Ralph Lauren (RL): Reassessing Valuation After a Strong 1-Year Rally and Recent Pullback

Ralph Lauren (RL) has quietly outperformed much of the apparel space over the past year, and that makes its latest pullback especially interesting for investors weighing fashion-driven cyclicality against steady brand strength.

See our latest analysis for Ralph Lauren.

The latest pullback comes after a strong run, with a 90 day share price return of 12.9 percent and a standout 1 year total shareholder return of 56.6 percent, suggesting momentum is still broadly constructive.

If Ralph Lauren’s surge has you rethinking the space, it might be worth lining it up against other consumer names and exploring fast growing stocks with high insider ownership for fresh ideas with strong backing.

With shares hovering just below analyst targets after a multiyear rally, the debate now turns to valuation: Is Ralph Lauren still trading below its true worth, or are markets already pricing in every stitch of future growth?

Most Popular Narrative Narrative: 1.9% Undervalued

With the most popular narrative putting fair value near $369.46 versus a last close of $362.53, the story leans toward modest upside grounded in earnings power.

Recent Street research on Ralph Lauren has tilted decisively positive, with a series of upward price target revisions clustered in the mid to high $300s and one notable target in the low $400s. The updates largely reflect confidence in the durability of brand momentum, operational discipline, and the potential for upside to management's conservative multi year outlook.

Want to see what kind of revenue runway, margin lift, and future earnings multiple are baked into that fair value math? The narrative spells out the full playbook.

Result: Fair Value of $369.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors still need to watch for macro driven demand softness and Europe’s expected deceleration, which could pressure margins and test today’s optimistic assumptions.

Find out about the key risks to this Ralph Lauren narrative.

Another Lens On Valuation

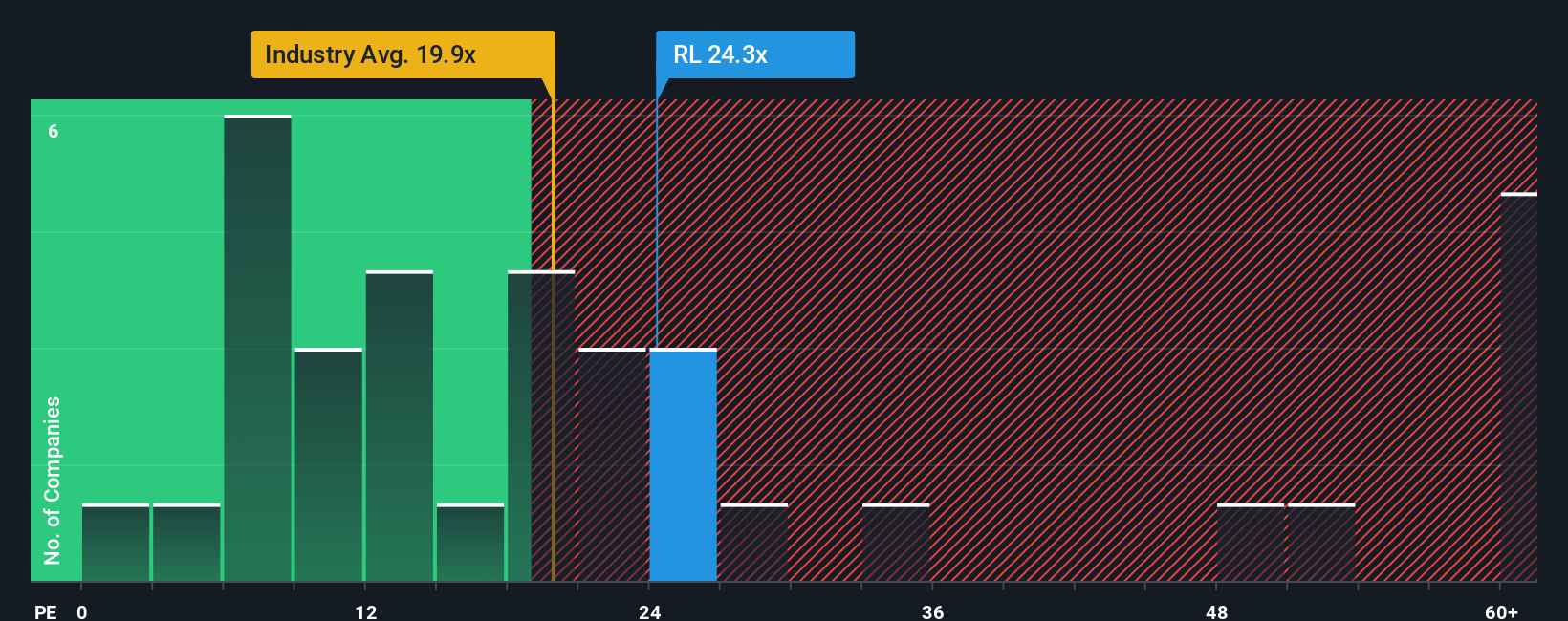

Multiples tell a cooler story. At roughly 25.7 times earnings versus a fair ratio of 18.5 times and a 20 times industry average, Ralph Lauren screens expensive, even though it still appears cheaper than peers at 48.5 times. This raises the question of whether the quality premium represents a margin of safety or a downside risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ralph Lauren Narrative

If you see the story differently or want to stress test every assumption yourself, you can build a complete view in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ralph Lauren.

Looking for more investment ideas?

If Ralph Lauren has sharpened your conviction, do not stop here. Use the Simply Wall Street Screener to pinpoint your next high conviction opportunity before others do.

- Capitalize on mispriced quality by targeting companies trading below their intrinsic value with these 875 undervalued stocks based on cash flows.

- Ride structural growth in automation, data, and innovation by focusing on future facing names through these 25 AI penny stocks.

- Lock in reliable income potential by zeroing in on stable payers offering attractive yields via these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報