini’s investment narrative around backlog quality and earnings visibility.

Find companies with promising cash flow potential yet trading below their fair value.

Tutor Perini Investment Narrative Recap

To own Tutor Perini, you need to believe its focus on large, complex civil projects can translate into more consistent profitability despite a history of uneven earnings. The Honolulu change order modestly improves near term backlog quality and earnings visibility, but it does not remove the central risk that execution missteps or fixed price contracts on mega projects could still drive volatile margins.

Among recent announcements, the board’s authorization of up to US$200 million in share repurchases stands out beside the Honolulu award. Combined with strong recent earnings beats, it signals management’s confidence that current backlog wins, including the rail expansion work, can support future cash generation even as investors weigh the ongoing execution and project concentration risks.

Yet while recent wins support the story, investors still need to be aware of how dependent future results are on a handful of very large public projects...

Read the full narrative on Tutor Perini (it's free!)

Tutor Perini's narrative projects $7.1 billion revenue and $515.9 million earnings by 2028. This requires 14.2% yearly revenue growth and a $648.2 million earnings increase from -$132.3 million today.

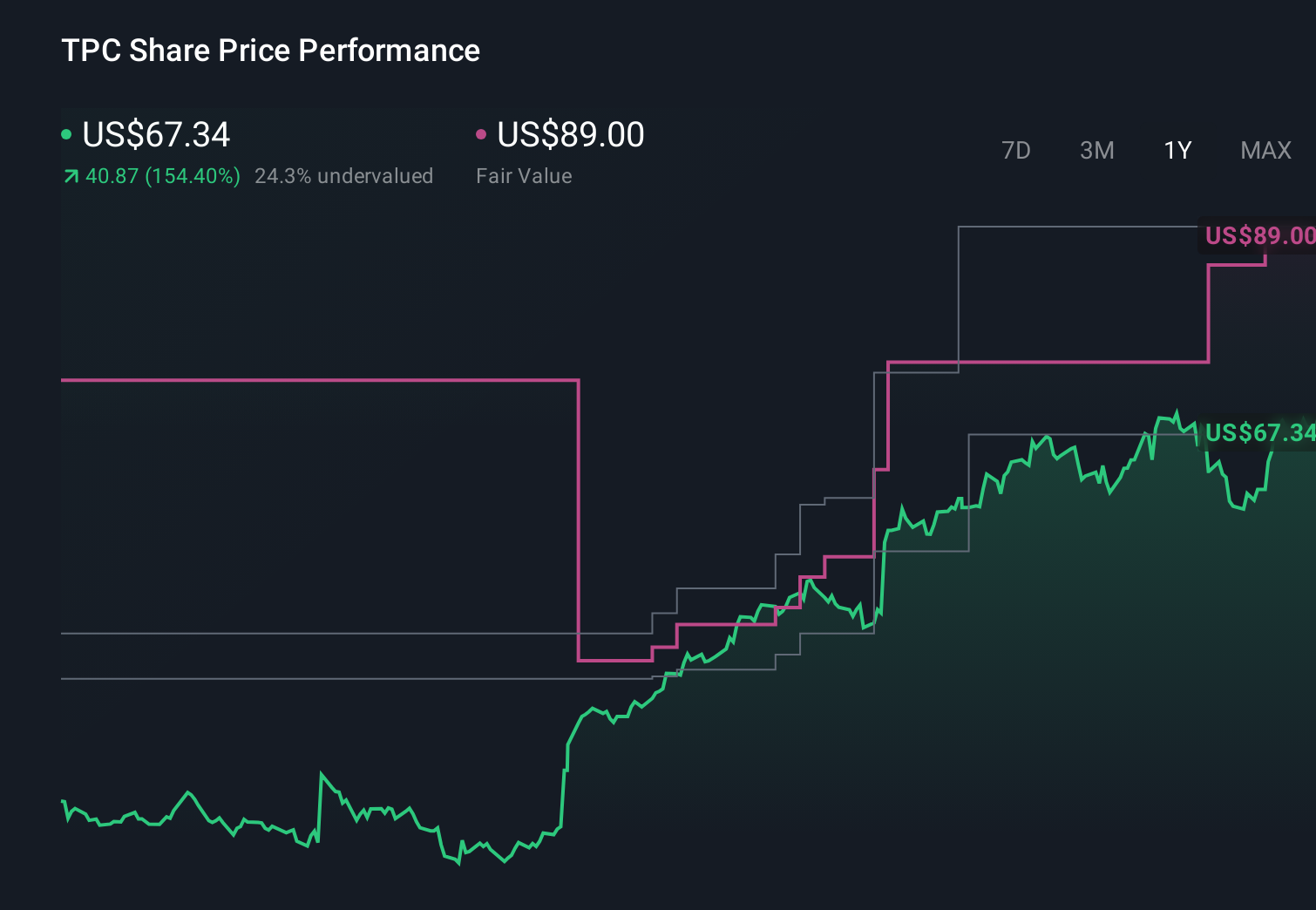

Uncover how Tutor Perini's forecasts yield a $89.00 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently see fair value for Tutor Perini between US$80.02 and US$89.00 per share, highlighting how far opinions can spread. You should weigh those views against the concentration risk in a few mega public projects, which could have outsized effects on future earnings if funding or schedules change, and consider how different scenarios might play out for the business.

Explore 4 other fair value estimates on Tutor Perini - why the stock might be worth just $80.02!

Build Your Own Tutor Perini Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tutor Perini research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Tutor Perini research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tutor Perini's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報