How StoneCo’s R$1.95 Billion Share Buyback Will Impact StoneCo (STNE) Investors

- In late 2025, StoneCo Ltd. announced and completed a significant share repurchase program, buying back 21,872,021 Class A shares, or 8.27% of its share base, for about R$1.95 billion under the authorization announced on May 8, 2025.

- This large-scale buyback, funded with up to R$2.00 billion and without a fixed end date, reduces the share count and can enhance each remaining shareholder’s claim on the company’s future earnings.

- We’ll now examine how this completed R$1.95 billion repurchase, shrinking StoneCo’s share base, may reshape the company’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

StoneCo Investment Narrative Recap

To own StoneCo, you need to believe in the steady formalization of Brazil’s small business economy and Stone’s ability to monetize that shift through payments and financial services. The recent R$1.95 billion buyback, retiring 8.27% of shares, mainly amplifies earnings per share and does not materially change the key near term catalyst of deeper cross-selling to clients, nor the biggest current risk around rising credit provisions and pressure on net margins.

The most relevant recent announcement here is StoneCo’s ongoing authorization to repurchase up to R$2.00 billion of Class A shares without a fixed end date, which underpins the completed buyback. This active capital return sits alongside the effort to recycle funds from software divestitures into higher margin financial services, reinforcing the near term focus on EPS support while the business contends with moderating TPV growth and stiffer competition in Brazilian payments.

But investors should also be aware of how rising provisions on a growing credit book could eventually offset some of the EPS lift from buybacks and...

Read the full narrative on StoneCo (it's free!)

StoneCo's narrative projects R$17.4 billion revenue and R$5.0 billion earnings by 2028. This requires 8.2% yearly revenue growth and a R$6.3 billion earnings increase from R$-1.3 billion today.

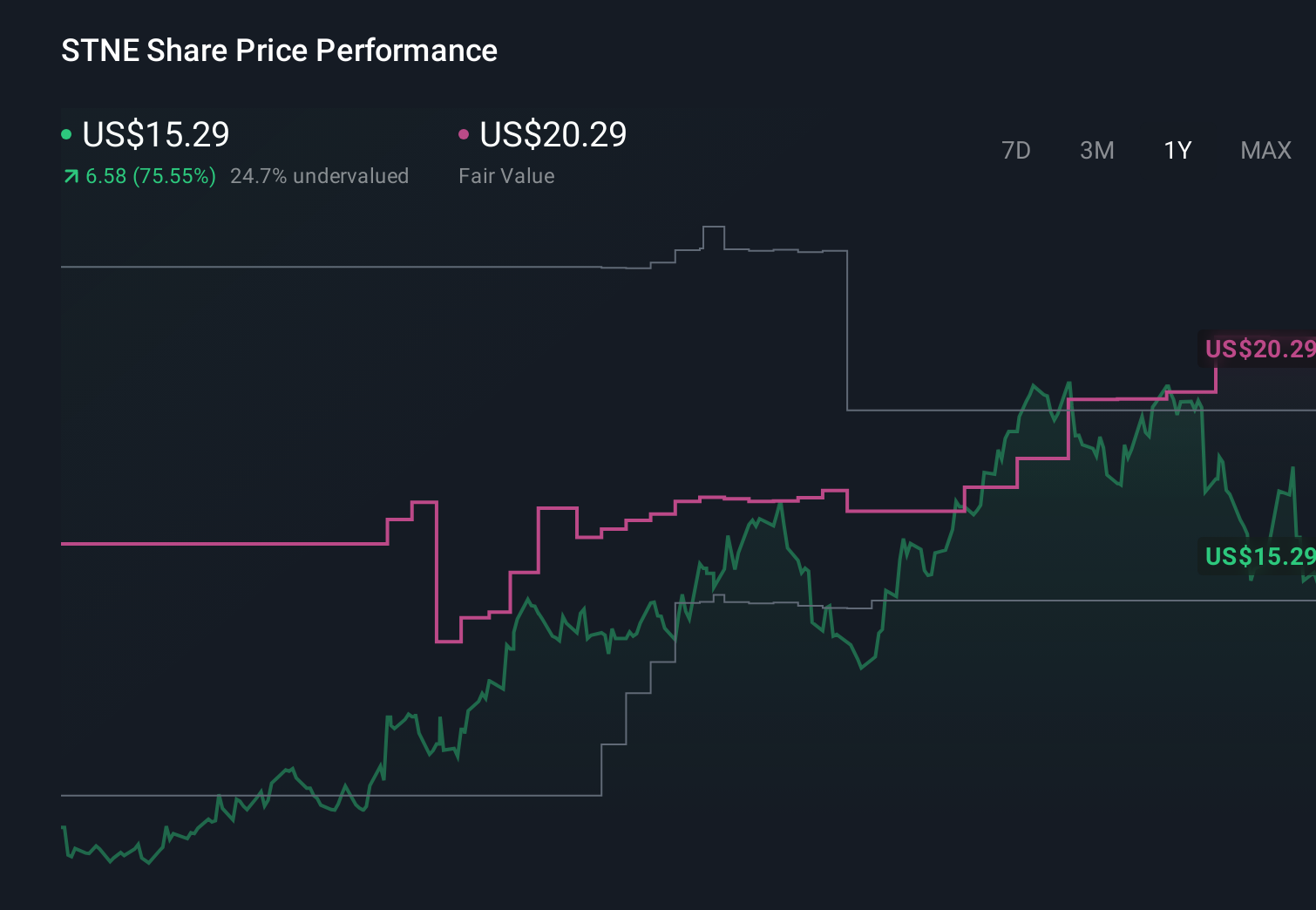

Uncover how StoneCo's forecasts yield a $20.29 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently see StoneCo’s fair value between US$15.52 and US$41.27, highlighting a wide spread of expectations. You should weigh those views against the reliance on buybacks and repricing to support EPS, and consider how shifts in Brazil’s MSMB payments growth could influence StoneCo’s ability to meet these varied expectations.

Explore 9 other fair value estimates on StoneCo - why the stock might be worth just $15.52!

Build Your Own StoneCo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StoneCo research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free StoneCo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StoneCo's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報