How Retail Traders’ 2025 Comeback Shapes GameStop (GME) Valuation Outlook

Recent analysis points to 2025 as a turning point for retail investors, and GameStop (GME) is once again at the center of that story, with renewed individual trading shaping its day to day moves.

See our latest analysis for GameStop.

Over the past few months, GameStop’s share price has been choppy, with a recent 1 day share price return of 2.69 percent, but a 1 year total shareholder return of negative 34.08 percent and a 5 year total shareholder return of 371.73 percent showing momentum that has cooled sharply from its meme era peak.

If the latest GameStop swings have you thinking about what else might be setting up for a strong narrative, it is worth exploring fast growing stocks with high insider ownership.

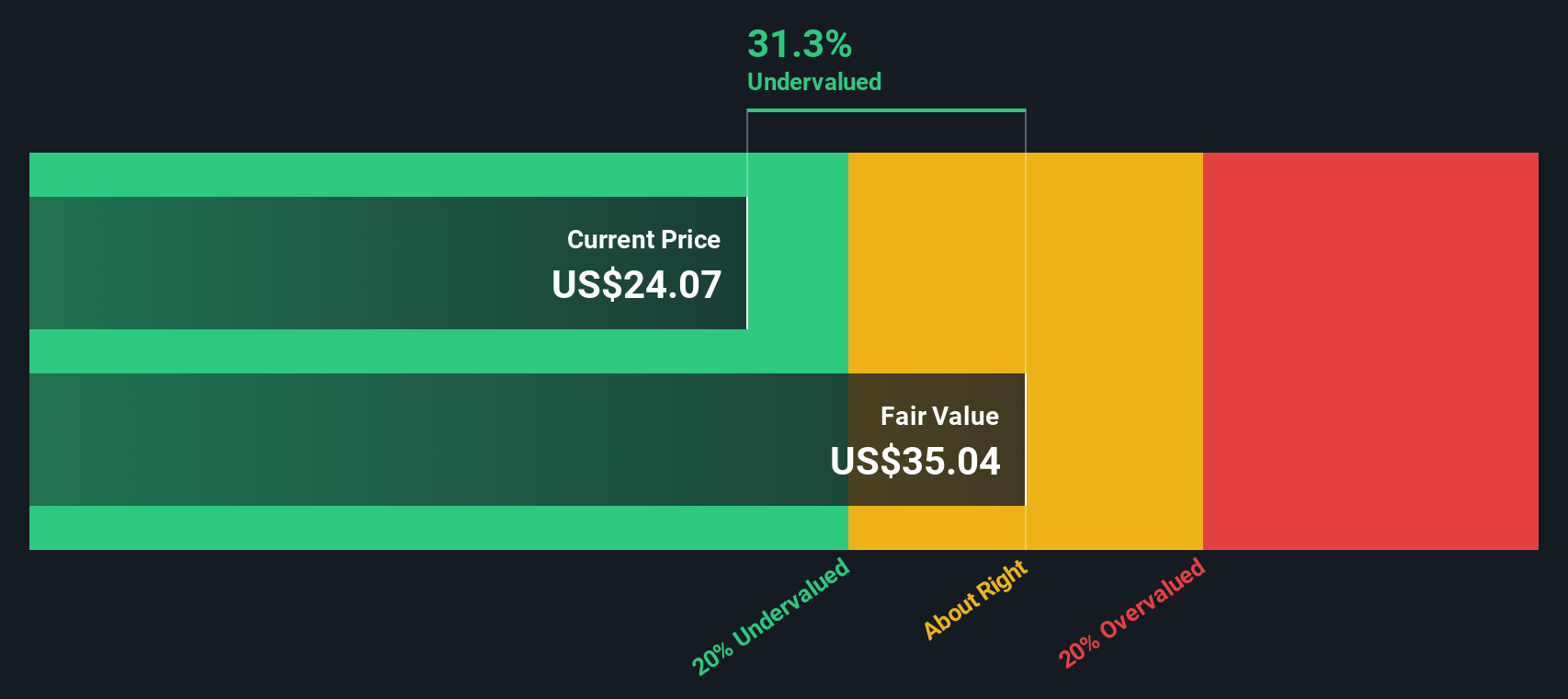

With GameStop still profitable, trading well below some estimates of intrinsic value, and back under intense retail scrutiny, the debate now shifts to fundamentals: is the stock genuinely undervalued, or is the market already pricing in future growth?

Price-to-Earnings of 21.9x: Is it justified?

Based on a price-to-earnings ratio of 21.9 times against the last close of $20.62, GameStop screens as more expensive than peers on earnings.

The price-to-earnings multiple compares the company’s market value to the profits it generates, a common yardstick for retailers where earnings drive long term equity returns.

For GameStop, a 21.9 times earnings multiple suggests investors are paying a premium for each dollar of profit, despite the stock’s sharp drawdown from its highs and mixed recent share price performance.

Compared with both its direct peer group average of 19.9 times and the broader US Specialty Retail industry at 19.8 times, GameStop’s higher multiple indicates that the market is assigning it a richer valuation than competitors on current earnings.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 21.9x (OVERVALUED)

However, risks remain, including slowing short term momentum and the possibility that renewed retail attention fades before fundamentals can justify today’s premium valuation.

Find out about the key risks to this GameStop narrative.

Another View on GameStop's Value

Flip the lens, and our DCF model implies a fair value of $101.62 per share, around 80 percent above the current $20.62 price. If cash flows are closer to the truth than earnings multiples, is the market overlooking a deep value setup or just skeptical for good reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GameStop for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GameStop Narrative

If this perspective does not quite align with your own or you prefer hands on research, you can quickly craft a personalized view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding GameStop.

Ready for your next investing move?

Before the market’s next big swing, consider positioning yourself ahead of it by using the Simply Wall St Screener to uncover fresh, data backed opportunities beyond GameStop.

- Explore potential long term income by reviewing these 14 dividend stocks with yields > 3% that aim to balance yield with stability.

- Position yourself early in transformative technology by assessing these 29 quantum computing stocks shaping tomorrow’s computing breakthroughs.

- Strengthen your watchlist with these 875 undervalued stocks based on cash flows that may trade below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報