Centrus Energy (LEU): Assessing Valuation After a 12% Daily Jump and Massive One‑Year Rally

Market context and recent performance

Centrus Energy (LEU) has quietly delivered a huge turnaround for long term holders, with the stock up roughly 2,373% over the past year, even after a choppy past 3 months.

See our latest analysis for Centrus Energy.

The latest 12.25% one day share price return adds a fresh burst of momentum to what has already been an extraordinary 1 year total shareholder return of 237.25%. This signals that investors are still repricing Centrus for higher growth and elevated execution risk.

If Centrus has you rethinking what upside can look like, this is a good moment to explore fast growing stocks with high insider ownership and see which other names are quietly building powerful trends.

With shares now trading near analysts’ price targets after a spectacular run, the key question is whether Centrus is still mispriced on its nuclear growth prospects or if the market has already fully priced in the future upside.

Most Popular Narrative Narrative: 3% Undervalued

With Centrus Energy last closing at $272.50 and the narrative fair value sitting closer to $280, the story leans toward modest upside, not euphoria.

The analysts have a consensus price target of $229.3 for Centrus Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $310.0, and the most bearish reporting a price target of just $108.0.

Want to see why a premium earnings multiple, shrinking margins, and steady top line growth can still point to upside? The valuation math might surprise you.

Result: Fair Value of $279.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in DOE funding, slower contract awards, or faster renewables adoption could all compress margins and challenge the current growth narrative.

Find out about the key risks to this Centrus Energy narrative.

Another angle on valuation

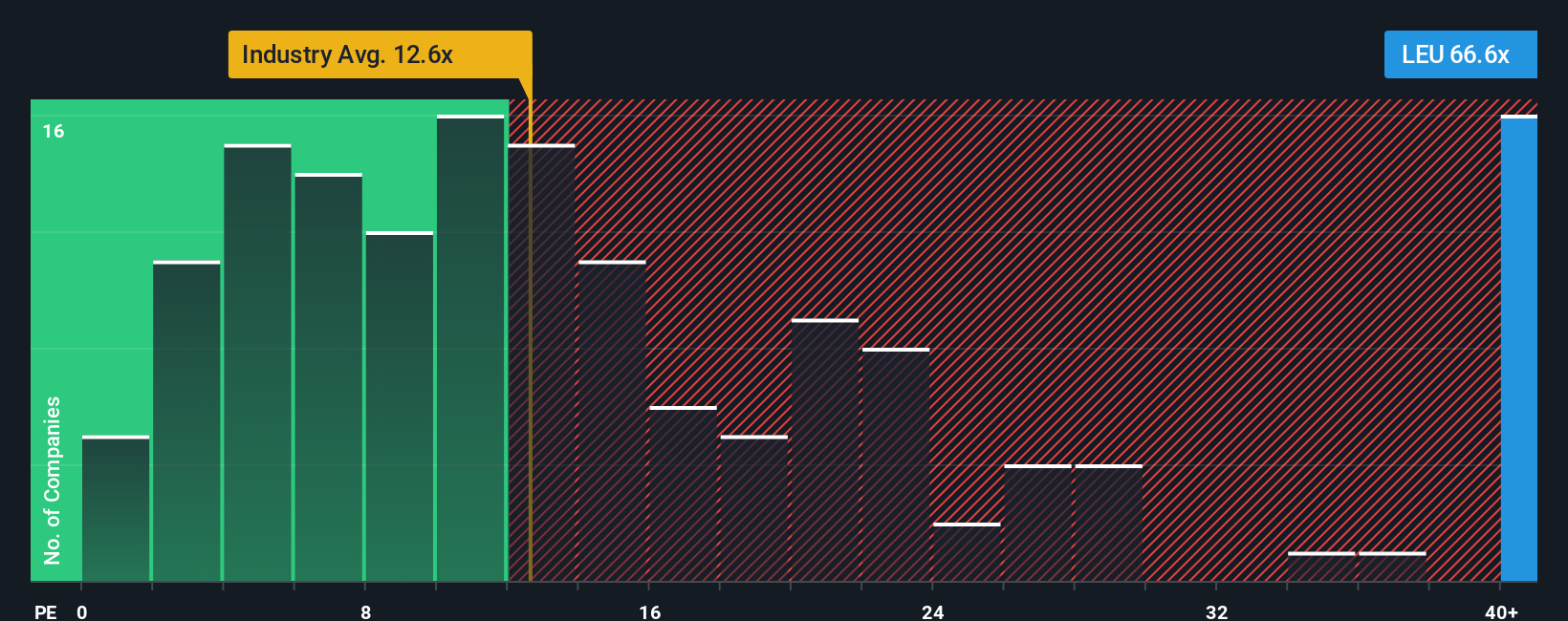

While the narrative fair value suggests modest upside, the earnings multiple paints a tougher picture. Centrus trades on a P/E of 43.6x versus 16.5x for peers and a fair ratio of 12.1x, which implies the market may have raced far ahead of fundamentals. Is this justified optimism or valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Centrus Energy Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in minutes with Do it your way.

A great starting point for your Centrus Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors do not wait for the next headline; they actively look for tomorrow’s potential winners using targeted screeners that surface opportunities before the crowd notices.

- Explore higher-upside potential by scanning these 3571 penny stocks with strong financials that pair smaller market caps with relatively strong fundamentals and financial strength.

- Access the frontier of innovation with these 25 AI penny stocks focusing on companies using artificial intelligence in efforts to reshape various industries.

- Seek more stable cash flows by reviewing these 14 dividend stocks with yields > 3% featuring income streams that may help support a portfolio through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報